Banking on Intelligence: David Pommerehn on Regulatory Challenges and the Future of Consumer Banking

SVP, General Counsel from the Consumer Bankers Association discusses navigating regulatory uncertainty and building durable compliance frameworks

Is Artificial Intelligence in banking a revolution or a passing fad?

SVP, General Counsel from the Consumer Bankers Association discusses navigating regulatory uncertainty and building durable compliance frameworks

Chief Risk Officer from Great Southern Bank shares insights on technology, customer relationships, and strategic partnerships

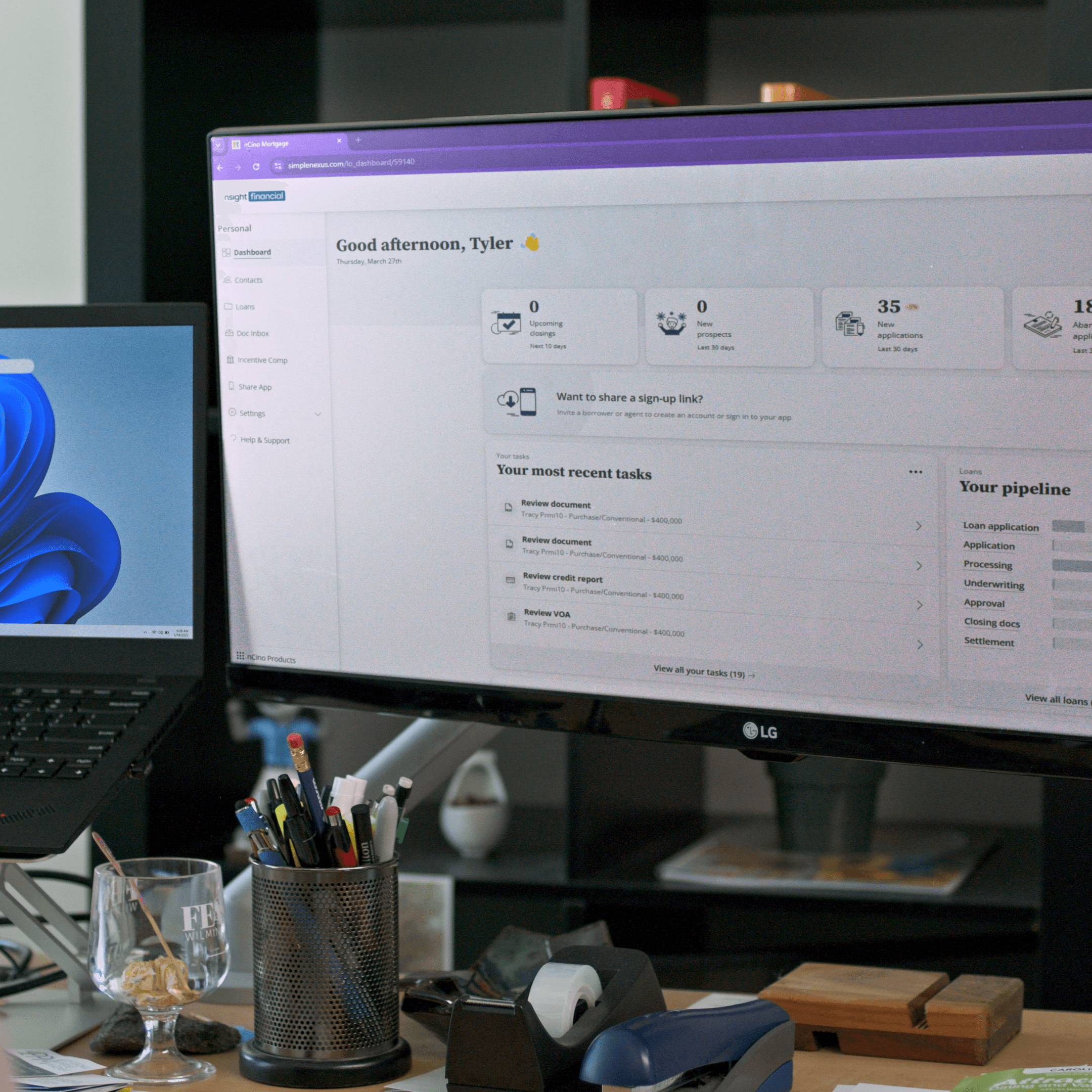

The mortgage industry is evolving at a rapid pace. Borrowers demand faster, more seamless digital-first experiences, and lenders face mounting pressure to adapt. With loan abandonment rates exceeding 75% at critical process stages, the stakes have never been higher.

The banking industry stands at a critical inflection point. As we advance through 2025, artificial intelligence has evolved from experimental technology to a strategic imperative reshaping how financial institutions operate, serve customers, and manage risk.

The building society sector continues to demonstrate remarkable resilience and momentum, accounting for 72% of mortgage market growth between April and September 2024.