A Platform of Best-in-Class Intelligent Solutions

The future of modern banking—today. As the pioneer of cloud banking, nCino is powering a new era in financial services.

Onboarding

Customer onboarding functionality supports the front, middle, and back-office onboarding processes, allowing financial institutions to assess the risk of doing business with clients while providing an efficient and personalized user experience.

Clients can upload documents, complete identity verification, and provide information about themselves and their business, enabling regulatory compliance. Institutions can also generate custom reports and achieve a holistic client view thanks to enhanced reporting tools and real-time analytics, enabling them to provide more value-added services and custom-tailored offerings.

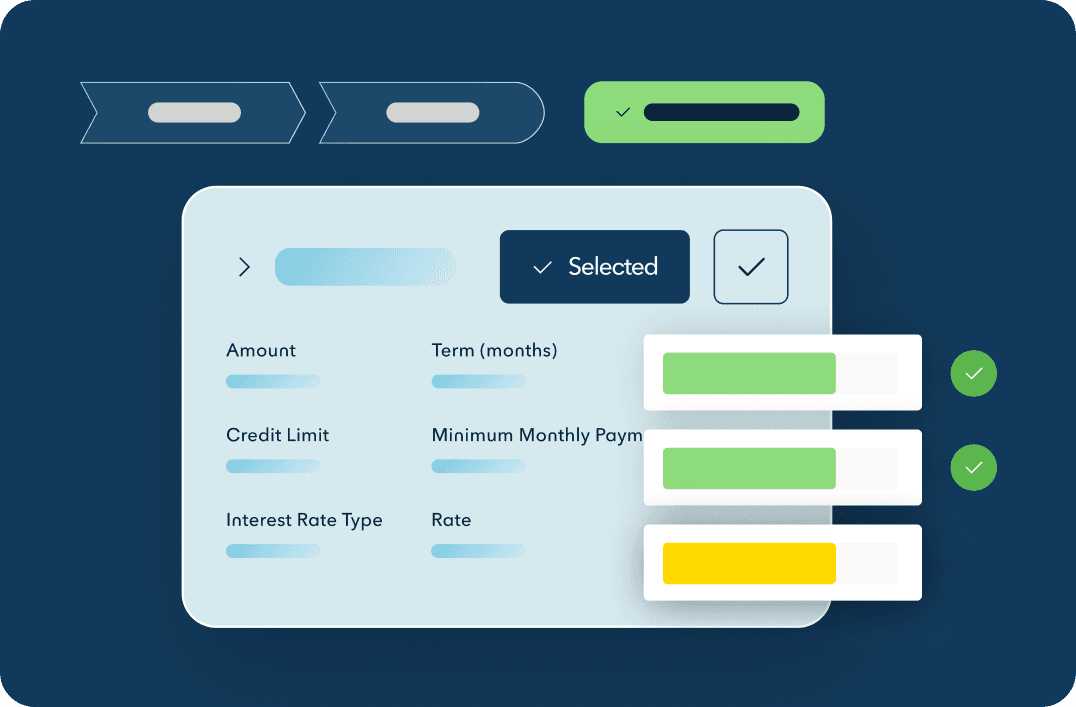

Loan Origination

The loan origination system provides a complete end-to-end solution for loan processing, including automated workflow, document management, and real-time reporting. It supports a wide range of lending products, from complex commercial loans to consumer loans, while maintaining regulatory compliance. The platform offers a single digital loan file accessible to all stakeholders, facilitating efficient and compliant loan management.

Account Opening

Deposit account opening streamlines the process of opening various types of bank accounts for commercial, consumer, and small business clients, while meeting compliance standards. It provides a flexible, intuitive, and scalable workflow so clients can seamlessly open accounts digitally across any device, in branches, or via call centers.

Embedded Intelligence

Intelligence is built into the core of every nCino solution, leveraging data and analytics to deliver optimal insights across the entire nCino Platform.

Ecosystem

By leveraging open APIs and productized integrations, nCino creates an open ecosystem that brings together disparate data sources and systems, acting as a data hub that integrates with core systems, credit reporting agencies, and other third-party applications. This centralizes the institution’s data, creating an actionable single data platform and warehouse.

Learn more about our Partner Ecosystem

decrease in document processing time, reducing onboarding from months to days

reduction in document

legacy systems replaced at one institution

faster loan decision time

“nCino really opened our eyes to what a modern architecture could do and how you could be nimble from an IT perspective.”

Brent Beardall

CEO, WaFd Bank

"The investment in emerging technology has created tangible, economical value for the company and has transformed how the bank conducts business."

Bryan Jordan, Chairman, President, and CEO, First Horizon