The Future of Modern Commercial Lending—Today.

Equip your institution with a streamlined application and origination process to accelerate revenue growth, improve operational efficiency, effectively manage risk, and deliver exceptional customer experiences with our Commercial Loan Origination System.

Experience the Power of nCino’s Commercial Loan Origination System

With nCino’s Commercial Loan Origination System (CLOS), you gain a cost-effective and intelligent solution that can grow alongside your institution and help you adapt to changes in the market. Our CLOS:

Replaces disparate, siloed systems with a streamlined commercial loan origination system.

Improves collaboration and transparency across front, middle, and back offices.

Accelerates the loan origination process with automation.

Utilizes real-time reporting for better portfolio management.

Maximizes performance, productivity, and profitability across commercial lending teams.

Digitize business lending to maximize speed, efficiency, and growth.

nCino Commercial Lending drives intelligent automation into every corner of your financial institution. Through a single platform, you have the power to manage all aspects of the commercial lending process from origination to underwriting and portfolio management.

WaFd Bank’s Success with nCino

Discover how nCino's intelligent technology enabled WaFd Bank to improve customer experiences, drive an increase in loan volume, and quickly adapt to serve new customers during the COVID-19 pandemic.

Download the WaFd Case Study

Originate commercial loans 54% faster and increase efficiency at every stage of the loan origination cycle

Increase in new loan volume

Increase in conversion rates

Reduction in loan servicing costs

nCino enables us to be more efficient and more collaborative, especially around renewals and originations. With nCino, we have completely automated and digitized the loan approval process.

Jeff Bajek

CCO, Platinum Bank

Save Time with Automations

Gain efficiency and save time across your lending team with automation and intelligence. nCino Commercial Lending:

Onboards new customers and assesses their needs faster with preconfigured workflows.

Automates pre-qualifications and credit approvals based on your institution’s policy rules.

Identifies parameters in which a loan should be automatically approved, declined, or recommended for manual review.

Configured for Compliance

nCino Commercial Lending provides tools that empower your institution to easily fulfil regulatory compliance policies and for adherence to global, local, and federal regulations. nCino’s LOS system:

Leverages an integrated document repository that incorporates your institution’s policies and leaves a visual audit trail for auditors and teammates.

Generates automatic notifications to remind users when a covenant is approaching its due date and serves as a record of compliance for auditing purposes.

Provides regulators and auditors with loan reports to facilitate the compliance review process.

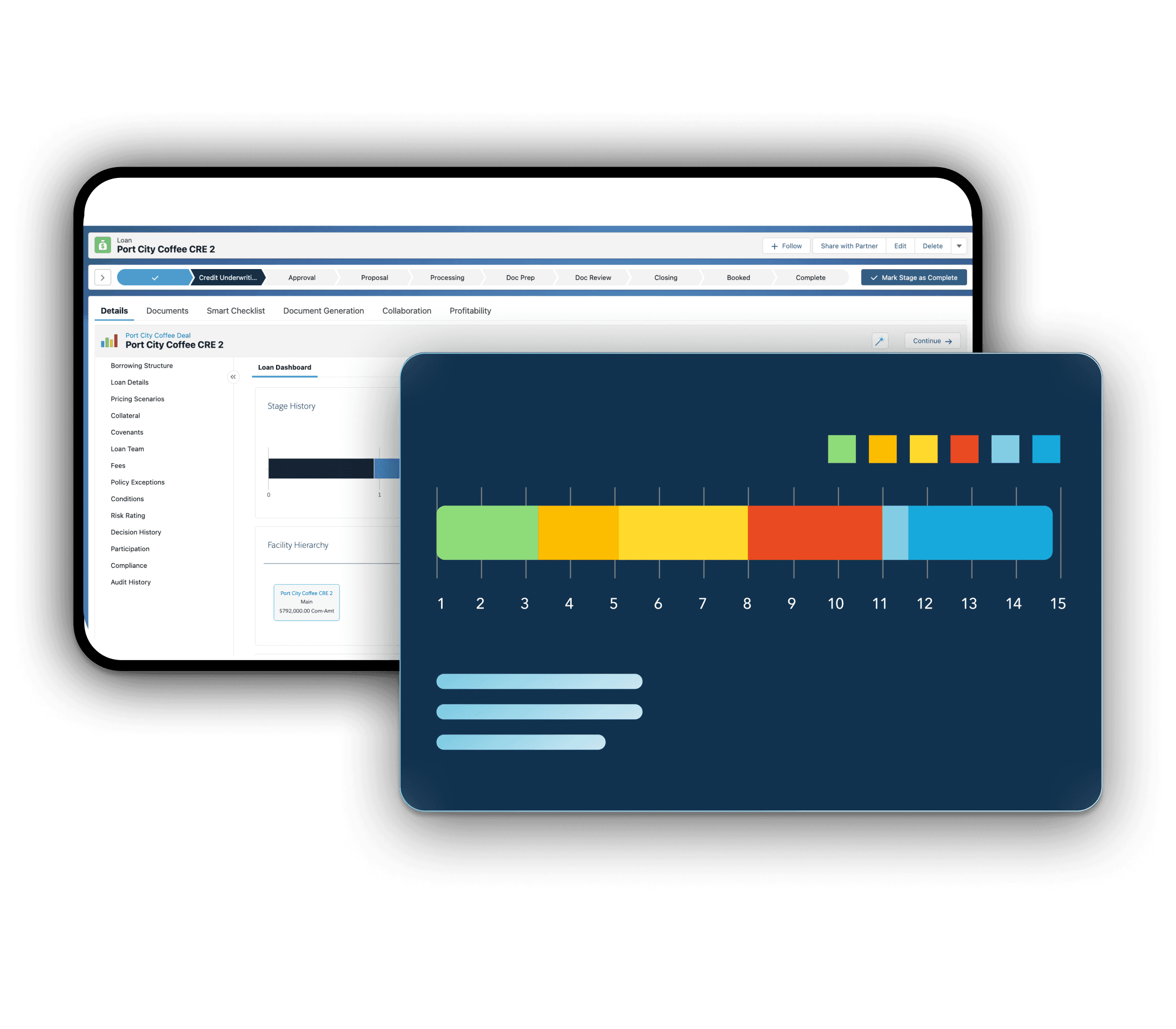

Simplify Deal Management

Accessible within the CLOS, Deal Management provides a straightforward way to access and manage the overall deals of your clients’ loan and treasury products in real time. This feature within the solution:

Delivers a complete view of the relationship in a single location.

Enables easy structuring and management of credit/non-credit deals and products.

Provides commercial bankers with a way to easily navigate through large numbers of records.

Supports creation of sub-loans, information cloning, and bulk editing of details for shared records.