How to Choose the Right Mortgage Origination System for Your Credit Union

Credit unions play a vital role in their communities by offering their members important financial services like loans and savings accounts. A key component of credit union operations is the lending technology members and employees use.

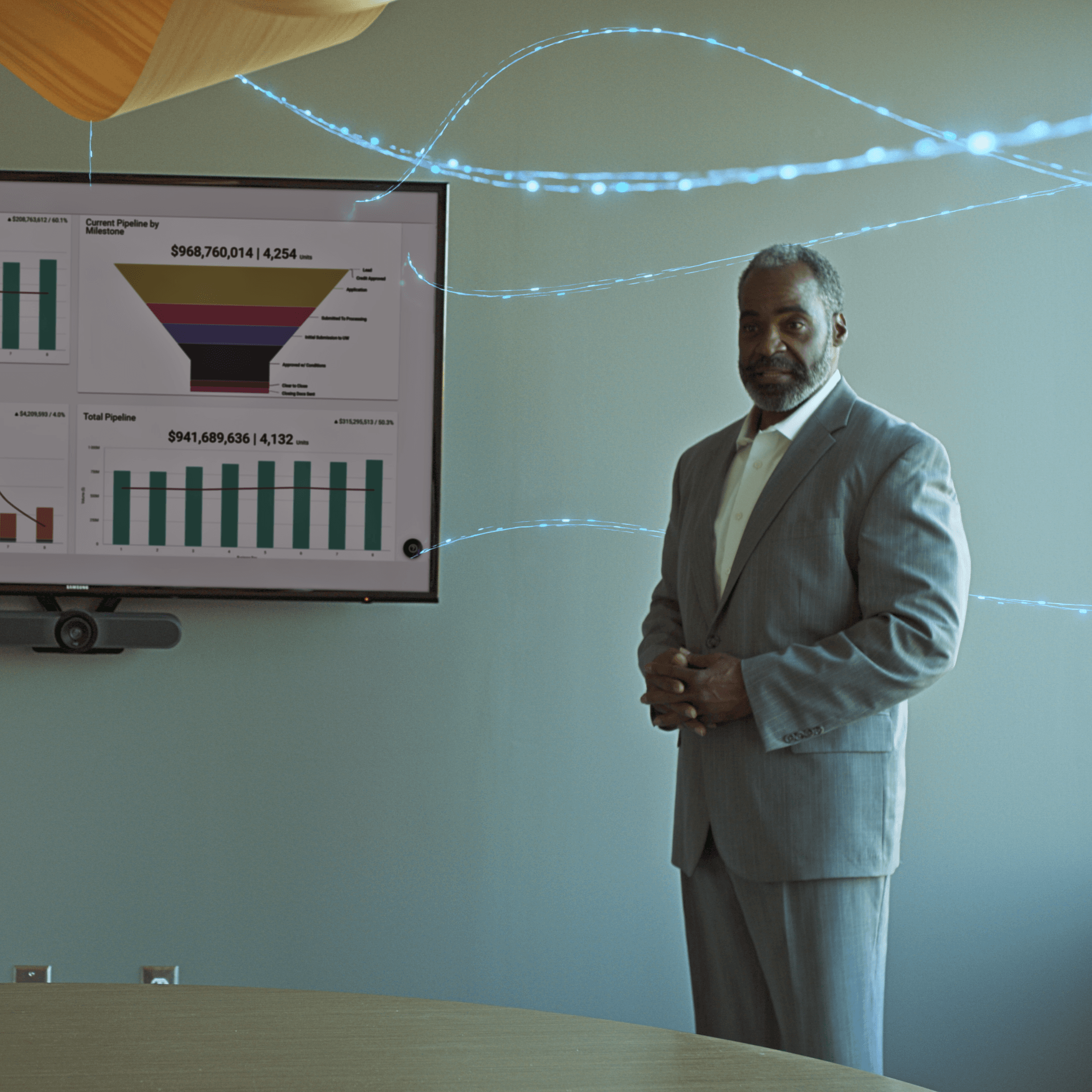

In its simplest form, mortgage lending technology serves as a digital tool that can significantly streamline and automate the lending process at all stages of the homeownership journey. For credit unions and member-owned financial cooperatives, this technology is pivotal in streamlining operations and enhancing service delivery for members and employees.

For credit unions, it's essential to understand what lending technology does, how its design assists in credit union operations, and the different digital tools available to scale for time, retention, and growth. It’s also important that loan officers at credit unions connect with borrowers at the right time. According to McKinsey, 35% of borrowers select a lender within 3 days after starting their home search, which means every missed moment has the potential to be a lost opportunity.

To remain relevant, credit unions must deliver the right experiences at the right time, and choosing the right technology partner is a key part of that strategy.

How do you know your credit union is making the right choice? Below are six key factors to consider when choosing your mortgage lending technology:

Ease of Use: The technology should have a user-friendly interface and require minimal training. The right technology partner providers should offer ample support for implementation and training.

Customization and Scalability: Your chosen technology partner should be customizable to fit your credit union's unique needs. Scalability is also crucial to grow your credit union and allow you to embrace opportunities to thrive.

Integration: Your technology partner should integrate seamlessly with your existing systems and allow for easy data migration.

Security and Compliance: It's critical that your lending technology partner prioritizes data security and adheres to all relevant regulations and standards.

Cost-effectiveness: Consider the balance between cost and value. The total cost of ownership should include both upfront and ongoing costs.

Reputation and Support: Vendor strength and stability is more important than ever. Check the vendor's reputation, read customer reviews, and ensure they offer responsive customer support and have referenceable customers.

The adoption of efficient mortgage lending technology is a critical step for credit unions to streamline their operations, enhance service delivery, and foster growth. The right technology should be easy to use, customizable, scalable, integrable with existing systems, secure, cost-effective, and backed by a reputable provider.

“We wanted a system that was going to evolve and grow with us, specifically in the commercial and business space,” said Lance Hatzenbeller, Senior Vice President of Customer Services at Idaho Central Credit Union.

“With nCino, we are better able to serve our business members by providing them a “one stop shop.” The experience is all in one place for them. They can open a membership and apply for a loan, all in one go.”

As the financial landscape continues to evolve, credit unions must adapt by leveraging digital tools that not only meet their unique needs but also provide value for their members. By doing so, credit unions will be better positioned to deliver timely, modern experiences that resonate with their members and ultimately drive their success in a competitive market.