nCino Consumer Banking Solution

Deliver innovative, customer-centered experiences while driving operational efficiency and growth with the nCino Consumer Banking Solution.

Trusted by industry leaders across the world

Streamline Digital & In-Branch Experiences

The nCino Consumer Banking Solution provides a seamless, omnichannel experience, enhancing online and in-branch processes to accelerate account openings, simplify lending, and ensure compliance.

Frictionless Onboarding: Onboard with a streamlined workflow and simplify compliance with KYC and Customer Due Diligence collection.

Digital-First Applications: Configure applications to be completed online, allowing customers to apply for loans and deposits anytime, anywhere.

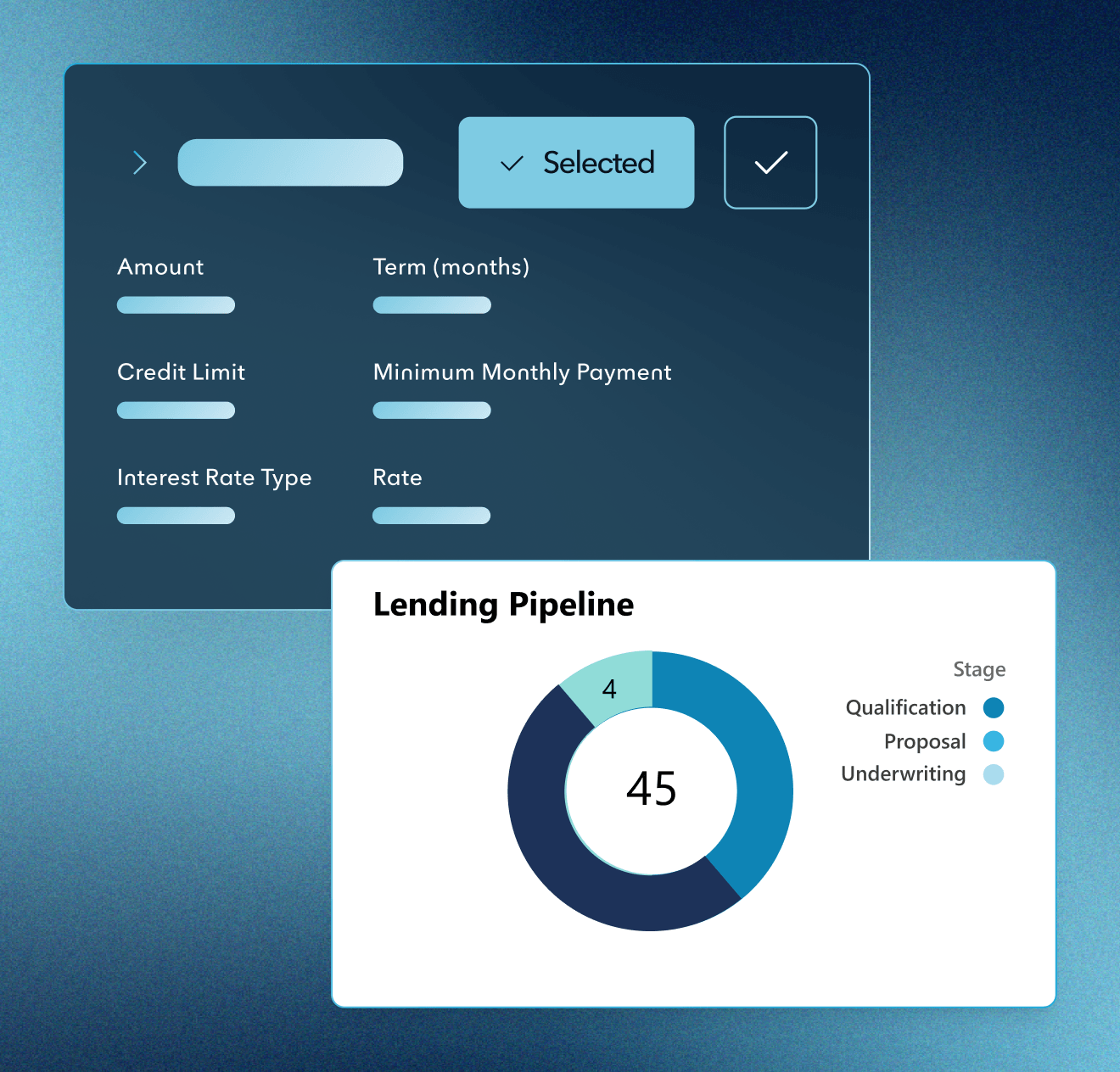

Retail Loan Origination: Automate decisions and streamline workflows using configurable workflows that reduce loan approval times by 95%.

Consumer Banking Reimagined

Gain efficiency and accuracy when you choose the nCino Consumer Banking Solution. Slash loan cycles by 74% and onboard customers faster, boosting satisfaction and operational success.

Streamlined Operations

Replace legacy and disconnected tech with a modern workflow.

Customer Insights

Understand individual needs with a 360-degree view of your customers.

Client-First Approach

Enable customers to access the products and services they need on their terms.

Efficient Growth

Drive deposit and loan growth at the lowest operating originations cost.

Success that speaks for itself

93%

reduction in average cycle time for consumer loans

95%

reduction in time to approve term loans

288%

increase in online applications

"By partnering with nCino, we are able to open accounts online—more efficiently, faster and better than our competitors and that is value added to us as a bank."

Brad Tidwell, President and CEO at VeraBank

Solutions Built to Power and Evolve Your Financial Institution

Ready to transform your institution?

Trusted by over 2,700 financial institutions, the nCino Platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.