Optimize Your SBA Lending with the Pioneer in Cloud Banking

nCino's SBA solution enhances the 7(a) loan process for your clients and employees by digitizing documentation collection, eliminating manual processes, simplifying data entry, and providing real-time transparency.

Schedule a DemoDeliver Opportunity with Small Business Lending

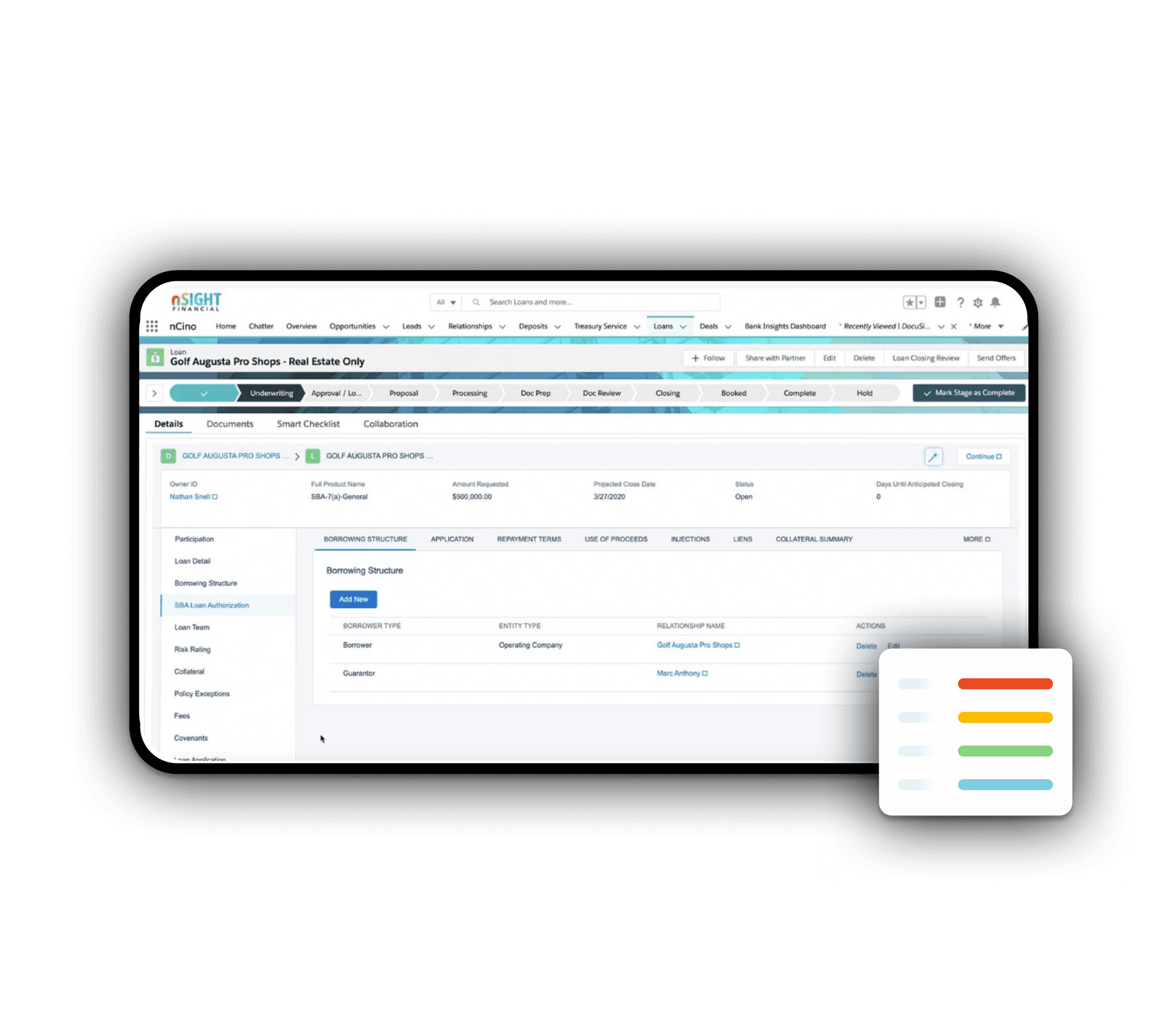

Submit SBA loan guaranty requests from within the nCino Bank Operating System via the SBA’s E-Tran Portal, reducing duplicative data entry.

Review and edit the application information and continue to send updated data until the SBA approves or rejects the loan and provides a loan number.

Control users’ access level with permission sets.

Data that users update in the E-Tran application window synchronizes with the related records on which the data resides.

Automated mapping and data translation capabilities work in the background to ensure data transmits to the SBA in the required format.

Enhance Your SBA Lending Experience with nCino

nCino's SBA Solution creates a streamlined documentation experience for customers and supports submitting forms via the Docusign integration, such as IRS Form 1919 and 4506-C.

Reduction in Time to Deliver Loan Decisions

The flexibility of nCino’s SBA solution has allowed us to process over half a billion dollars in PPP loans for new and existing clients, and the fact that we were able to get up and running on it in literally a matter of days.

Brent Beardall

President and CEO, WaFd Bank

Financial institutions using the nCino Cloud Banking Platform have been able to swiftly and digitally provide more than $30 billion for their eligible small business clients through the SBA’s Paycheck Protection Program (PPP).

Improve SBA Lending Efficiency

The nCino SBA Solution facilitates the loan approval process for any type of SBA loan, including but not limited to 7(a) and Express. Take advantage of nCino’s integrated view of your customers to streamline the data entry process and to create and submit their loan application via an integration to E-Tran. With our SBA solution, you can:

Leverage a complete end-to-end system for SBA loan processing with intuitive step-by-step workflows for automatic routing of applications.

Streamline loan processing with an intuitive SBA loan interface with applicable built-in SBA workflow rules.

Reduce duplicative data entry by submitting the loan application directly to the SBA using the E-Tran integration.

Discover the Foundations of SBA

Accelerate Document Generation and Management

All documentation and forms are stored within nCino, allowing FIs to package the loan and its related documents quickly and conveniently, improving operational efficiency and eliminating manual re-keying of application data.

Generate SBA 7(a) closing documents through document prep integrations.

Create and map the SBA Loan Authorization and SBA Express Loan Authorization forms.

Leverage nCino’s Document Manager, a configurable, integrated document repository providing instant, secure and digital access to any form within nCino.

Provide clients with a streamlined document and closing experience through digital channels and e-signature capabilities.

Submit the application directly to the SBA via an integration to E-Tran.

nCino not only allows us to react quickly to customers' needs but also helps us maintain transparency so that we are able to efficiently manage priorities as the current situation continues to evolve.

Brad Turner, EVP and Chief Credit Officer, Coastal States Bank

Ready to learn more? Explore the Implementation and Modernization Process for Customers.

Over the last decade, nCino has supported thousands of institutions with implementation projects through a phased, project-based approach. From this experience, we’ve identified best practices to ensure your financial institution undergoes a successful transformation that eliminates inefficiencies, improves strengths, maximizes productivity, and builds a competitive advantage.