WEB APPLICATION

Acquire New Business and Build Long-Term Client Relationships

Identify new opportunities that drive growth and revenue for your brokerage by leveraging data-driven insights.

Schedule a Demo

The Platform Trusted by Industry Leaders Across the World

Overcoming Broker Market Pressures to Drive Growth

UK insurance brokers navigate intense competitive pressures from direct insurers, regulatory compliance demands, and complex operational workflows that impact client acquisition, retention, and profitability.

Client acquisition

Intense competition from direct insurers and digital platforms makes client acquisition increasingly expensive, with brokers struggling to differentiate value propositions.

Client retention

UK insurance retention rates are significantly below top-performing companies, costing brokers more new client acquisition and leaking client bases.

Submission complexity

Complex underwriting submissions across multiple syndicate boxes create operational friction and slow turnaround times, impacting broker-insurer relationships and efficiency.

Consumer Duty

FCA regulations demand extensive fair value assessments and outcome monitoring, creating compliance burdens as potential enforcement actions threaten operations.

Accelerate broker growth with smart market insights

Transform your brokerage operations with a comprehensive platform that enhances client acquisition, strengthens relationships, and ensures regulatory compliance, enabling you to identify high-value prospects, retain clients more effectively, and navigate complex market dynamics with confidence and expertise.

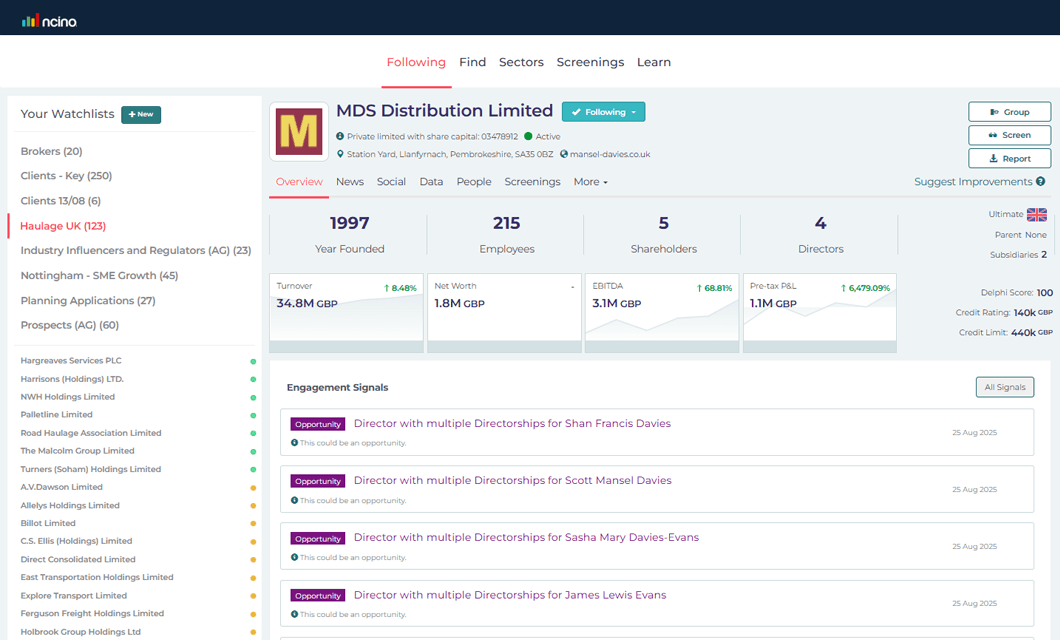

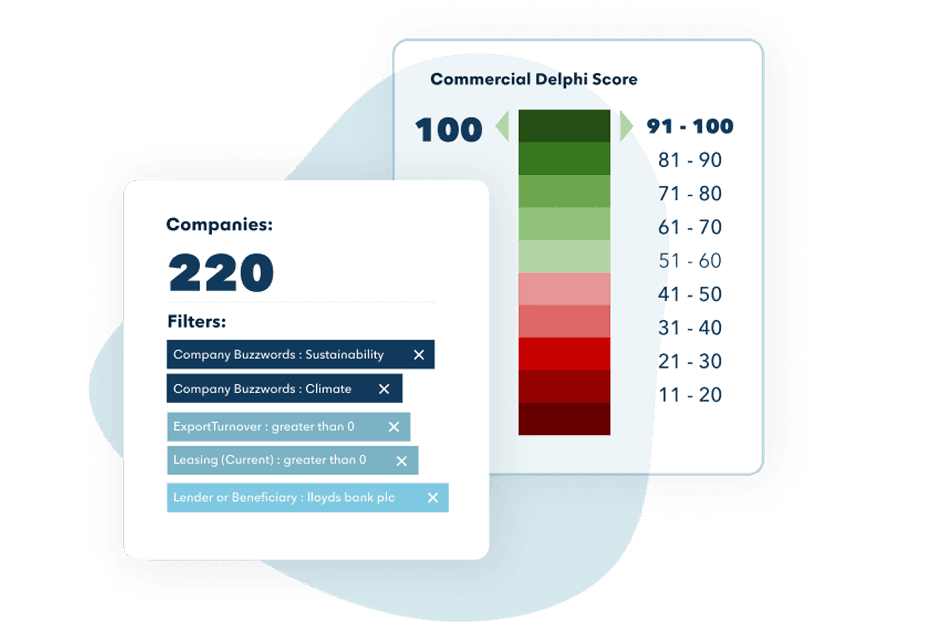

Prospect Qualification

Identify and qualify potential clients through sophisticated screening criteria and risk assessment tools.

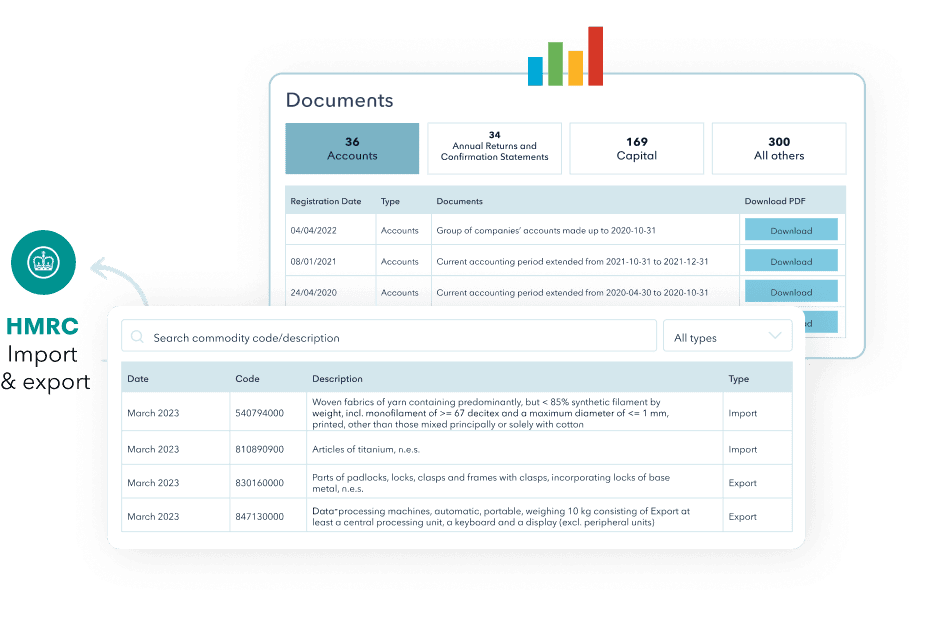

Relationship Intelligence

Access complete customer profiles, enabling proactive relationship management and demonstrating deep understanding of client operations and industry exposure.

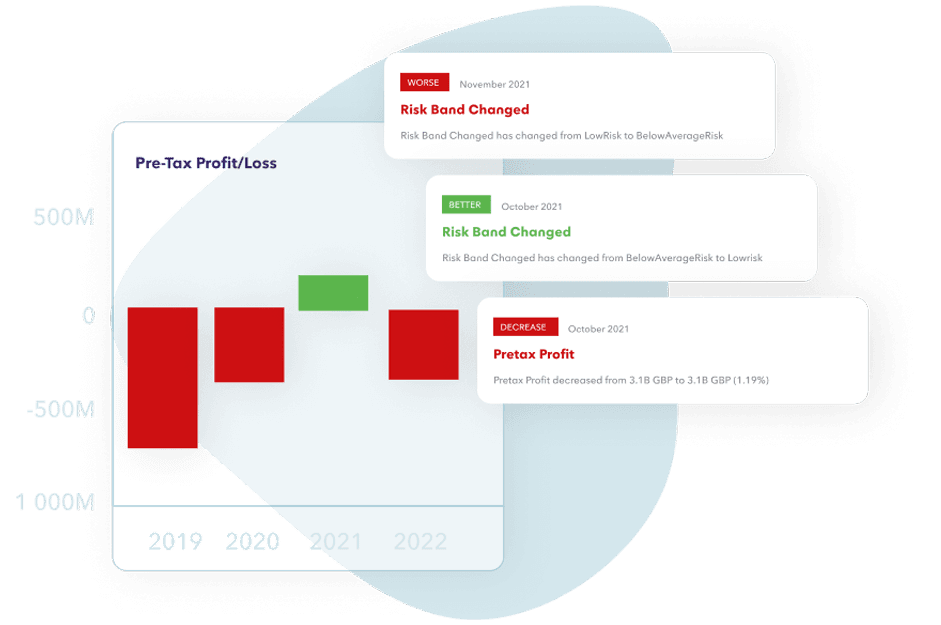

Compliance Automation

Navigate FCA Consumer Duty requirements with automated monitoring and real-time alerts on regulatory changes.

Integrated Insights

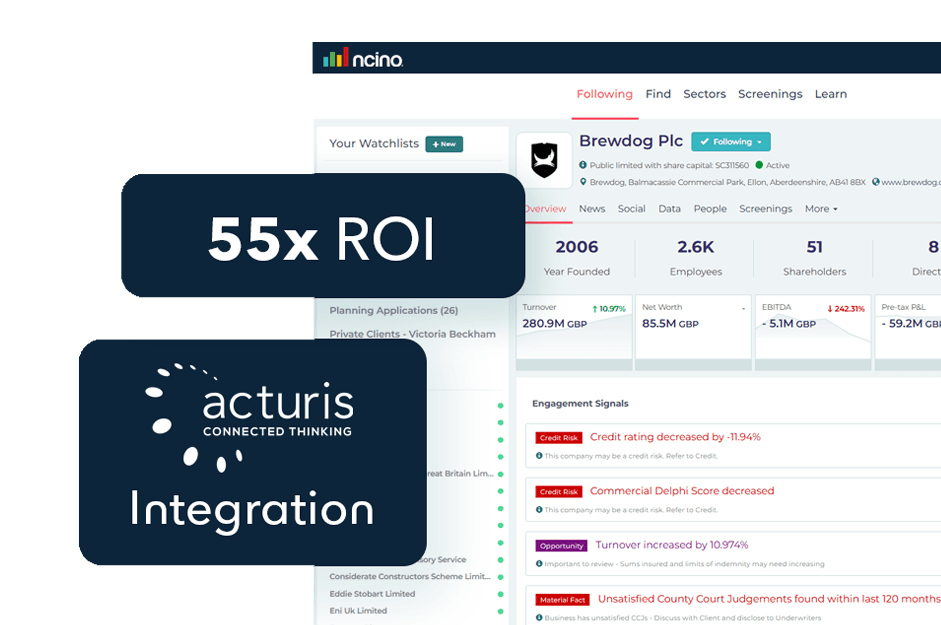

Plug-in to rich, contextualised, and connected company information via a seamless SmartBroker and Acturis integration.

SUCCESS THAT SPEAKS FOR ITSELF

55x

Return on Investment

300%

More finance-ready leads

108%

Increase in record accuracy

"FullCircl is different. It doesn't just present you with static data; it gives you the 'why' factor—a legitimate reason to get in touch and build credibility."

Amanda Duffield, Sales Director & Client Management, WTW

Disclaimer: This testimonial reflects original FullCircl endorsement prior to the company's acquisition by nCino.