Home Lending on a Single Platform

A flexible cloud-based, omni-channel solution uniting customers and third parties on a single platform, nCino’s Mortgage Solution helps you exceed customer expectations at every stage of the home lending process.

A Platform that Delivers Efficiency and Speed

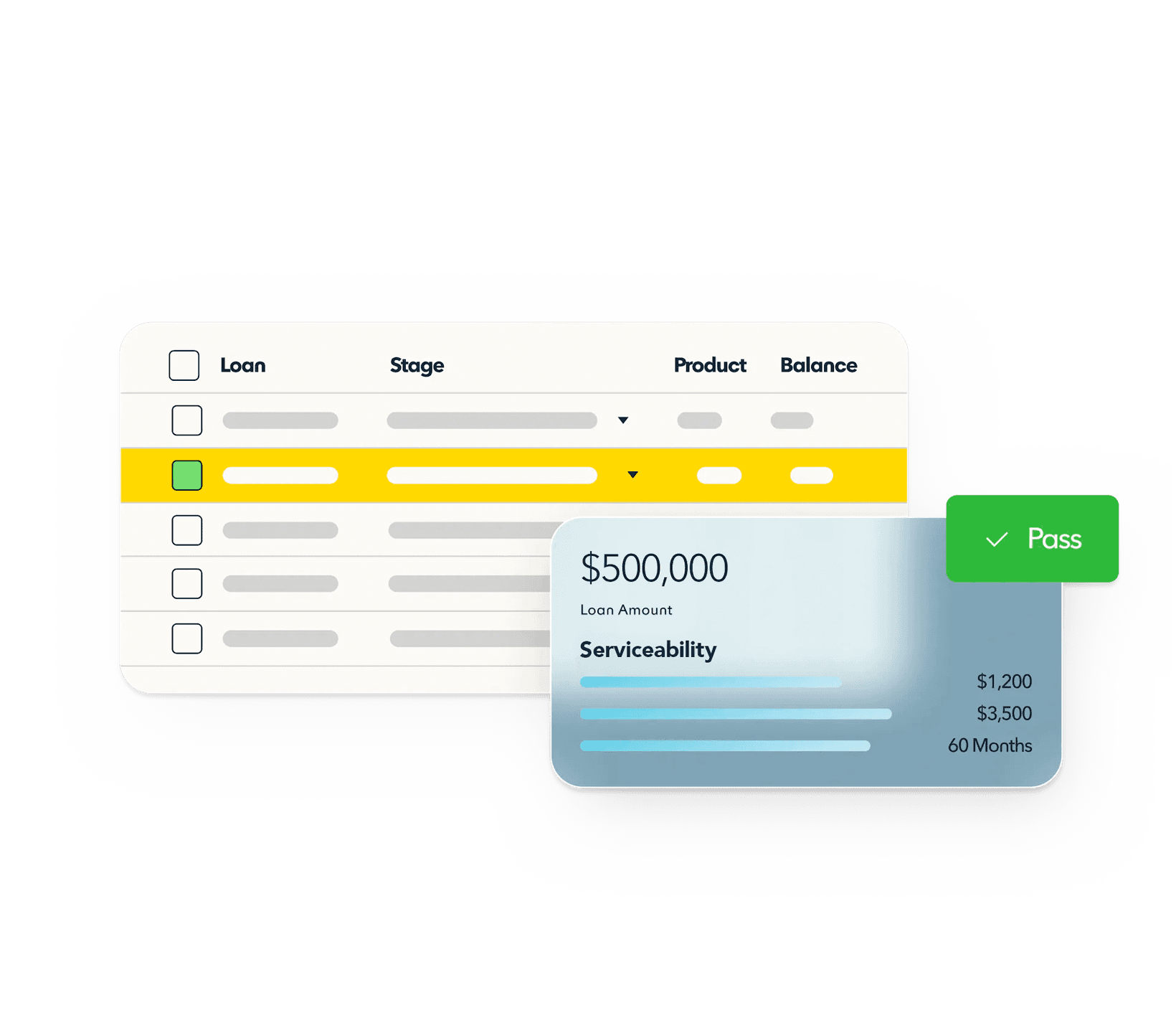

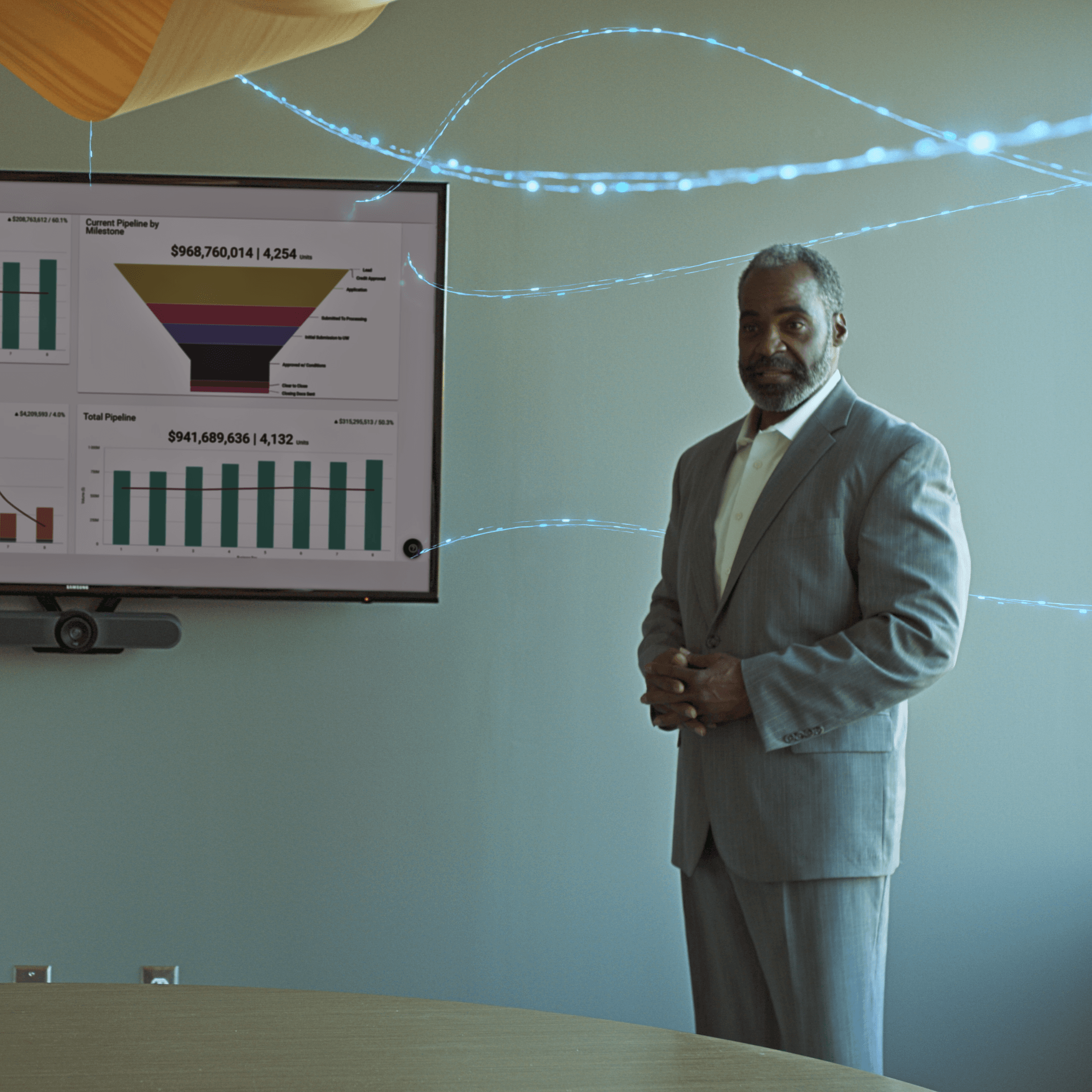

Spanning the entire origination lifecycle, from inquiry and credit decisioning through to settlement. nCino helps you eliminate manual processes for faster response times and a superior customer experience.

Benefit from a consolidated tech stack

Lower the cost of origination

Achieve a faster time to decision

Improve scalability

360-degree customer lifecycle view

Designed for You

Provide a streamlined and personalised digital experience for a customer-centric home lending offering, with a platform you can configure to your exact needs.

Updates can be made quickly with no coding or vendor involvement required, allowing you to pivot and adapt to shifting market conditions as needed.

Real-time flexibility lets you make changes and develop on-platform so you can quickly react to market changes, customer demands, and new regulations.

reduction in time from application to completion

"nCino’s Mortgage Solution exceeded the expectations of everyone in our organisation and will provide our borrowers and lenders with a personalised and integrated experience that is seamless, transparent, and simple."

Stephen Gorman

Chief Credit Risk Officer, RedZed

Boost Customer Retention

Build long-term, profitable relationships by offering competitive rates and flexible products and propositions for an exceptional customer service.

Explore the Foundations of the Mortgage Suite

Accelerate Instant Offers

Use intelligent automation and AI to improve underwriting and quickly generate offer documents for better way to provide instant offers.

Featuring Our Mortgage Solution