Redefine Lending with Intelligent Solutions

Outdated systems and rising demands challenge lending success. Today’s financial institutions must deliver smart, scalable solutions to simplify operations, ensure compliance, and exceed customer expectations.

Schedule a Demo

Trusted by industry leaders across the world

Tackling Challenges in Modern Lending

The financial landscape is becoming increasingly complex, presenting new challenges for institutions to tackle.

Operational Inefficiencies

Disconnected systems result in errors, cause delays, and limit visibility, impacting your bottom line and customer expectations.

Compliance Challenges

Manual processes risk data inaccuracy, creating audit vulnerabilities during the lending cycle.

Customer Experience Gaps

Fragmented applications and poor communication frustrate borrowers seeking fast, transparent lending.

Siloed Systems

Multiple systems limit data insights, personalization, portfolio management, and decision-making.

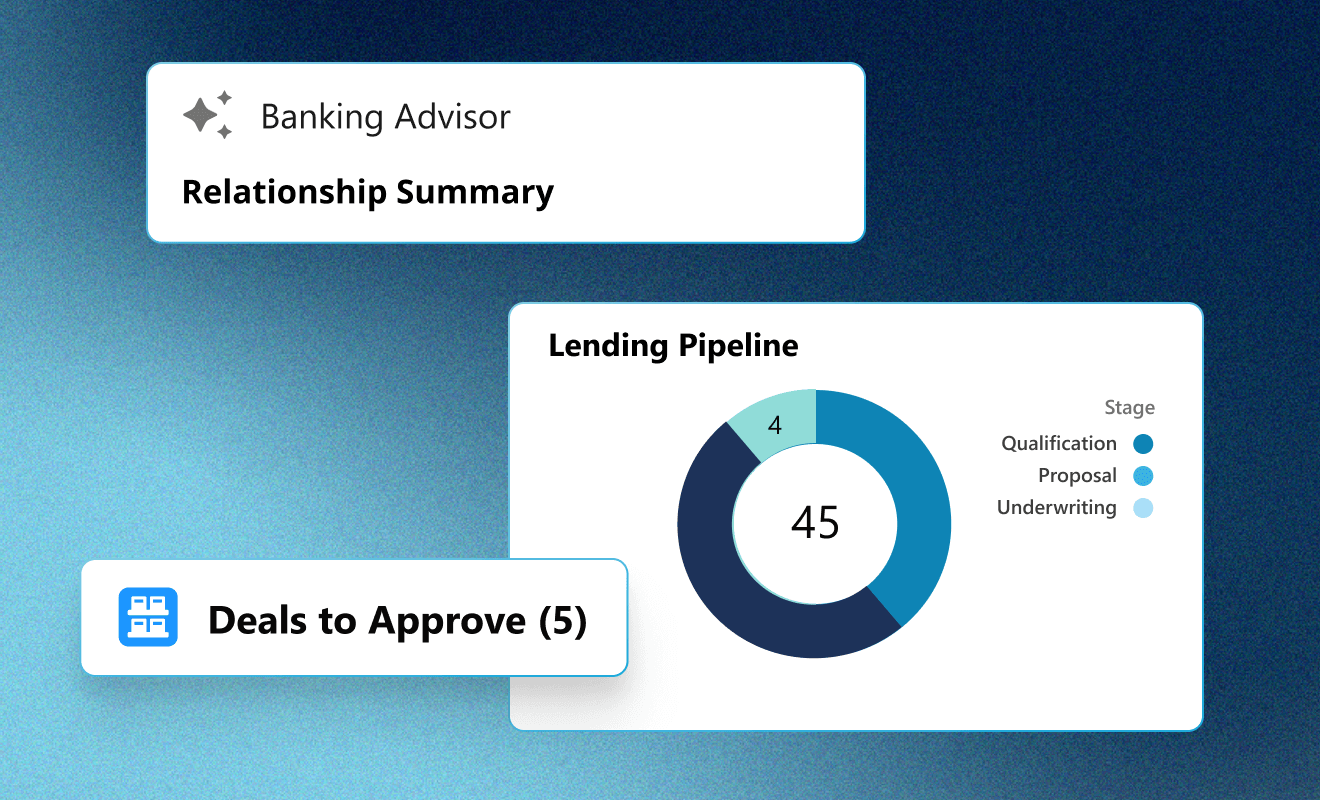

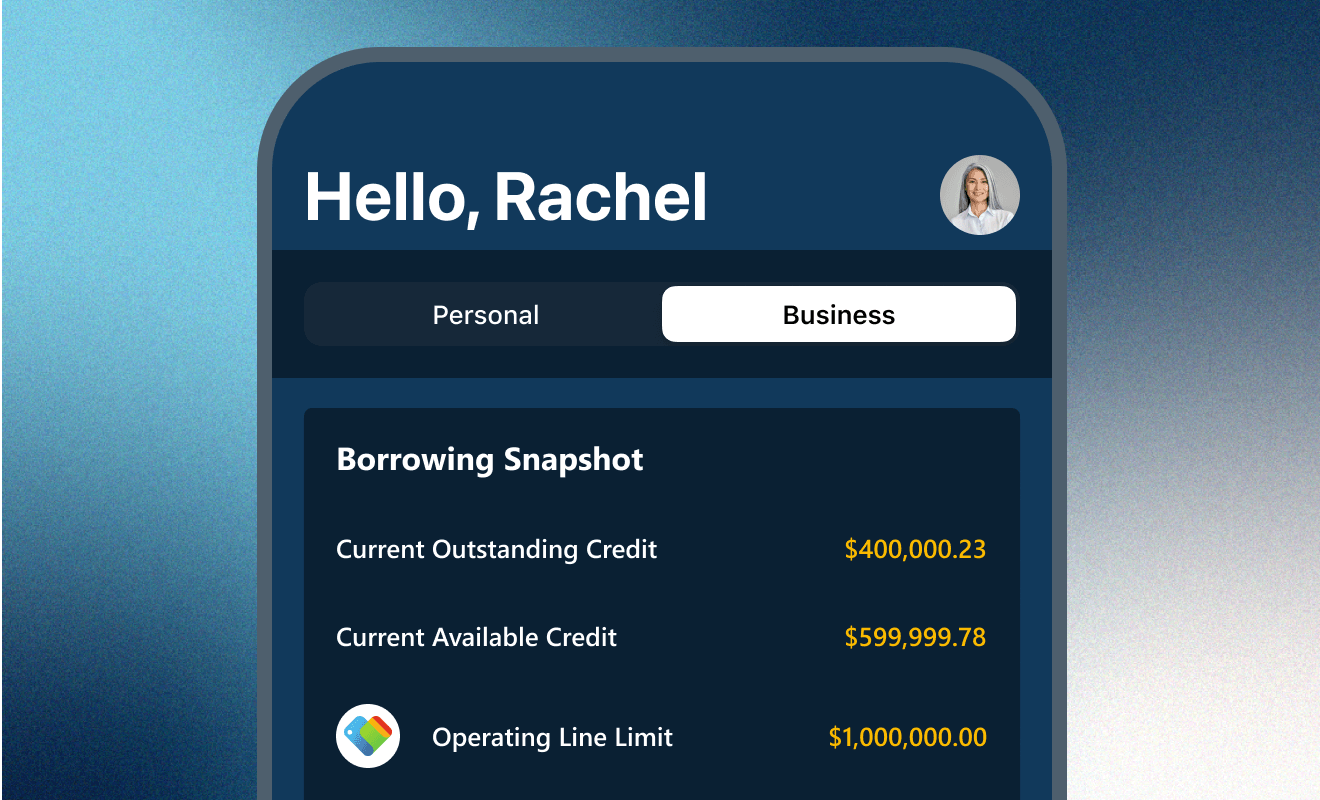

Meet Lending Expectations with nCino

nCino lending solutions unify teams, workflows, and insights into a single platform, transforming lending into a seamless, efficient, and transparent process for businesses and consumers alike.

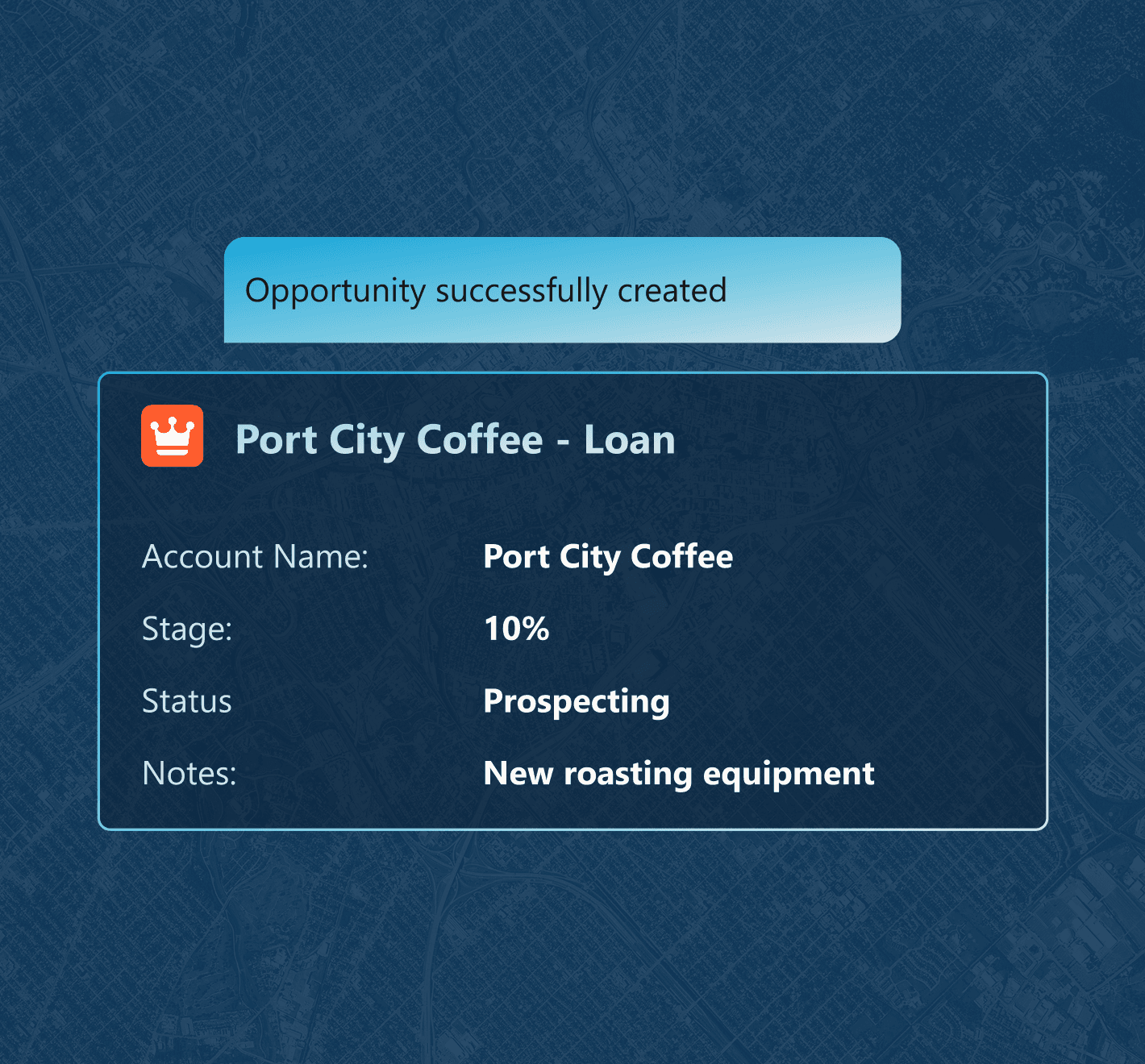

Streamlined Processes

Replace outdated systems with automation, faster approvals, fewer errors, and seamless collaboration.

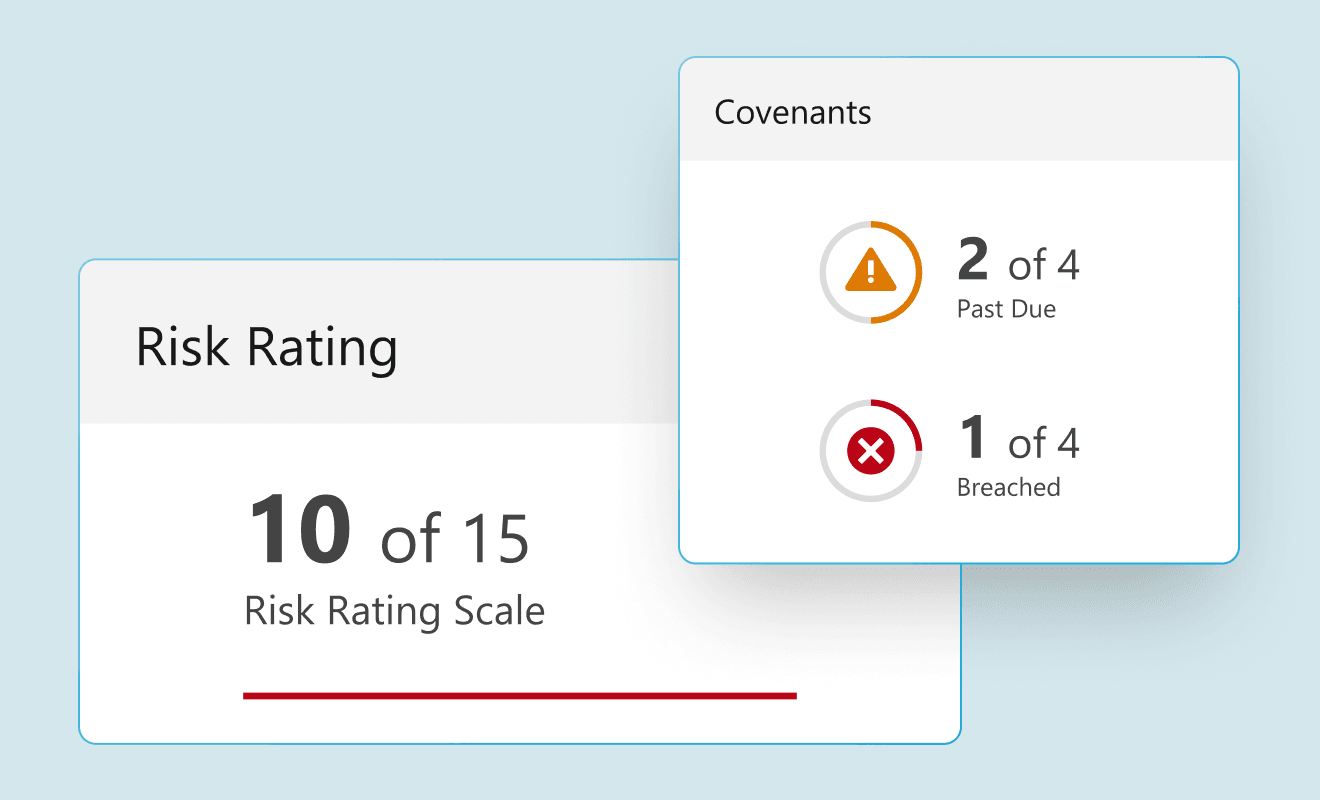

Simplified Compliance

Easily meet regulations with automated data capture, proactive alerts, and transparent audits.

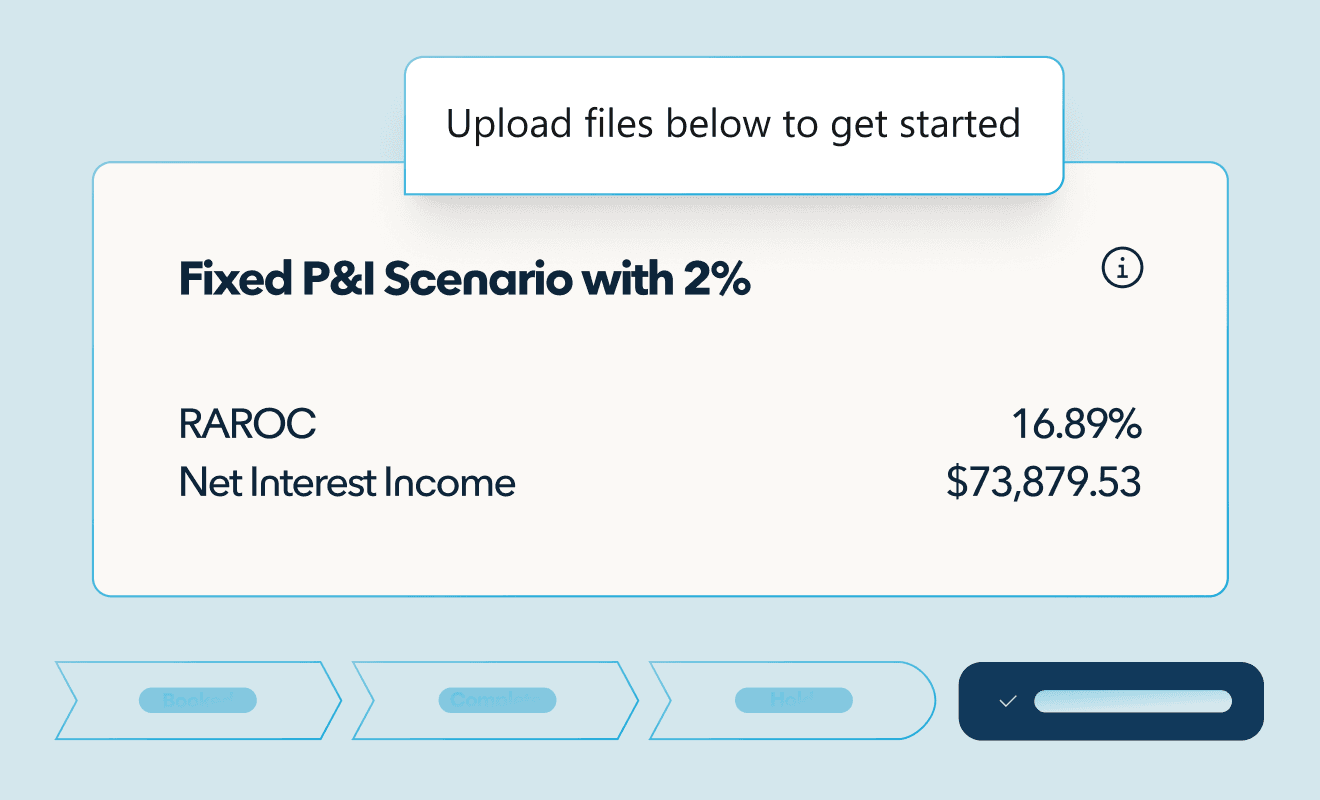

Advanced Analytics

Leverage centralized data, dynamic dashboards, and advanced scoring for growth and risk management.

Exceptional Experiences

Deliver modern, personalized lending with omnichannel access, real-time updates, and quick decisions.

Success that speaks for itself

288%

increase in online applications completion rates

70%

decrease in loan approval time

80%

decrease in time spent to originate commercial loans

“With nCino, we are able to bring the idea of greater simplicity into the lending process. We're closing loans more quickly and efficiently than before and collaborating across our banking offices.”

Jonathan N. Krieps, Chief Operations Officer, North State Bank

Solutions Built to Power and Evolve Your Financial Institution

Ready to transform your institution?

Trusted by over 2,700 financial institutions, the nCino Platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.