Intelligent Banking Redefined

nCino Commercial Banking Solution

Revolutionize the way your institution does banking with the nCino Commercial Banking Solution. Streamline processes, manage data intelligently, and deliver exceptional customer experiences.

Schedule a Demo

The Platform Trusted by Industry Leaders Across the World

Solutions Designed to Scale Success

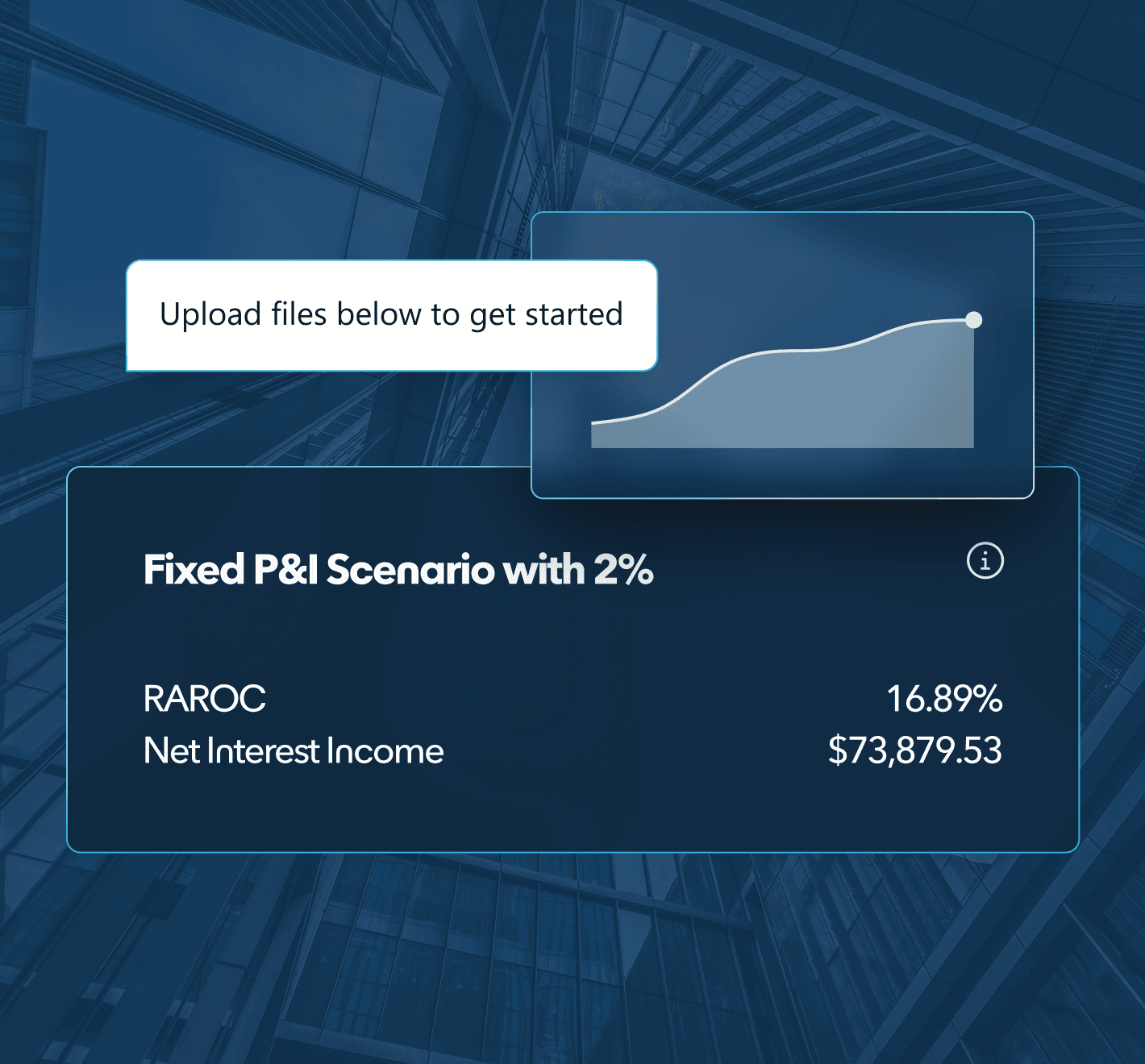

nCino Commercial Banking Solution offers a scalable experience for financial institutions (FIs) to effectively address customer onboarding, deposit account opening, loan origination, underwriting and portfolio management.

Replace outdated systems with an intelligent, end-to-end platform

Reduce manual tasks and increase efficiency with automation and generative AI

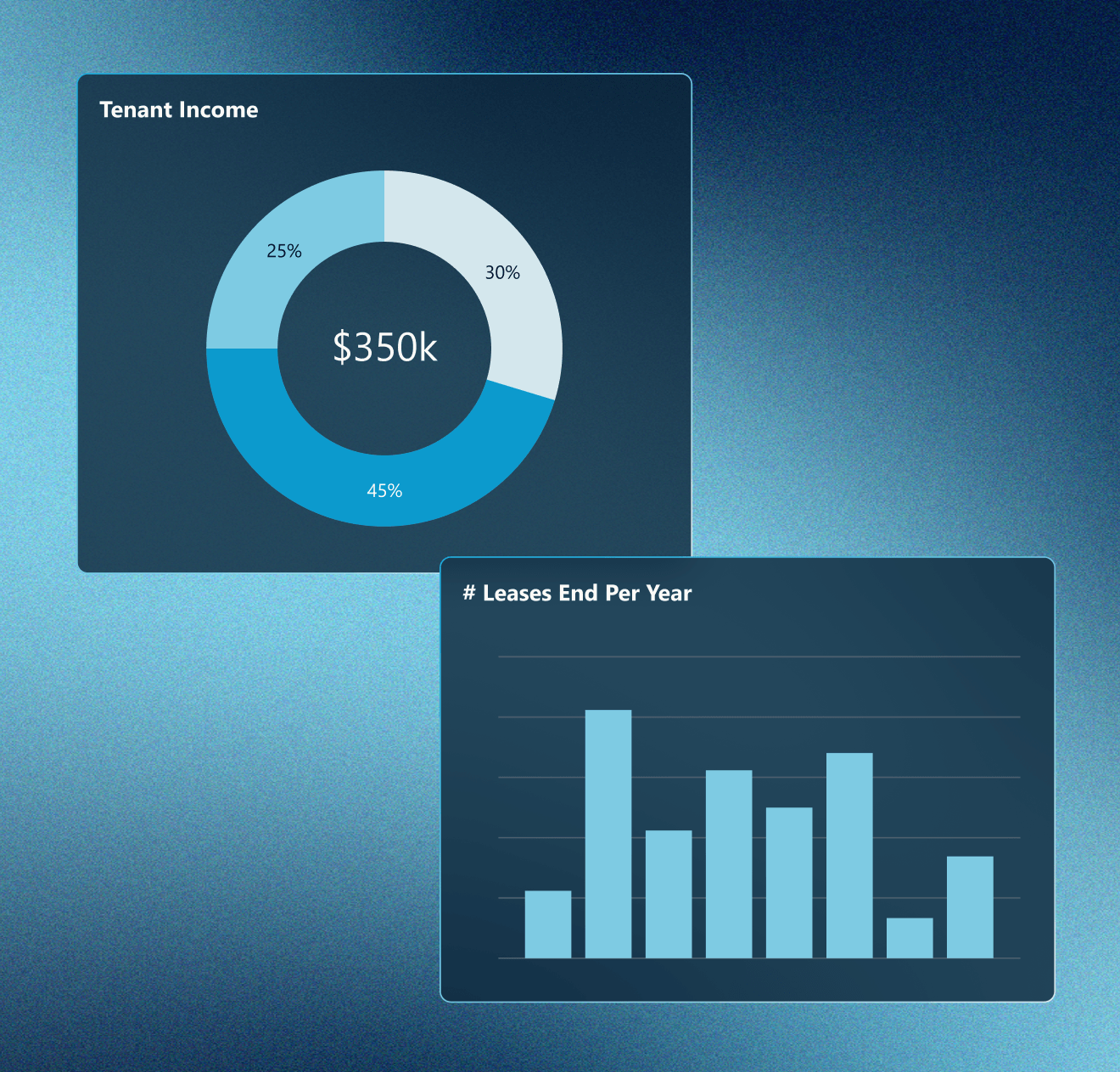

Gain real-time insights to enhance risk management and compliance

Empower your team with a solution made to deepen client relationships

Drive Efficiency with Intelligence

Increase operational efficiency by up to 80% with automated workflows. Centralize data for effective risk management and real-time decision-making.