A Modern Banking Integration Solution to Build a Smarter, Stronger Business

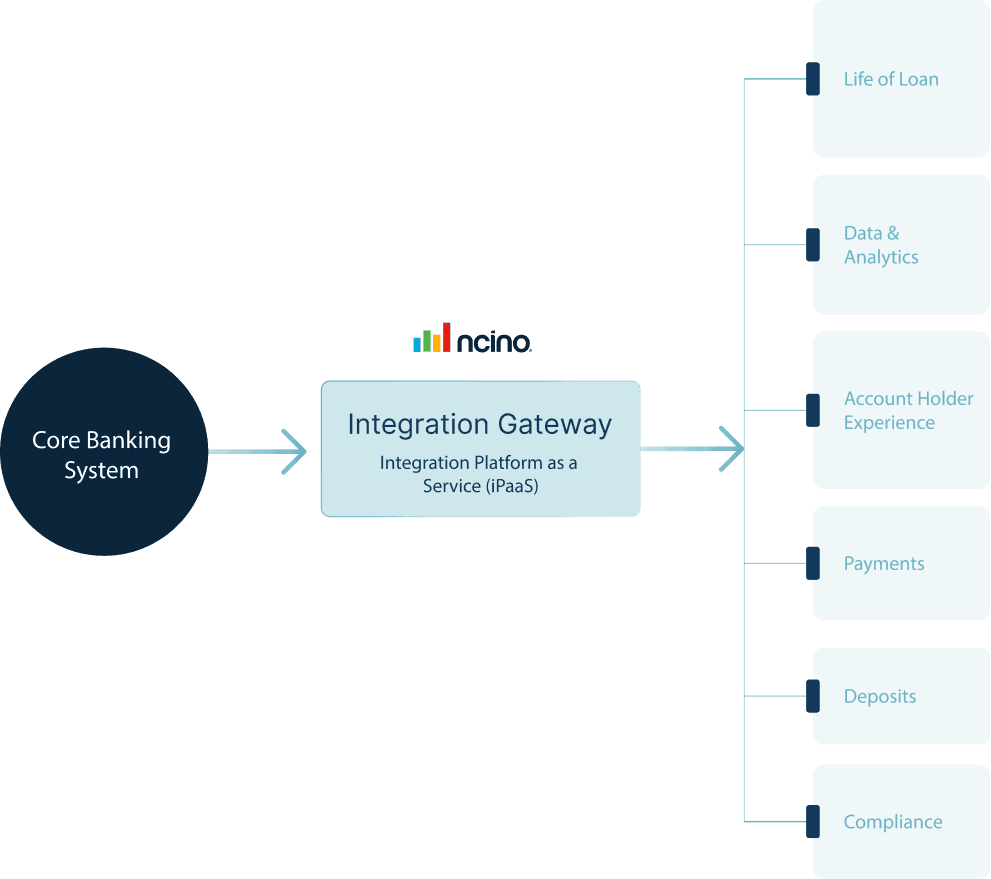

nCino Integration Gateway (formerly Glyue by Sandbox Banking) is the Integration Platform as a Service (iPaaS) that eliminates bottlenecks & accelerates digital transformation with a purpose-built platform designed specifically for financial institutions.

Schedule a DemoBreaking Down Banking Integration Barriers

Financial institutions face mounting challenges as they strive to integrate systems effectively in a complex and evolving digital landscape, including:

Legacy System Limitations: Loan officers waste time rekeying data from various systems back to the core (or vice versa), slowing approvals and creating the potential for data discrepancies.

Integration Bottlenecks: IT teams are tied up fixing data discrepancies and integration connectors, rather than focusing on innovation and new technology.

Data Silos: Without banking API integrations, bank and credit union employees must manually re-enter customer or member data across multiple systems because they can't see the complete account picture.

High Development Costs: IT teams spend months building custom integrations instead of launching the fintech tools and integrated banking solutions your customers and members are requesting.

The Platform Trusted by Industry Leaders Across the World

Solutions Built to Power and Evolve Your Financial Institution

With pre-built connectors, low-code automation, and governance-ready security, nCino Integration Gateway empowers institutions to accelerate innovation via single integrations, multi-module systems, or full iPaaS functionality without overwhelming IT resources.

For CTOs and CIOs

Transform your IT strategy with API-led connectivity.

Accelerate innovation without overwhelming IT

Speed digital transformation with vetted, low code and pre-built templates that standardize data integration patterns rapidly.

Eliminate integration backlogs and vendor dependencies

Automate system connections, reduce maintenance overhead, and free your team from repetitive integration work. Focus on strategic initiatives instead of managing point-to-point connections.

Future-proof with governance-ready architecture

Built-in audit trails, role-based permissions, and regulatory compliance features ensure your integrations meet banking standards from day one—no retrofitting required.

For Heads of Lending

Unify data from core, CRM, LOS, and fintech systems into a real-time, single customer view, improving service, insights, and operational efficiency.

Eliminate rekeying between LOS and core systems

No more manual data entry or document chasing—just automated workflows that move borrower information seamlessly from application through booking.

Reduce NIGO rates and speed decisioning

Automate data validation, income verification, and document collection. Spend less time fixing incomplete applications and more time closing quality loans.

Lend with precision and speed

With consistent, secure, real-time data flow, borrowers enjoy a safe and efficient lending experience while lenders can trust the accuracy and relevance of the data leveraged.

For Innovation Leaders

Enable rapid fintech deployment with banking-specific integration

Launch new digital products without IT bottlenecks

No more waiting for custom integrations or complex vendor negotiations—just pre-built connectors that let you deploy new services and partnerships quickly.

Create unified customer experiences across all touchpoints

Connect digital banking, CRM, core systems, and fintech apps into one seamless ecosystem. Customers get consistent, personalized service whether online, mobile, or in-branch.

Build your competitive moat with connected data

With unified customer views and real-time insights across all systems, you can deliver the personalized, intelligent banking experiences that keep customers loyal and engaged.

Purpose-Built Connectivity

Streamline banking API integrations with connectors built specifically for financial services, reducing implementation time and technical complexity.

Connect major cores from Fiserv, Jack Henry, FIS and many others with pre-built connectors

Integrate fintech platforms without custom development overhead

Leverage banking-specific data transformation and routing capabilities

Ensure regulatory compliance with built-in governance features

Accelerated Innovation

Deploy fintech partnerships and digital products faster with low-code tools that don't overwhelm your IT team.

Expedite the launch of new banking API integrations

Enable business users to manage workflows without heavy IT involvement

Reduce time-to-market for digital banking initiatives and fintech partnerships

Scale integration capabilities without expanding development resources

Operational Excellence

Centralize data flow for seamless operations, turning disconnected systems into a unified source of truth.

Eliminate manual data entry and rekeying across banking platforms

Ensure accurate, bi-directional data synchronization in real-time

Automate account maintenance, loan processing, and account holder updates

Free staff to focus on strategic initiatives and customer or member service rather than system maintenance

Future-Proof Architecture

Scale your digital infrastructure with flexible integrated banking solutions that adapt to evolving banking technology.

Support both real-time APIs and batch data processing in one platform

Add new systems and augment legacy technology without disrupting workflows

Maintain secure, compliant integrations as regulations evolve

Build a foundation for AI and advanced analytics with unified data access