WEB APPLICATION

Drive Business Growth with Data-Driven Customer Acquisition

Acquire new customers faster by identifying high-potential businesses, tailoring your outreach, and gaining timely insights to mitigate risk.

The Platform Trusted by Industry Leaders Across the World

Navigating Market Complexities with Confidence

Banks face mounting pressure to deliver personalised experiences while managing operational costs, regulatory compliance, and evolving risk landscapes in an increasingly competitive market environment.

Prospect targeting

Banks struggle with generic approaches that fail to identify high-value prospects, resulting in inefficient acquisition costs and poor conversion rates.

Personalisation gap

Traditional one-size-fits-all banking services cannot meet evolving customer expectations for tailored experiences, leading to reduced loyalty and competitive disadvantage.

Operational inefficiency

Legacy systems and manual processes drive up operational costs significantly, with banks struggling to achieve efficiency improvements despite technology investments.

Risk visibility

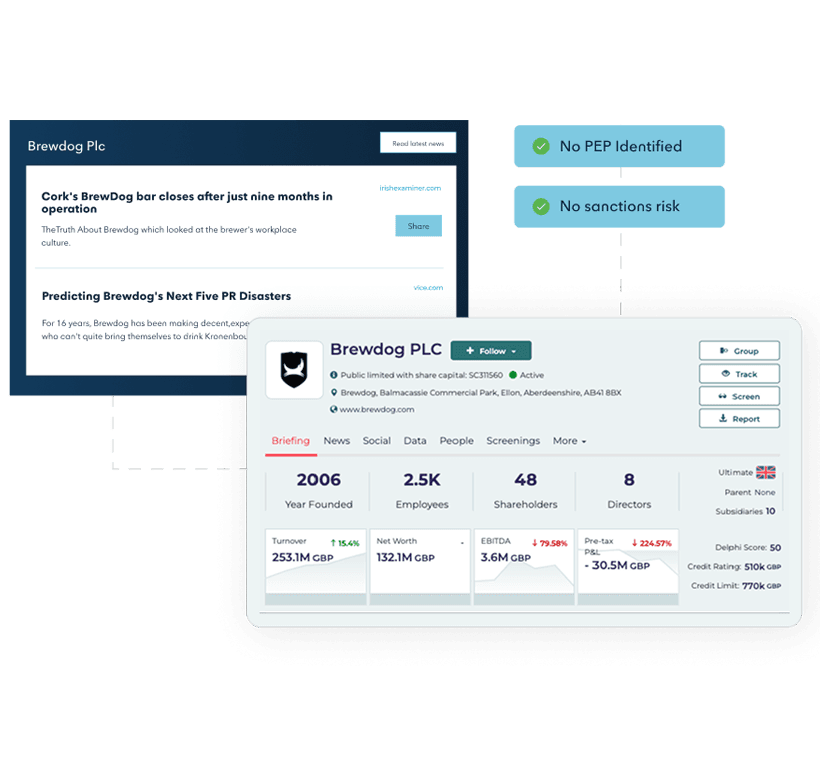

Fragmented risk management approaches and poor data quality limit the ability to identify emerging threats and maintain comprehensive oversight across portfolios.

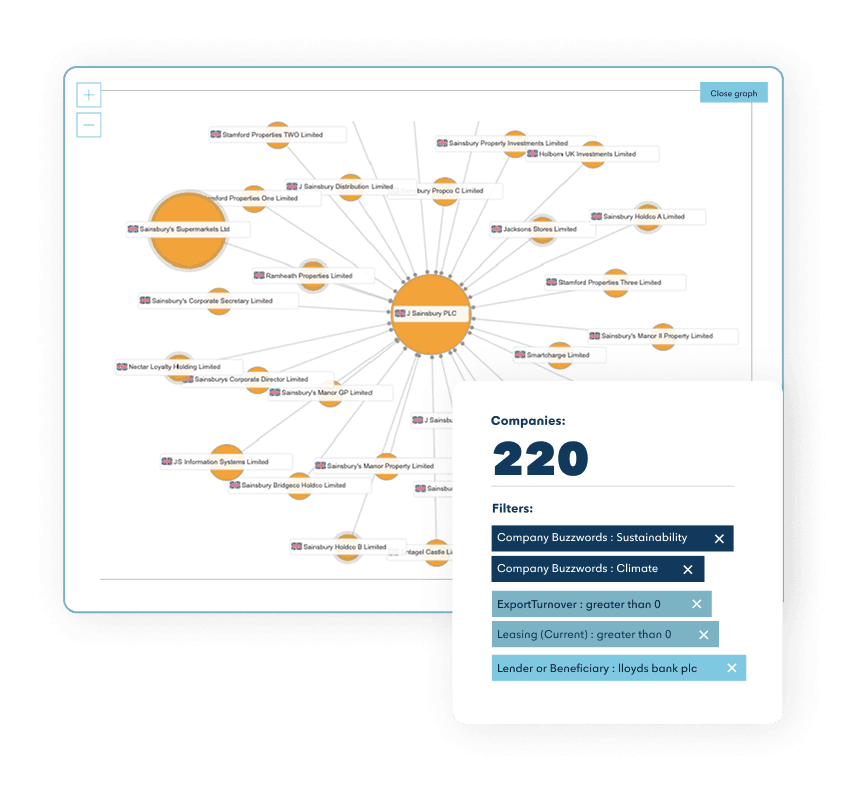

Deliver Intelligence-Driven, Personalised Banking Experiences

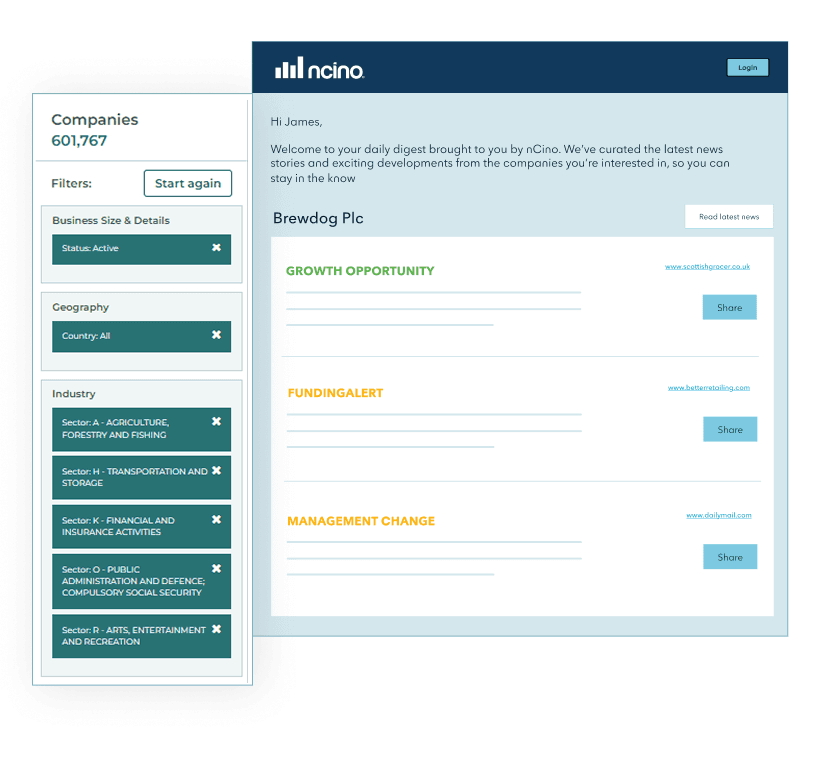

Access information on over 6 million UK and Irish companies, including financials, shareholders, group structures, and UBOs through advanced prospecting filters, reducing time spent gathering information, while still ensuring data accuracy.

Risk Matching

Leverage pre-qualification screening and normalised financial data to identify prospects that match your risk appetite.

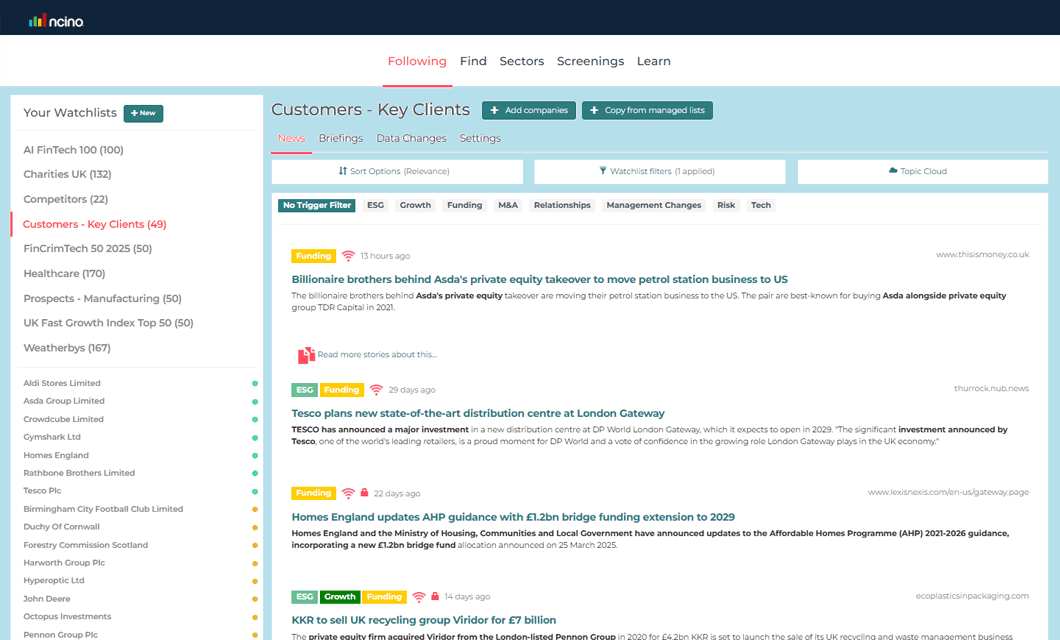

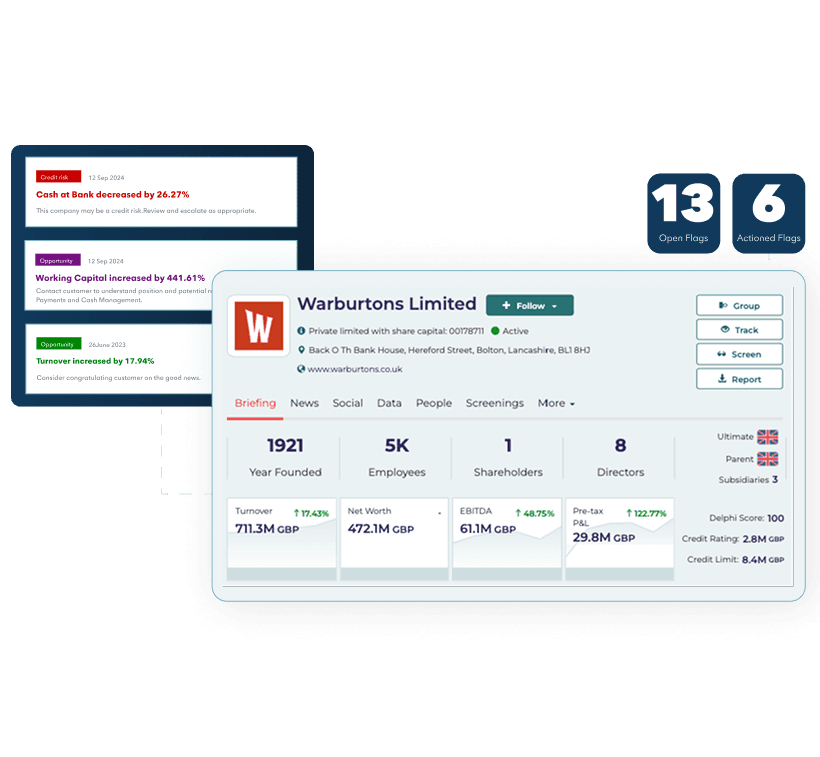

Alert Intelligence

Receive alerts about critical changes identified to your customers and the next best actions to take on an account.

Change Tracking

Monitor customer changes and receive automated engagement triggers including daily email alerts.

Real-time Engagement

Stay informed with contextual news and social insights from 60,000 global sources updated every 30 seconds, processing over 2 million articles per day.

SUCCESS THAT SPEAKS FOR ITSELF

6M

UK&I Companies enriched daily

17,000

Relationship professionals served daily

18M

Directors and shareholders

"FullCircl is the engine that drives this vision, providing our RM's with the data and insight-driven ability to create compelling experiences throughout the customer journey."

Andy Gray, Managing Director Corporate & Commercial Coverage, NatWest

Disclaimer: This testimonial reflects original FullCircl endorsement prior to the company's acquisition by nCino.