It's All About

the Go-Live

Implementing an industry-leading platform requires a thoughtful strategy. nCino's team works with your institution to create a plan that meets your needs and ensures your success.

Deploy with Confidence

Our phased project approach eliminates inefficiencies, improves strengths, and maximizes productivity with a customized deployment schedule for your institution. Join us as we highlight the key components of each phase.

1. Define the Scope

As you prepare to implement the nCino Platform, we provide an introductory call between our teams to discuss project timelines, define product ownership roles, and review high level scope for the project.

We want to ensure that we thoroughly understand your needs and communicate the logistics for the project. It’s important to us to establish effective cross-team communication and understand the critical project dependencies for both teams to make your implementation successful. During this phase, you’ll work with our teams to:

Create an nCino project plan, escalation policy, and project terminology

Identify your project team and points of contact

Establish rules of engagement

Schedule weekly status calls

Identify any project risks

2. Integrate nCino with Your Institution’s Core

It’s time to deep dive into your institutional core’s custom architecture and structure. We analyze this structure in depth before we begin integration and configuration to ensure clarity and understanding of specific bank terminology and associations or categorizations used in the core.

During this time, we identify, plan, and resolve any discrepancies or potential risks between your core and nCino's data model. We also provide our project specialists with critical information on how your institution categorizes borrowing relationships, loans, deposits, products, and entities. Throughout this phase, you can expect:

Successful loading of your core data (loans, borrowing entities, borrowing individuals, contacts, and collateral) into nCino's environment

Data mapping documentation that highlights any data conversions between your core and nCino

3. Align Teams to Optimize Your Experience

Let’s discuss your business processes and the challenges you face day to day. We meet with you in person during an official on-site to review any gaps in your current loan process and observe a detailed walk-through to understand how a loan flows through your institution.

We aim to create excitement and synergy between our teams as the value and understanding of the nCino system grows. In this phase, you can expect:

Formal on-site and in-person introductions between our teams

Completion of the initial data load that lets nCino demonstrate and test real data transfer from your core environment

Confirmation that the reporting and analytics are operating during the preliminary configuration sessions in preparation for Phase 4

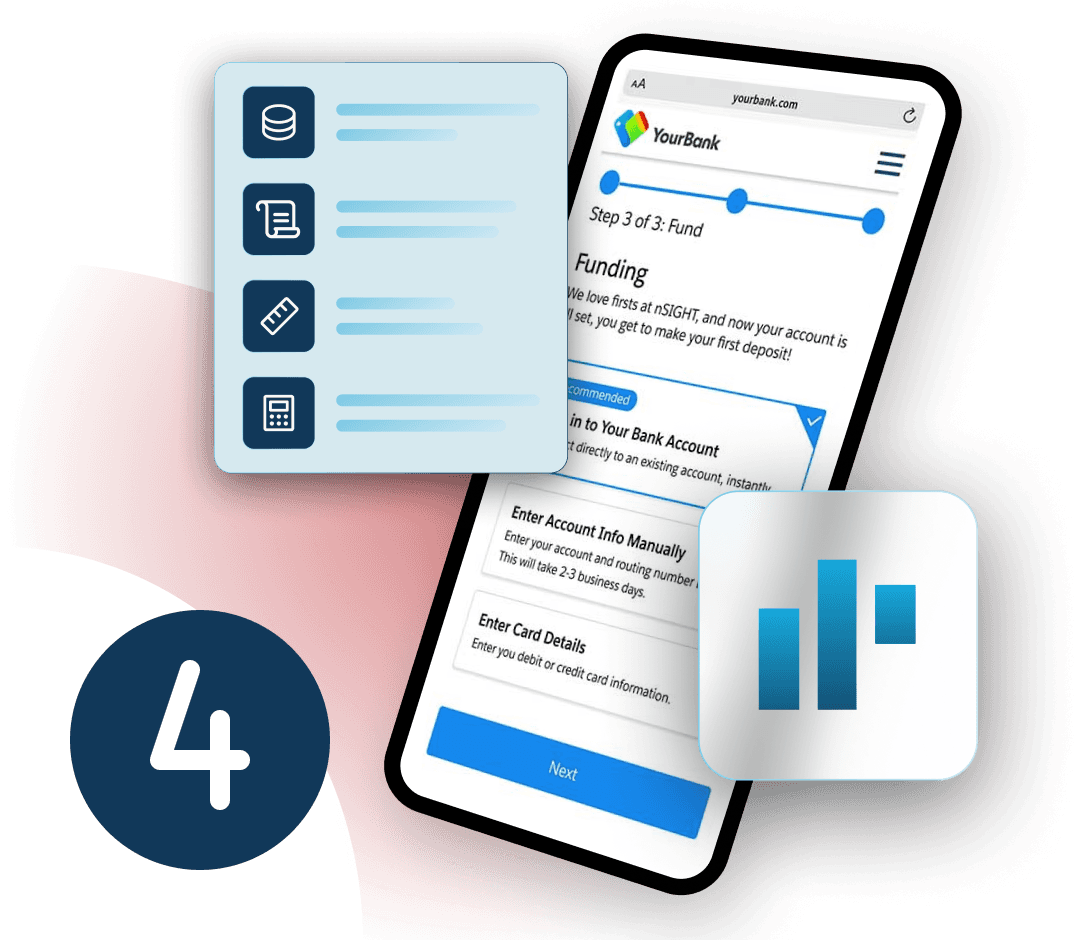

4. Configure Your Custom Environment

It’s time to customize and build the intelligent platform that fully meets your needs. We use this time to develop the features and functionality as your institution requested during the configuration and specification plan.

As this phase progresses, you’ll see a working baseline model that has been customized and configured to the defined specifications. We also host multiple on-site "walk-through" sessions to introduce the baseline solution to familiarize users with the layout, functionality, and features.

5. Test Your Environment

Your feedback is the most important part of this phase. We want to make sure that everything is exactly the way you want it before we help bring your institution live on the nCino platform.

We also use this phase to launch your pilot team’s training with "train the trainer" sessions, which empower your team to confidently configure and navigate the platform. During these training sessions, we use your feedback to perform data validation and user acceptance testing (UAT) sessions. After this phase, you can expect:

A comprehensive view of the entire solution customized specifically for your institution

Hands-on training for the pilot team and users

Pilot loans run through the working solution

Time to provide feedback to nCino to make final adjustments in preparation for your go-live

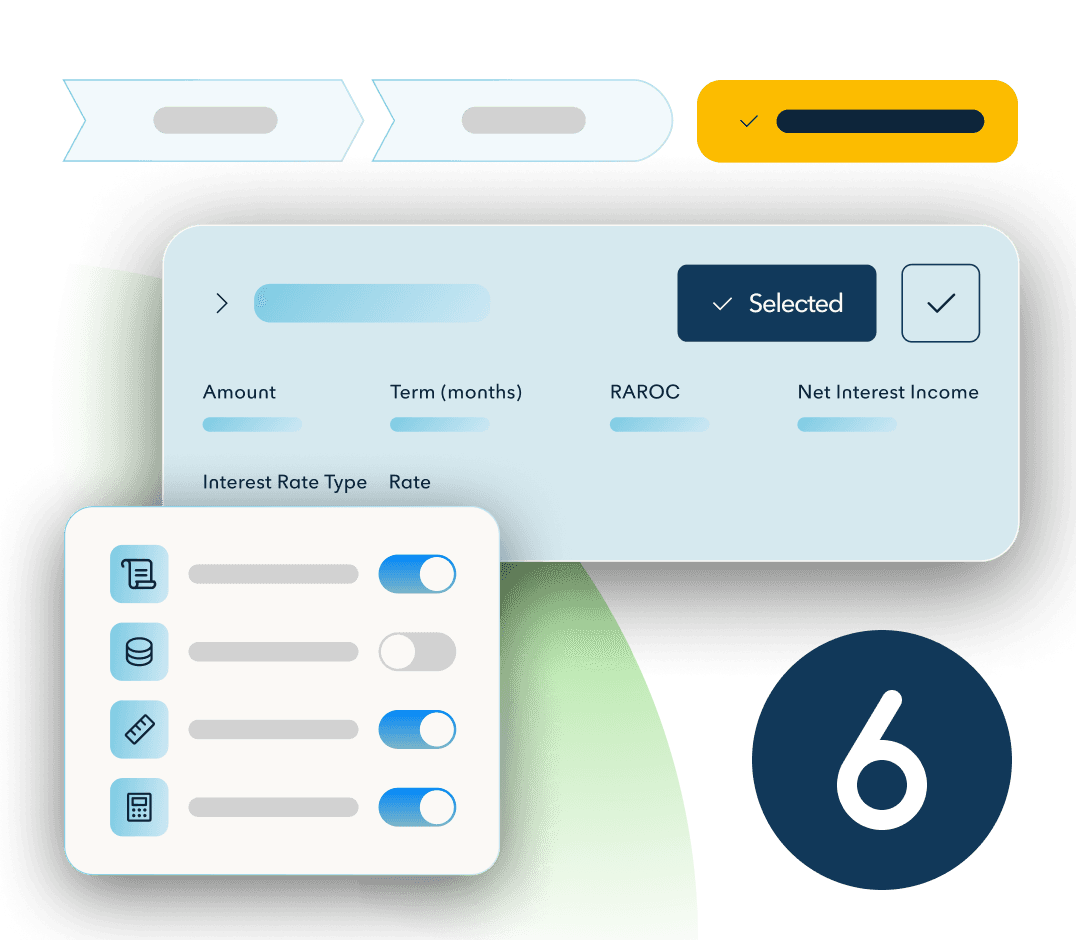

6. It’s All About the Go-Live

This is the most exciting phase as we wind down the implementation process. As the first formal introduction of the nCino platform to the majority of people at your institution, it's a critical time to ensure full user adoption. It also represents a significant milestone that improves how your organization operates and communicates on a daily basis.

Together, we’ll have an on-site and organizational-wide training for everyone in your institution that will use the platform—which also includes an on-site kick-off and celebration with the nCino project team and your institution. With this phase, you can expect:

Coordination of all internal resources and users

Role-based, remote, or on-site training sessions with nCino University Trainers

nCino administration training

Official Go-Live with the nCino Platform

7. We’re Here to Support Your Success

We value your partnership and rely on your feedback to continue refining, improving, and innovating the nCino Platform. Because your needs can change over time, we’ve built a proactive account management approach that includes maintenance, upgrades, enhancements, and training. In other words, we’re here for you every step of the way.

During this ongoing time, you can expect:

Continuous monitoring and support to ensure best practices that maximize your ROI

Cross-enterprise integration and adoption

Customer success management

Proactive support

Ongoing needs-based analysis