AI Banking Software Built on 13 Years of Industry Data

nCino's AI is built on one of the most comprehensive perspectives in financial technology, which allows us to deliver what no other partner can: AI informed by collective industry intelligence and real-world banking expertise.

Schedule a Demo

The Platform Trusted by Industry Leaders Across the World

AI That Solves Real Banking Challenges

nCino's AI-powered solutions address critical pressure points across the financial services lifecycle. While competitors showcase disconnected tools and make shallow promises about efficiency, nCino processes billions in loans across our global customer network. We have the data. We have the deep domain expertise. And we know how to leverage AI to help you become more efficient, more compliant, and more competitive.

From loan origination and credit decisioning to risk management and compliance, our artificial intelligence tools are transforming how financial institutions operate. Below are some of the key AI capabilities helping banks and credit unions work smarter, faster, and more efficiently.

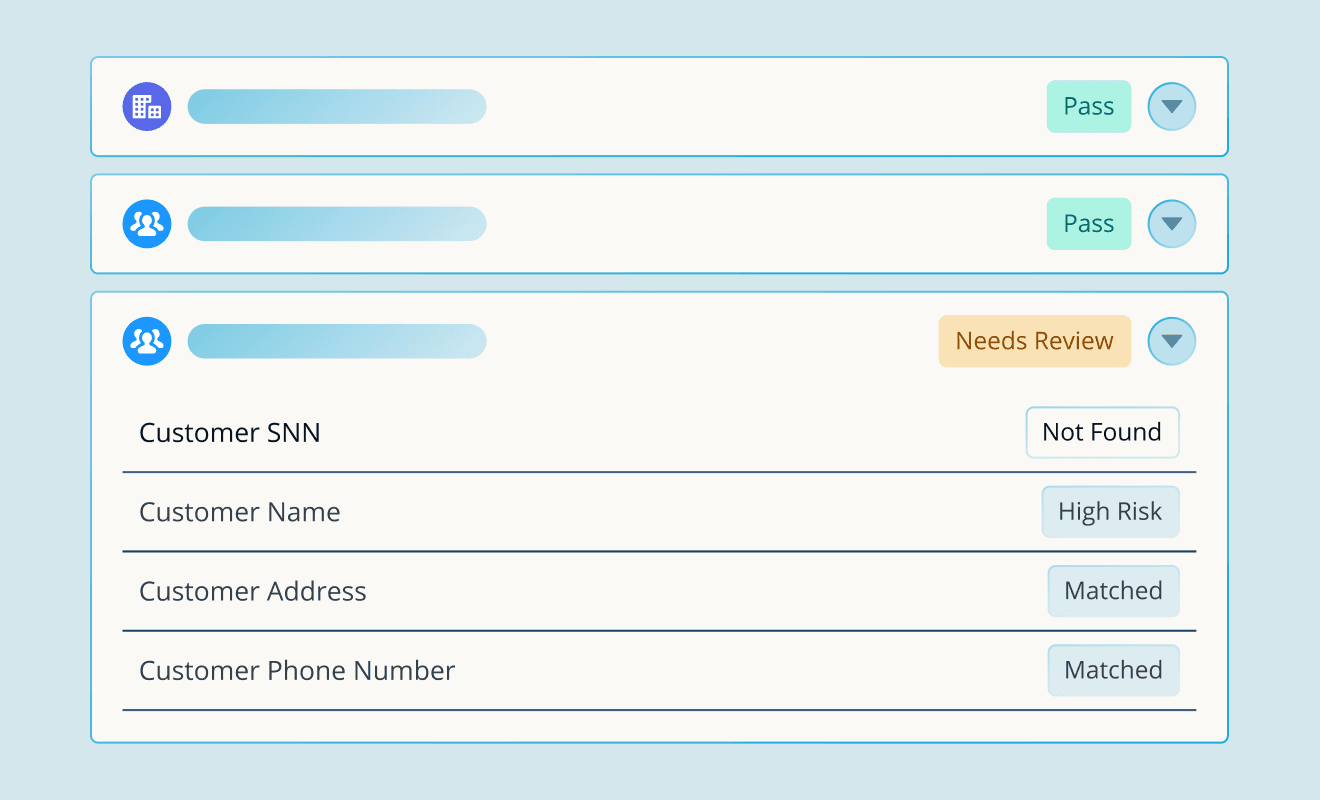

Risk and Compliance: Know What's Changing Before It's a Problem

Features like Continuous Credit Monitoring provide real-time, data-driven insights for proactive risk monitoring across the entire credit lifecycle. The system automatically identifies at-risk loans by monitoring performance patterns, generates prioritized risk alerts with impact scoring, and recommends corrective measures.

Institutions using Continuous Credit Monitoring shift from reactive firefighting to proactive portfolio management. Risk officers receive automated alerts when loan performance deviates from expected patterns, with context from peer benchmarks showing how similar loans perform across the industry.

Explore Continuous Credit Monitoring

Agentic AI: Your Digital Banking Teammate

nCino is launching “Digital Partners” into the nCino Platform to seamlessly support banking talent with agentic capabilities. These role-based agents will enable financial institutions to focus on decision-making and relationship building rather than navigating complex systems, working invisibly in the background to amplify human capabilities. Our Digital Partners are being built on a multi-layer architecture that combines foundational tools, specialized sub-agents, orchestrated agentic workflows, and role-specific intelligence delivered through natural conversation. Four of the Digital Partners will be accessible through Banking Advisor, nCino's conversational AI interface, and each is designed to address the distinct workflows, pain points, and objectives of its targeted users:

Executive Digital Partner will deliver strategic intelligence for C-suite decision-making

Analyst Digital Partner will accelerate risk assessment and complex financial analysis

Service Digital Partner will enhance customer and member relationship management

Processor Digital Partner will eliminate workflow bottlenecks

Client Digital Partner will deliver AI-enhanced self-service digital banking experiences directly to customers and members

These Digital Partners are designed to deliver contextually relevant assistance through the nCino Platform. With embedded domain expertise and access to critical financial data within the operational context of financial institutions, our digital partners will work alongside your staff seamlessly, creating a “dual workforce” fit for the future.

Discover Digital PartnersEfficiency and Automation: Work Smarter, Not Harder

Manual document sorting and data entry can take hours. Tools like Locate and File automatically identify document placement in your borrowing structure and populate data fields. When a loan officer receives financial statements, Locate and File extracts the data with 99% accuracy and routes documents to the correct location in the loan file, saving valuable time.

Combined with Automated Spreading, these tools transform documentation workflows from time-consuming manual processes into automated intelligence that frees your team to focus on decision-making rather than data entry.

Explore Document Management SolutionMortgage Lending: Faster Closings, Better Experiences

Traditional mortgage processes burden loan officers with 1-2 hours daily answering repetitive borrower questions, while over 20% of borrowers report communication difficulties with lenders outside business hours. nCino Automated Pre-Approval Flow transforms this experience by unifying credit authorizations, verification services, fee calculations, and AUS integrations into one seamless AI-powered process that automatically handles up to 50% of loan applications with minimal loan originator intervention.

At the heart of this automation, nCino Mortgage Advisor provides 24/7 multilingual support with loan-specific guidance informed by individual borrower application data. This generative AI chat experience maintains compliance-focused responses while guiding borrowers through the automated approval process, freeing loan officers to focus on relationship building and complex cases that require human expertise. The result: faster decisions, reduced operational costs, enhanced borrower satisfaction, and a transparent experience that keeps applicants engaged from application through closing.

Explore nCino Mortgage Solution

"Our data and human-centered approach is what separates outcome-based innovation from technology for technology's sake."

Sean Desmond, Chief Executive Officer at nCino

The Data Foundation That Powers Everything

Before AI can transform financial services, it needs the right data foundation. nCino's analytics tools build this foundation by unifying fragmented data sources, standardizing information, and creating the clean, structured datasets that fuel our AI capabilities. Three core analytics tools create this foundation:

Operations Analytics

Transform operational performance with pre-built dashboards that eliminate manual reporting. Operations Analytics provides historical trending, peer benchmarking, and process mining capabilities—all powered by anonymized data from the nCino Data Community. Track loan cycle times, identify bottlenecks, measure workforce efficiency, and compare your performance against industry peers to identify competitive advantages.

What makes it unique: Access to peer benchmarking data from hundreds of institutions, giving you context beyond your own four walls.

Learn more about Operations Analytics

Portfolio Analytics

Monitor credit risk and portfolio health with analytics designed for banking workflows. Portfolio Analytics helps institutions manage risk better by providing real-time insights into portfolio concentration, early warning indicators, and CECL impact—all within the lending workflow where decisions are made.

What makes it unique: Transform weeks of manual analysis into instant, actionable insights that drive better decisions and reduce regulatory risk.

Learn more about Portfolio Analytics

Mortgage Analytics

Gain visibility into mortgage operations with dashboards purpose-built for mortgage lending. Track pipeline performance, monitor compliance metrics, and optimize workflows across the entire mortgage lifecycle—from application to closing and servicing.

What makes it unique: Mortgage-specific KPIs informed by data from institutions processing billions in mortgage volume annually.

Learn more about Mortgage Analytics