8 Reasons Credit Unions Are Choosing nCino for Mortgage Origination

Credit unions represent a unique sector within the world of finance. They offer an exceptional service to their member base, backed by competitive loan offerings. In order to deal effectively with this unique operational model, credit unions' lending technology needs to align correctly.

In this digital era, borrowers are increasingly tech-savvy, with 60% (as noted by McKinsey) preferring a completely online application process. HousingWire's recent survey found that 68% of homebuyers feel that technology has enhanced the homebuying process, citing convenience and ease of use. The role of technology in a credit union's capacity to serve their members' needs is undeniably significant. Hence, selecting the appropriate partner is more critical than ever.

Optimizing Mortgage Origination with a Technological Partner

The ideal technology partner must bring automation, intelligence, and a member-centric design to the table for credit unions. This technology should enhance the experience of all involved in the homeownership journey. It should simplify the loan application process, provide comprehensible loan tracking, and ensure timely notifications for all stakeholders in the real estate journey. Beyond productivity and efficiency, these benefits should allow you to concentrate on the most critical aspect - relationships.

Jordan Houghtaling, Manager of Real Estate Systems, Altra FCU agrees. When discussing why his credit union choose nCino’s Mortgage Suite, he says, “Our vision statement is ‘helping you live your best life,’ and supporting members’ journey to homeownership is central to that goal. Personal relationships with members are the heartbeat of our mortgage operation. nCino allows us to grow, manage and evaluate the impact of those relationships with just a few clicks.”

How Mortgage Loan Software Contributes to Operational Efficiency

Digitizing operations can greatly improve the loan experience for members and streamline a credit union's processes. It allows you to offer the right experiences at the right moments. nCino’s Mortgage Suite, a comprehensive mortgage loan software, is a testament to this. Here are 8 benefits of choosing nCino’s Mortgage Suite:

Efficiency, Scalability, and Productivity: This mortgage origination software automates numerous time-consuming tasks in the lending process. This allows employees to focus on strategic tasks and member services, thereby enhancing scalability, productivity, and overall efficiency.

Improved Member Experience: The software enhances the loan experience for credit union members, providing features such as online applications and real-time loan tracking.

Customization and Scalability: It can be tailored to fit the unique needs of any credit union. The software can adapt and scale as the credit union grows, ensuring it stays one step ahead of the competition.

Seamless Integration: nCino’s Mortgage Suite is designed to work smoothly with a credit union's existing systems, such as loan origination systems (LOS), and CRM software.

Security and Compliance: The software prioritizes data security, adhering to all relevant financial regulations and standards.

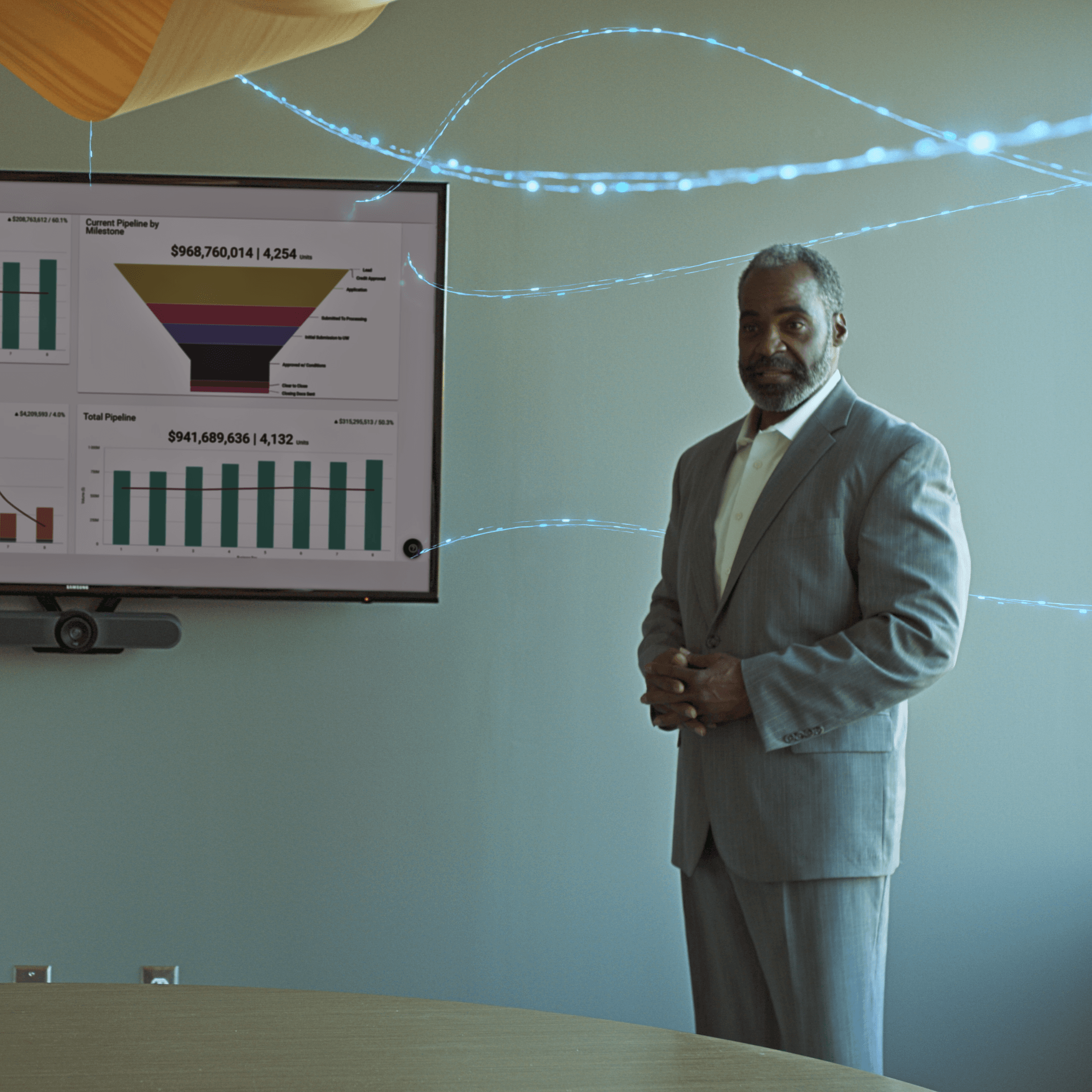

Streamlined Decision-Making: Comprehensive reports and analytics provided by the software aid strategic decisions to optimize lending operations and improve loan portfolio performance and profitability.

Cost Savings: The mortgage loan software helps credit unions reduce operational costs in the long run by automating various tasks, reducing errors, and improving efficiencies.

24/7 Access: Both members and credit union staff can access the software anytime, anywhere.

Unleashing the Power of Digital Mortgage Origination with nCino’s Mortgage Suite

By adopting a solution like nCino’s Mortgage Suite, credit unions can revolutionize their lending operations and offer superior service to their members from pre-application to post-closing.

nCino’s user-friendly, secure, and customizable digital mortgage solution that integrates seamlessly with your existing systems.

To streamline your lending process, improve member satisfaction, and profitably grow your credit union, look no further than nCino’s Mortgage Suite. To learn more, schedule your demo today.