Transform Mortgage Lending at Your Institution

Mortgage lending is evolving, and now more than ever financial institutions must work to overcome inefficiencies, meet borrower expectations, and stay competitive.

The Platform Trusted by Industry Leaders Across the World

Tackling Modern Mortgage Challenges

Financial institutions operating in the mortgage industry face ongoing challenges that can prevent growth and profitability, including:

Inefficient Processes

Outdated, manual workflows create bottlenecks, increasing loan cycle times and reducing operational efficiency.

Fragmented Systems

Disconnected technologies lead to miscommunication, errors, and duplicated efforts, frustrating both borrowers and lenders.

Evolving Expectations

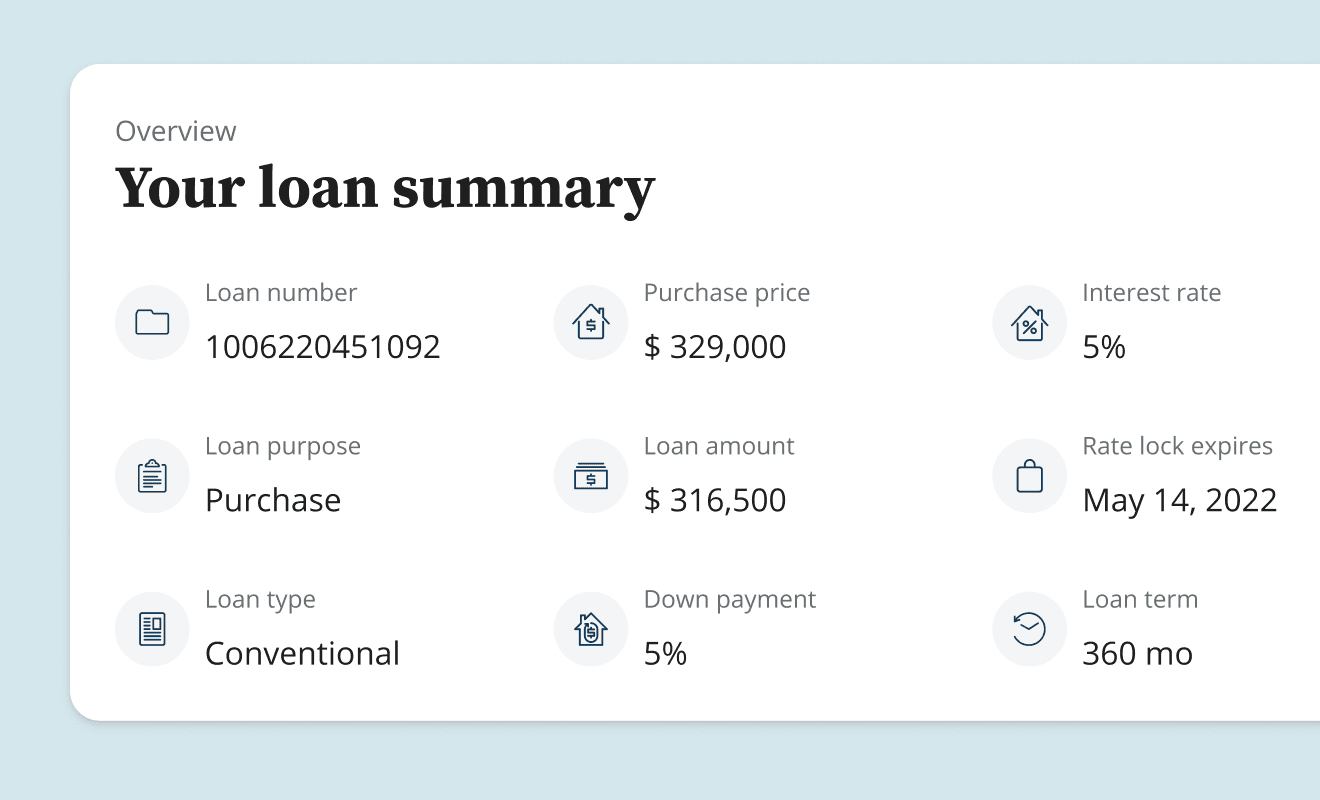

Borrowers demand faster, more transparent, and digital-first experiences, which many institutions struggle to deliver.

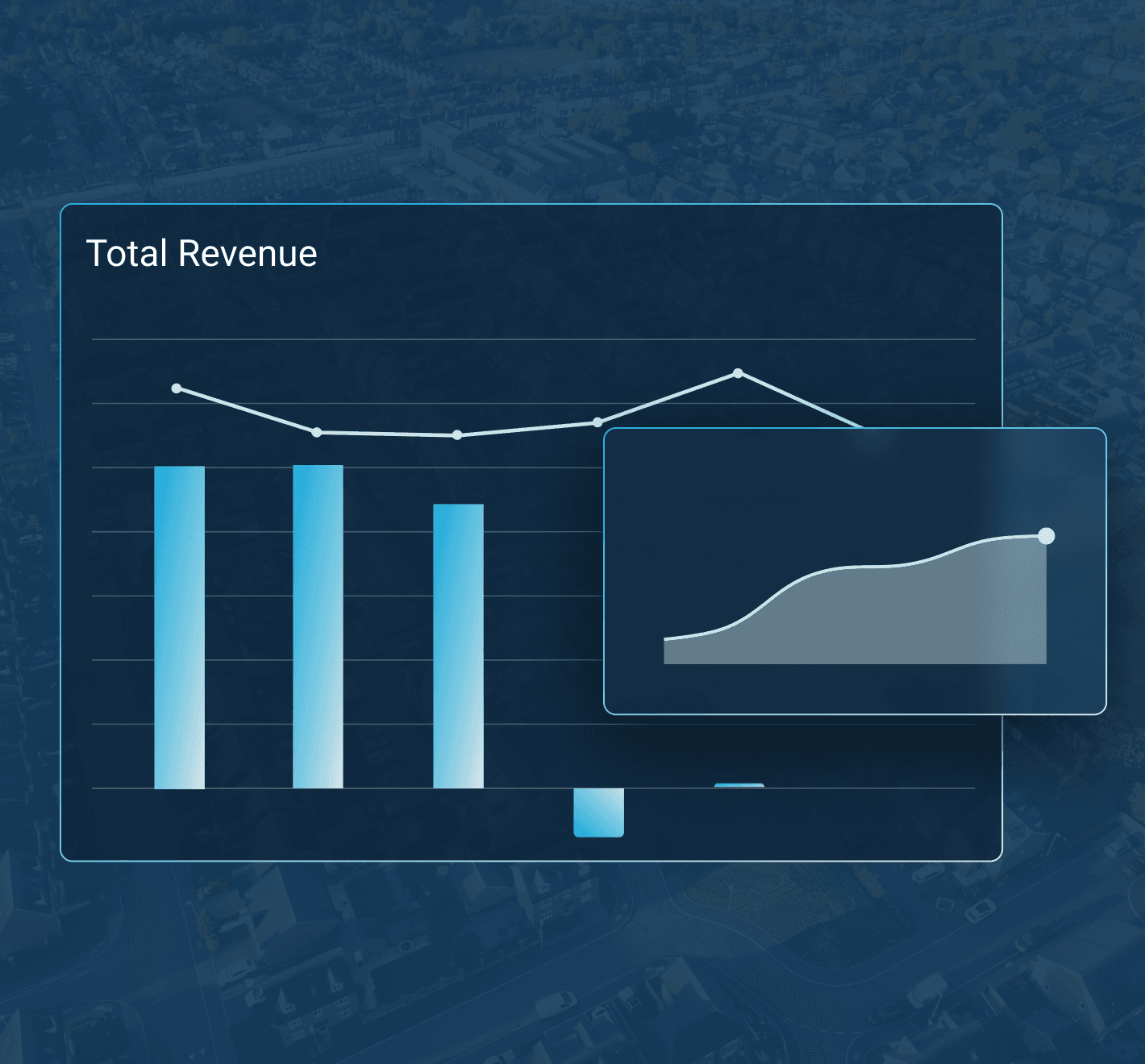

Optimize Mortgage Lending with nCino

The nCino Platform revolutionizes mortgage lending by driving efficiency, collaboration, and exceptional borrower experiences.

Streamlined Workflows

Automate workflows to connect every stage and accelerate processes and reduce errors.

Innovative Solutions

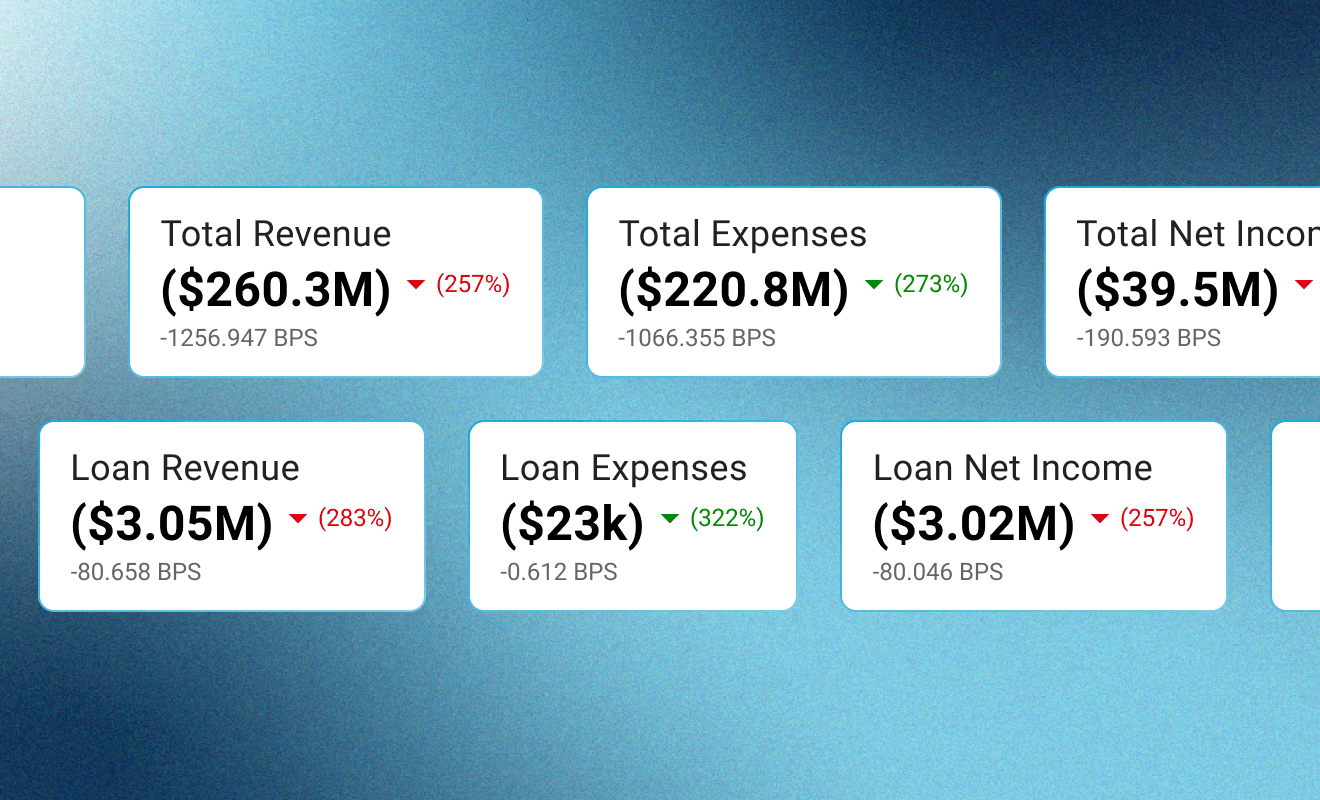

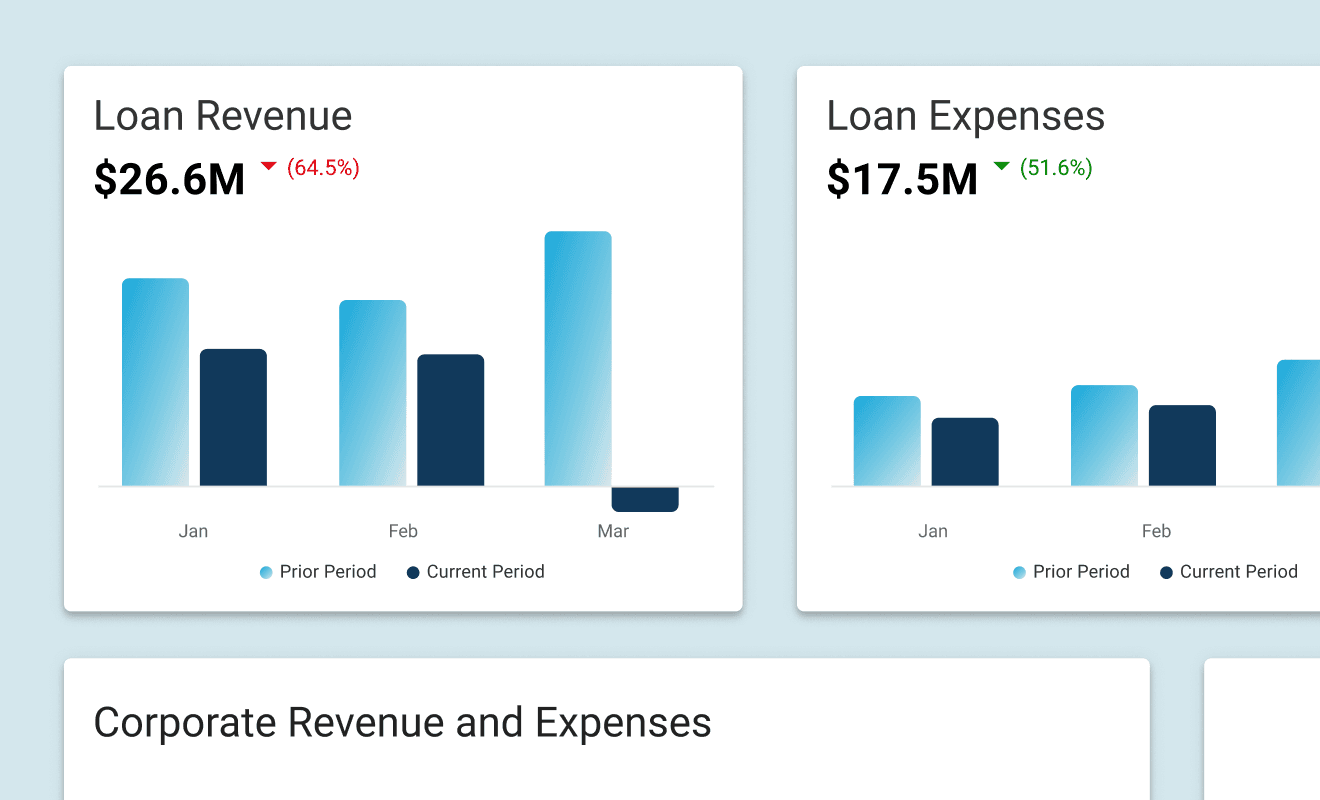

Leverage real-time insights using AI, improving decisions, reducing risk, and enhancing lending outcomes.

Unified Collaboration

Enable seamless collaboration, uniting teams for a smooth and efficient lending process.

Scalable Tools

Integrate adaptable solutions that grow with your institution to meet demand, regulations, and market shifts.