Experience the Power of Client Lifecycle Management

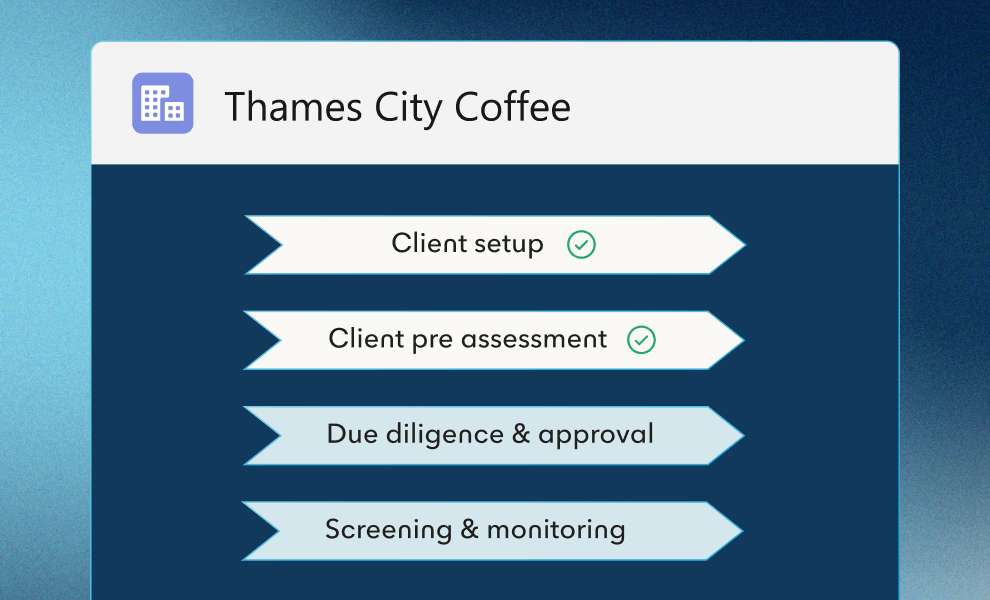

From onboarding to ongoing success, nCino Client Lifecycle Management (CLM) revolutionises how banks acquire, onboard, and grow commercial relationships.

Schedule a Demo

The Platform Trusted by Industry Leaders Across the World

Overcoming Obstacles to Onboarding CLM

Financial institutions face mounting pressure to streamline client relationships throughout their lifecycle. Yet a variety of challenges impact client onboarding and lifecycle management, leading to extended timelines and frustrated customers.

Manual Inefficiencies

Legacy systems rely on repetitive, manual data entry and paperwork that slow down onboarding timelines.

Compliance Roadblocks

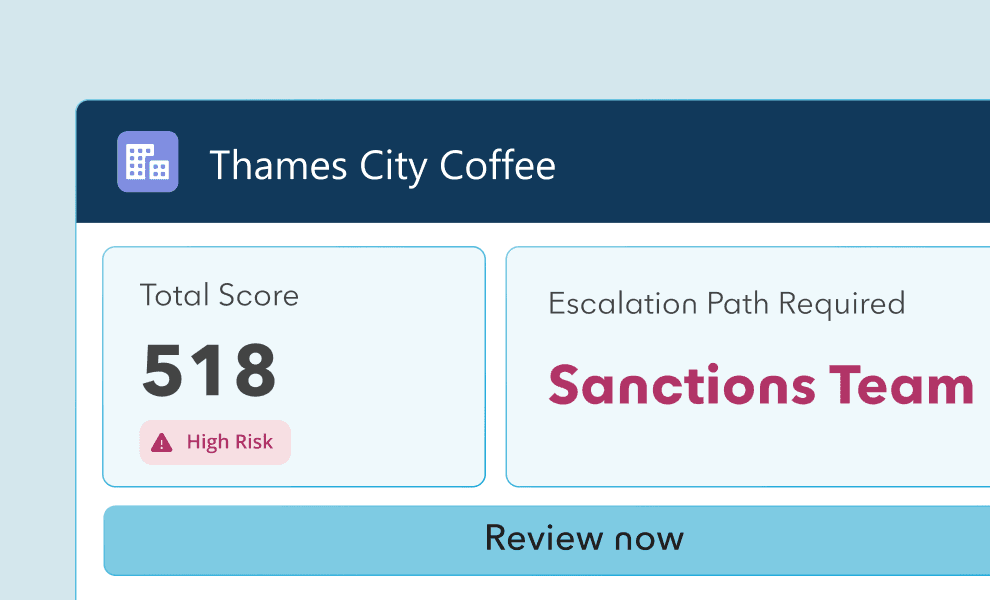

KYC and AML regulations place additional strain on resources, increasing the complexity of compliance management.

Customer Expectations

Customers demand fast, seamless, personalized banking. Delays risk losing customers.

Limited Scalability

Growing institutions struggle to maintain onboarding efficiency as volumes increase.

Compliance Simplified. Smarter Onboarding. Faster Growth.

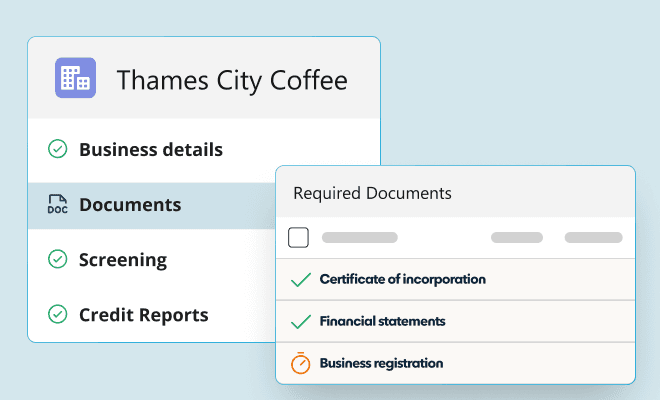

nCino CLM streamlines commercial onboarding by embedding UK-specific business intelligence directly into your workflows. Instantly pre-populate forms, automate risk assessments, and remove manual data entry with deep data integration powered by our FullCircl acquisition.

Data Aggregation

Provides a single source of truth, so you never have to ask clients for the same document twice.

Team Connection

Connects front, middle, and back office teams to improve collaboration and consistency.

Workflow Automation

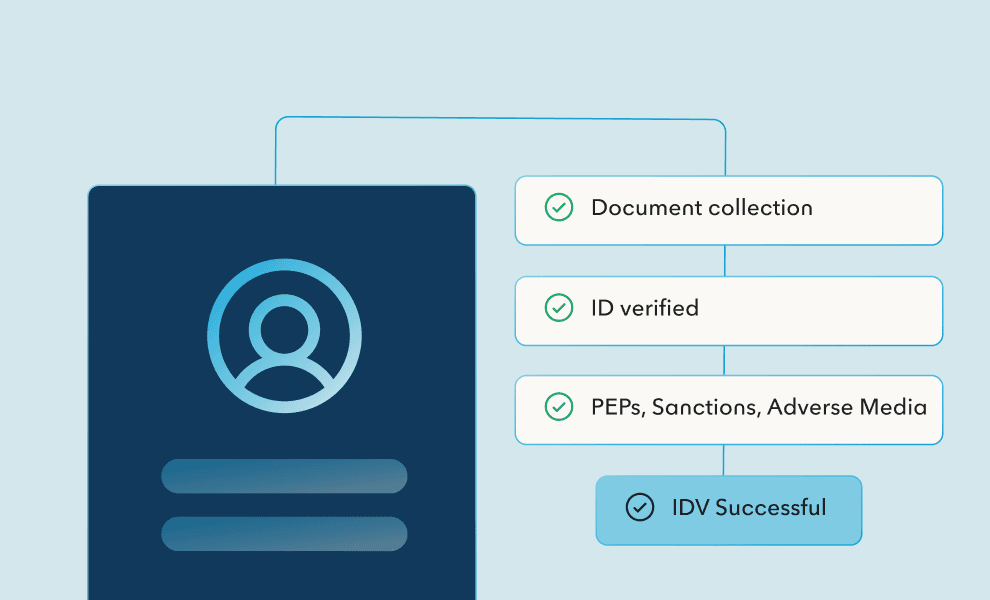

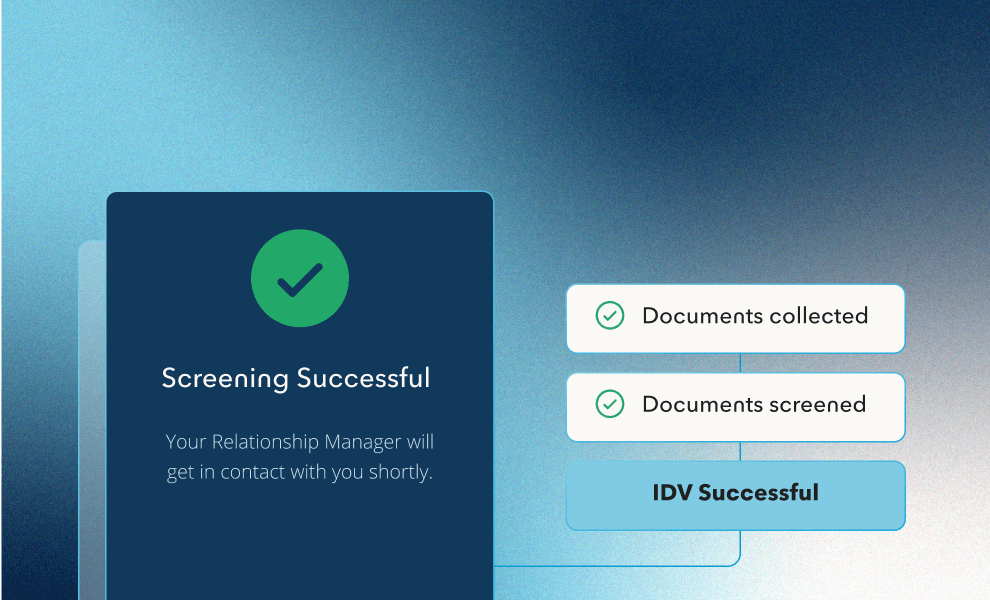

Automates onboarding tasks like document collection, KYC/KYB, and compliance workflows.

Regulatory Control

Helps your teams manage regulatory requirements with more control and less friction.

Client Satisfaction

Give clients the transparency they expect through real-time updates.

Sustainable Growth

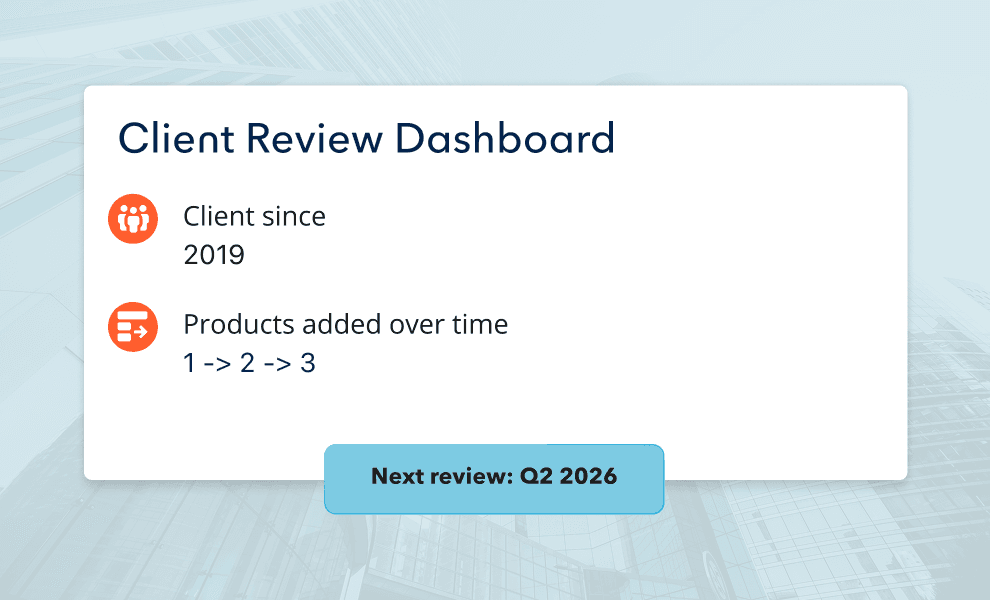

Supports long-term growth by creating stronger, more efficient commercial relationships.

Success that speaks for itself

75%

Reduction in Onboarding time

39

paper based forms eliminated

14%

more critical risk issues identified for enhanced security and compliance

Your Data Delivered Directly in Your Workflow

For UK Financial Institutions Only — nCino CLM streamlines commercial onboarding by embedding UK-specific business intelligence directly into your workflows. Instantly pre-populate forms, automate risk assessments, and remove manual data entry with deep data integration powered by our FullCircl acquisition. This exclusive integration gives UK financial insitutions unparalleled access to:

Entity Search and KYB – Access 270M+ business records with real-time Companies House data and instant company verification.

UBO and Related Parties – Full visibility of ownership structures, corporate links, and key officers.

ID&V and AML Screening – Biometric identity checks plus real-time sanctions, PEP, and adverse media screening.

CIFAS Integration – Fraud prevention intelligence to protect against financial crime.

Credit Bureau Data – Instant creditworthiness assessment and financial health indicators.

Operating outside the UK? nCino CLM integrates seamlessly with leading data providers worldwide—from credit bureaus to compliance databases and regional intelligence sources. Our flexible platform connects to the partners that matter most in your market. Contact us to configure the perfect data ecosystem for your institution.