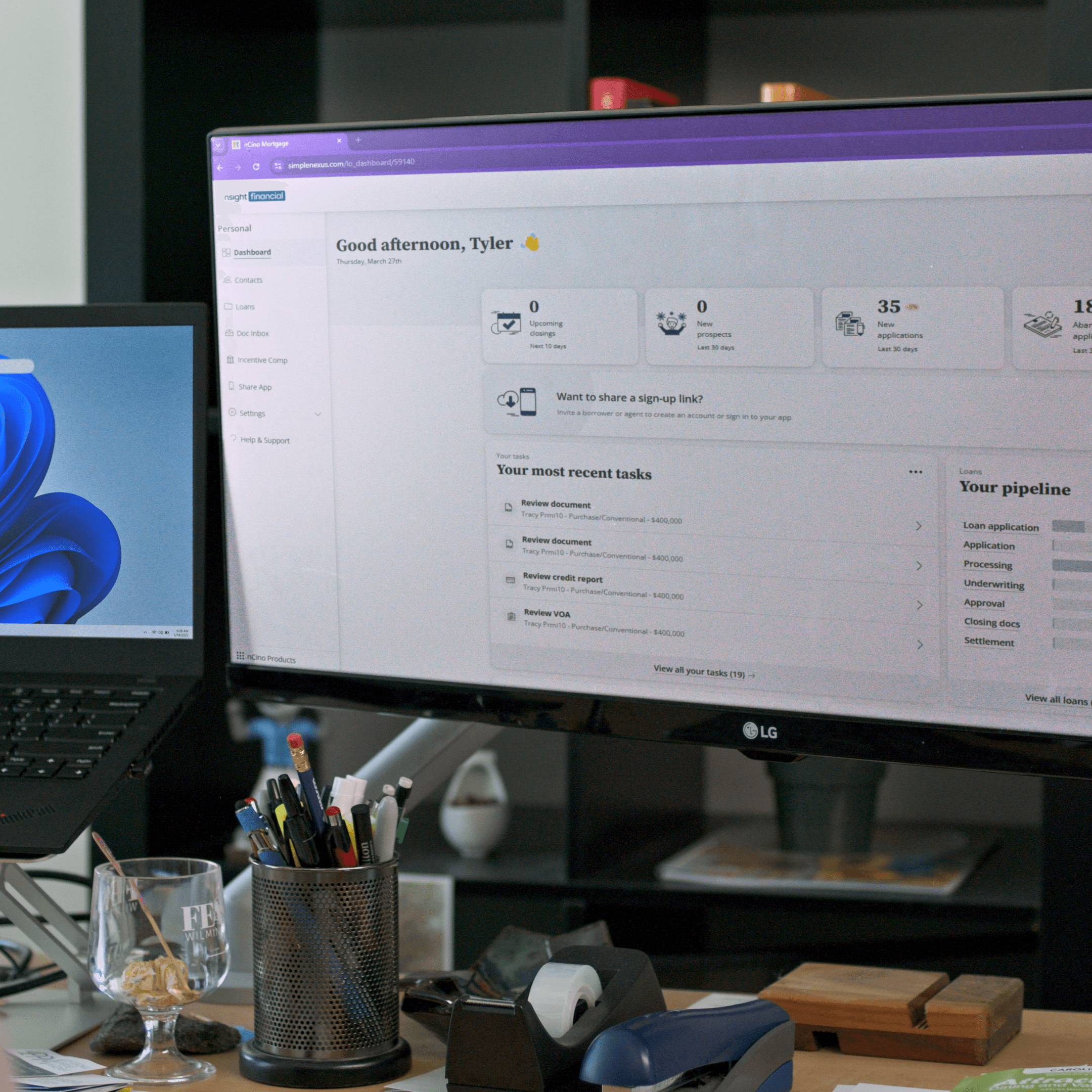

Holland Mortgage Advisors Drives 90% of Application Volume through Mobile with nCino Mortgage Solution

Based in Pittsburgh, Pennsylvania, Holland Mortgage Advisors (HMA) is licensed in more than 25 states, partnering with local and national lenders to offer clients exceptional services at competitive rates. A 100% referral-based company, HMA works with industry professionals such as realtors, attorneys, insurance agents, and financial planners.

Read More