AI vs. Automation in Banking: Why Confusing These Two Technologies Costs Millions

AI and automation aren't the same—confusing them can cost your bank millions in mismatched technology investments.

AI and automation aren't the same—confusing them can cost your bank millions in mismatched technology investments.

Commercial clients bring tremendous value to financial institutions through larger loans, deposits, and richer treasury services. Capturing all of that data, however, is time-consuming and often inefficient.

Leading banks spend millions every year on commercial onboarding—until they discover how to transform this cost into accelerated revenue.

Functional Business Analyst from Invest International shares insights on leveraging technology for development finance across emerging markets

This analysis is based on Celent's Global Commercial Banking Onboarding Survey 2025, surveying 409 banking professionals across North America, EMEA, and Asia-Pacific, representing financial institutions ranging from $10 billion to $500 billion+ in assets.

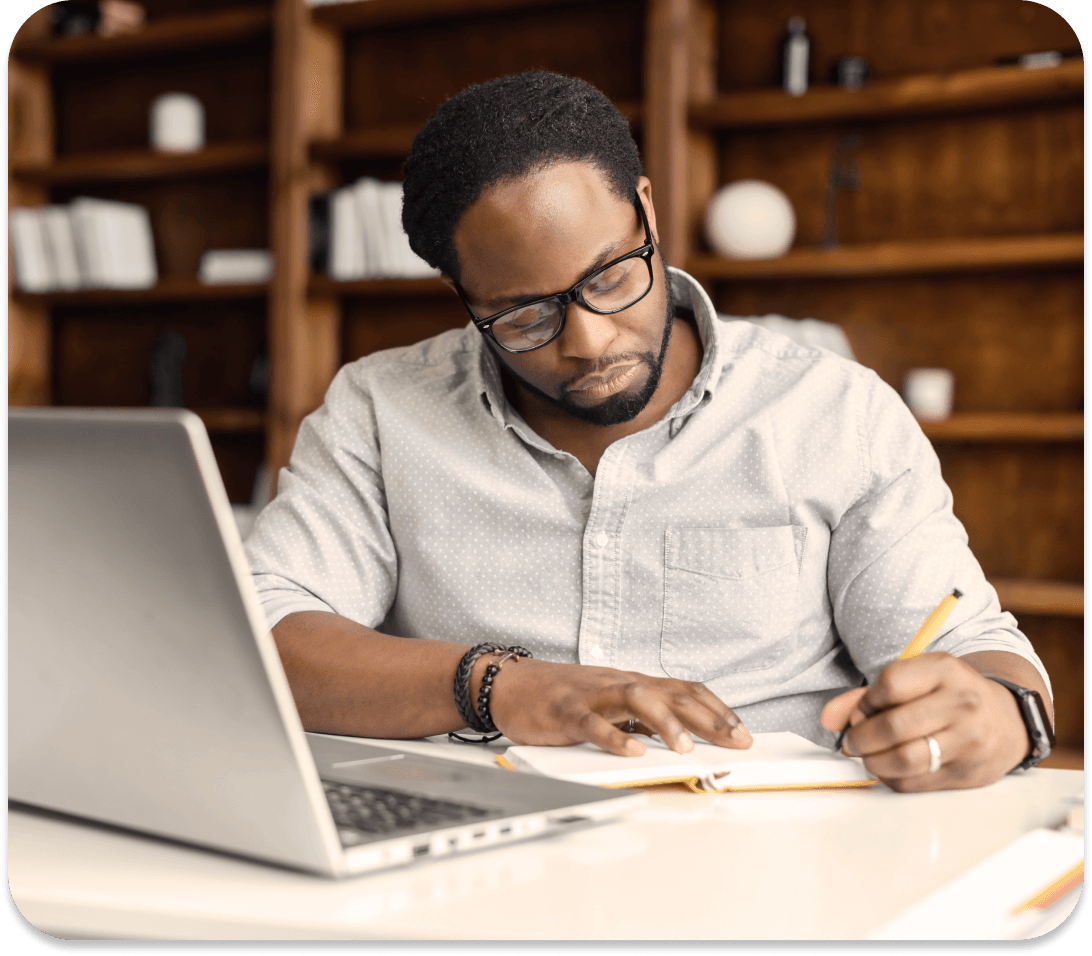

You’ve read the case studies. You’ve attended the webinars. You’ve heard the promises. Yet, despite recognizing automation's transformative potential, you remain stuck in extended evaluation cycles, unable to move from pilot programs to meaningful implementation.

Credit unions are quietly rewriting the automation playbook in financial services. The latest research reveals a strategic insight that challenges conventional wisdom: 67% of credit unions prefer fintech partnerships for automation implementation—the highest adoption rate among all institution types.This isn't about being tech-forward for technology's sake. It's about credit unions recognizing something fundamental: the right automation partnerships can amplify their member-first mission rather than compromise it.

Community and regional banks have built something remarkable: the ability to be a true financial partner across the entire lifecycle of your market's success stories. You're there when the entrepreneur opens their first small business account. You finance the equipment when they're ready to scale. You provide the working capital that gets them through growth spurts. You manage the wealth when success comes, and you're structuring the complex credit facilities when they become the major employer in town. This full-spectrum capability—delivered with personal attention at every stage—is your superpower.

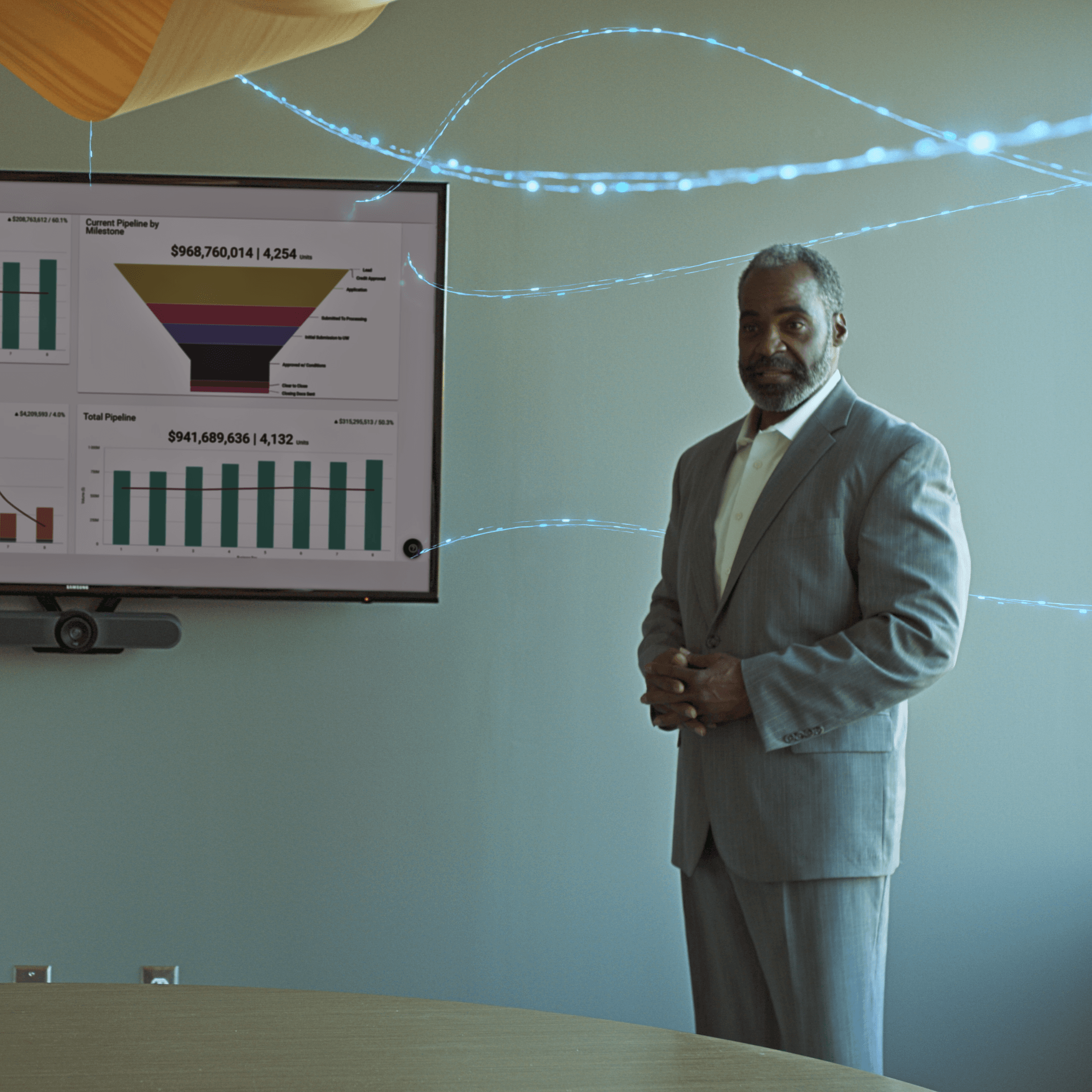

nCino's CEO discusses industry optimism, AI transformation, and the path to automated banking workflowsIn this episode of Banking on Intelligence, nCino's Brandon Lokits sits down with Sean Desmond, CEO of nCino, to explore the current banking landscape and how financial institutions are embracing a new era of technology-driven transformation.

You know AI is essential for staying competitive. But here's what we're seeing: too many institutions jump into automation without the visibility they need to make it count. In today's challenging environment—economic headwinds, evolving regulations, rising customer expectations—you need more than speed. You need precision.

More than half of banking customers are ready to switch banks due to poor digital experiences. That's not just a warning sign—it's a call for change.

Chief Industry Innovation Officer shares insights on navigating the data-AI bridge and building stronger customer relationships through technology

Chief Risk Officer from Great Southern Bank shares insights on technology, customer relationships, and strategic partnerships

nSight 2024, nCino’s annual conference, was held May 14 – 16 in Charlotte, NC.

As technology continues to rapidly change the way financial institutions conduct business, AI has the potential to transform CIB lending.

In the dynamic world of financial services, Artificial Intelligence (AI) stands at the forefront of a revolution, unlocking unprecedented value for financial institutions. This technology, characterized by its ability to learn and adapt, is not merely an addition to the toolkit of the financial sector; it's a game-changer. By harnessing AI, financial institutions (FIs) are enhancing decision-making processes, optimizing operational efficiencies, and delivering highly personalized customer experiences.

Learn how joining the nCino Data Community can benefit your financial institution.

Thanks to the advances in artificial intelligence (AI) and machine learning, the future of the lending industry is undergoing a major transformation. AI is enabling lenders and financial institutions to automate processes, reduce costs, improve customer experience, and manage risks more effectively. AI can also help lenders offer more personalized and tailored products and services to their customers, based on their preferences, behavior, and creditworthiness.

As economic conditions grow more volatile, financial institutions (FIs) are all wondering the same thing: how can we build resilience and maintain or grow a competitive position in these uncertain times?In many cases, this debate centers around where to reduce spending or which projects can be put on hold as efforts and priorities are reshaped. However, seeking savings by cutting or pausing digital transformation projects can do more harm than good.

JOHANNESBURG, South Africa – November 1, 2022 – nCino, Inc. (NASDAQ: NCNO), a pioneer incloud banking and digital transformation solutions for the global financial services industry, today announced that Absa Bank Limited (Absa), a leading African bank, has selected the nCino Bank Operating System®, to deliver a single platform solution to automate its debt case management and portfolio reporting processes in its Relationship Banking Business.As the bank accelerates its digitization programme, nCino will deliver this cloud-based platform and help Absa reduce complexity and eliminate high-touch processes, ultimately enhancing its employee and customer experience and improving efficiency.“The introduction of nCino will provide Absa with a single centralized workflow solution, which will streamline its internal processes,” said Kate Jane Johnsen, Regional Vice President at nCino. “I am eager to see the results of this partnership in action.”

Rabobank Australia and New Zealand has partnered with nCino to implement its Bank Operating System. This will help RANZ to automate its financial spreading analysis, improve the speed and quality of credit decisions, and free up employees' time to focus on strengthening customer relationships.

Natixis CIB is partnering with nCino to streamline and automate several legacy processes. With solutions like Automated Spreading, nCino IQ (nIQ) and the Corporate Banking Solution, Natixis CIB will strengthen competitiveness and provide enhanced services to its clients.

Summit Bank, a $761 million-asset bank based in Oregon, has selected nCino's Cloud Banking Platform to transform its operations and digitize its commercial lending business. By leveraging nCino's Commercial Banking and Automated Spreading solutions, Summit Bank aims to gain insights faster, automate tasks and provide a personalized experience for its clients, while replacing disparate systems and enhancing workflow and approval processes.

Amerant Bank has expanded its use of nCino's cloud banking and digital transformation solutions beyond Commercial Banking to include nCino's Retail Banking Solution and Portfolio Analytics. By leveraging nCino's platform, powered by AI and advanced analytics capabilities, Amerant aims to streamline workflows, improve the customer experience, manage risk more effectively and deliver comprehensive reporting across the institution.

WILMINGTON, N.C. and SALT LAKE CITY, July 16, 2019 /PRNewswire/ — nCino, the worldwide leader in cloud banking, today announced that it has acquired Visible Equity, a market-leading financial analytics and compliance software company based in Salt Lake City, Utah. This strategic acquisition leverages the unique strengths and joint synergies of each company to further drive and accelerate transformation in financial services.