The Intelligent Automation Revolution: Transform Mortgage Lending from Application to Close

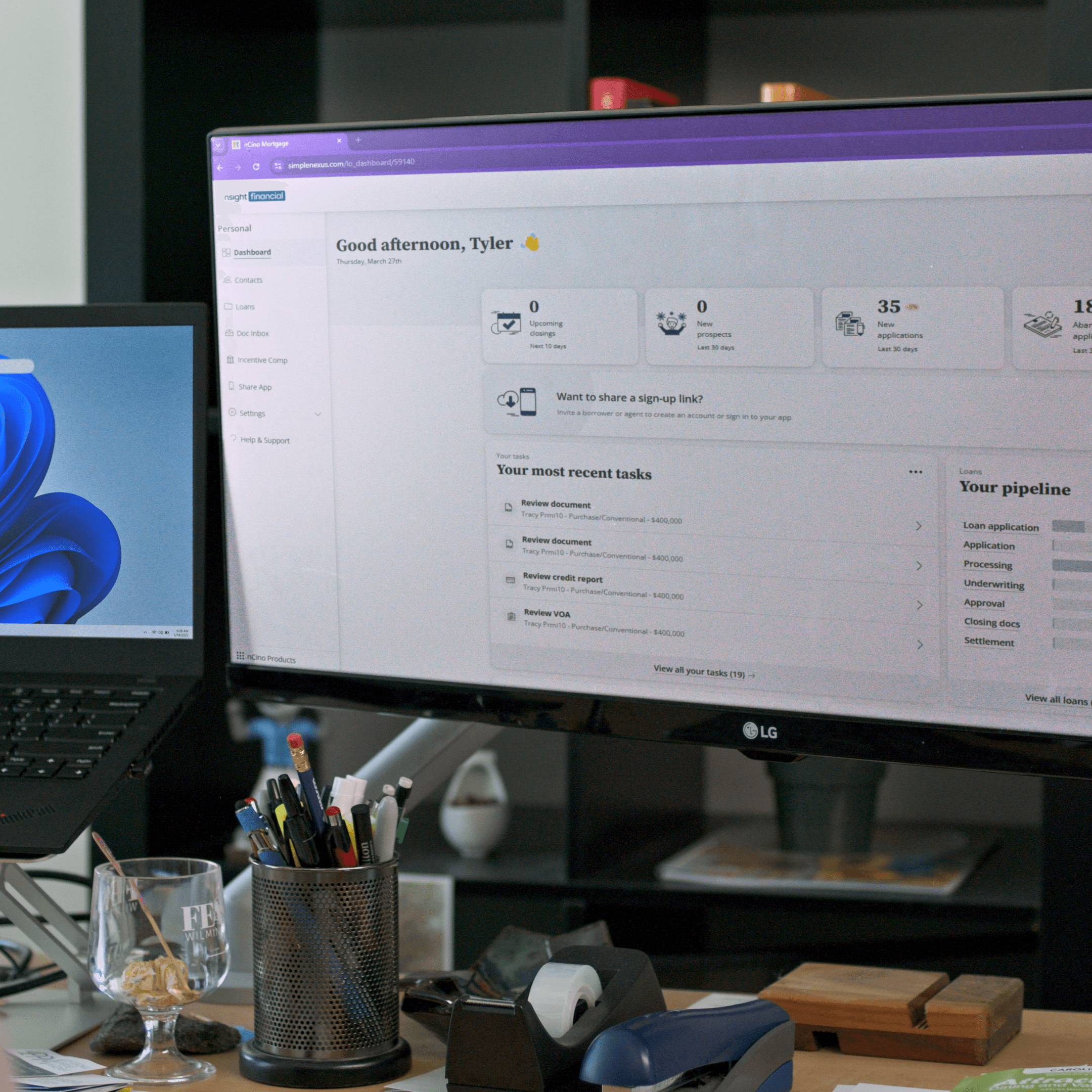

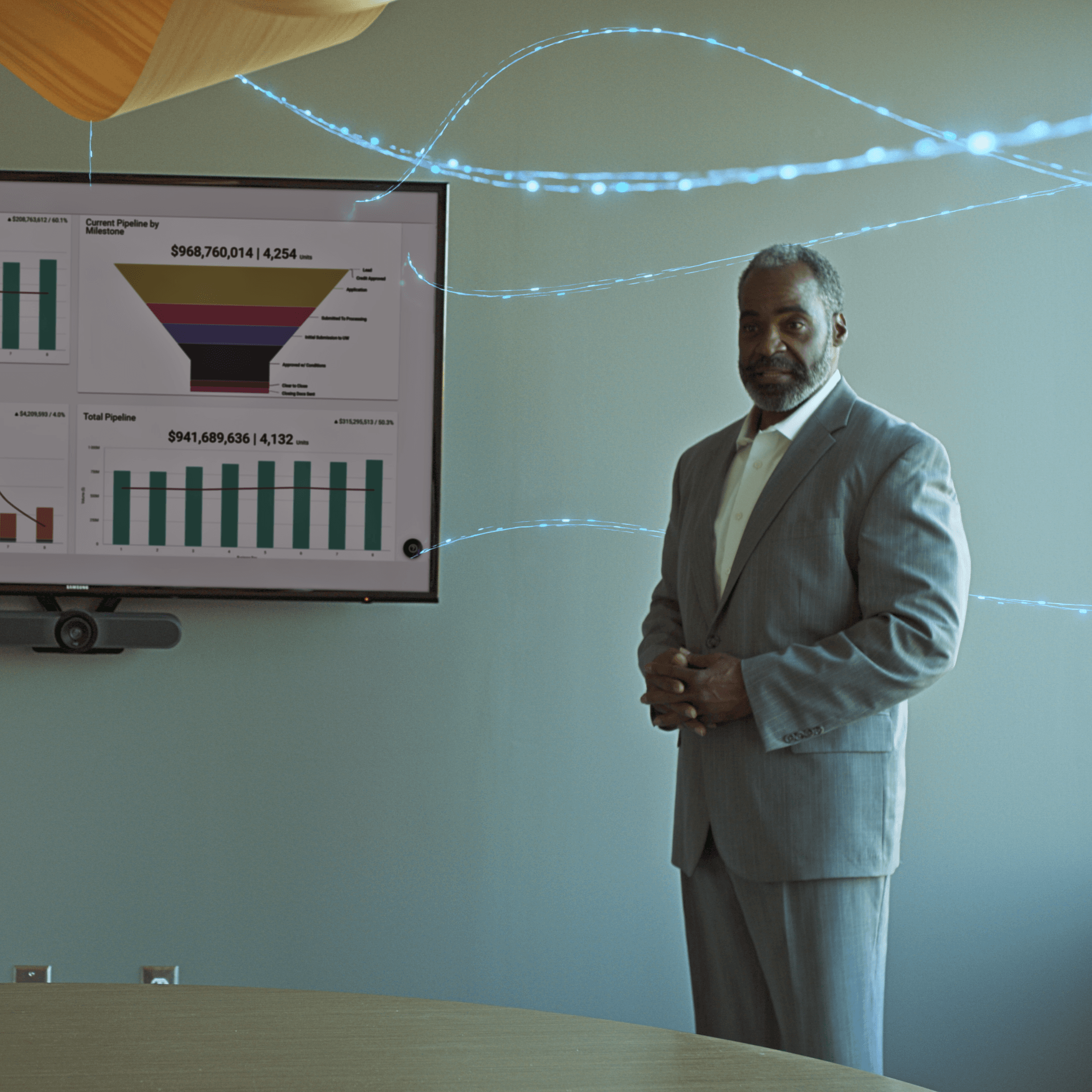

The mortgage industry is evolving at a rapid pace. Borrowers demand faster, more seamless digital-first experiences, and lenders face mounting pressure to adapt. With loan abandonment rates exceeding 75% at critical process stages, the stakes have never been higher.