nCino’s Credit Analysis Suite

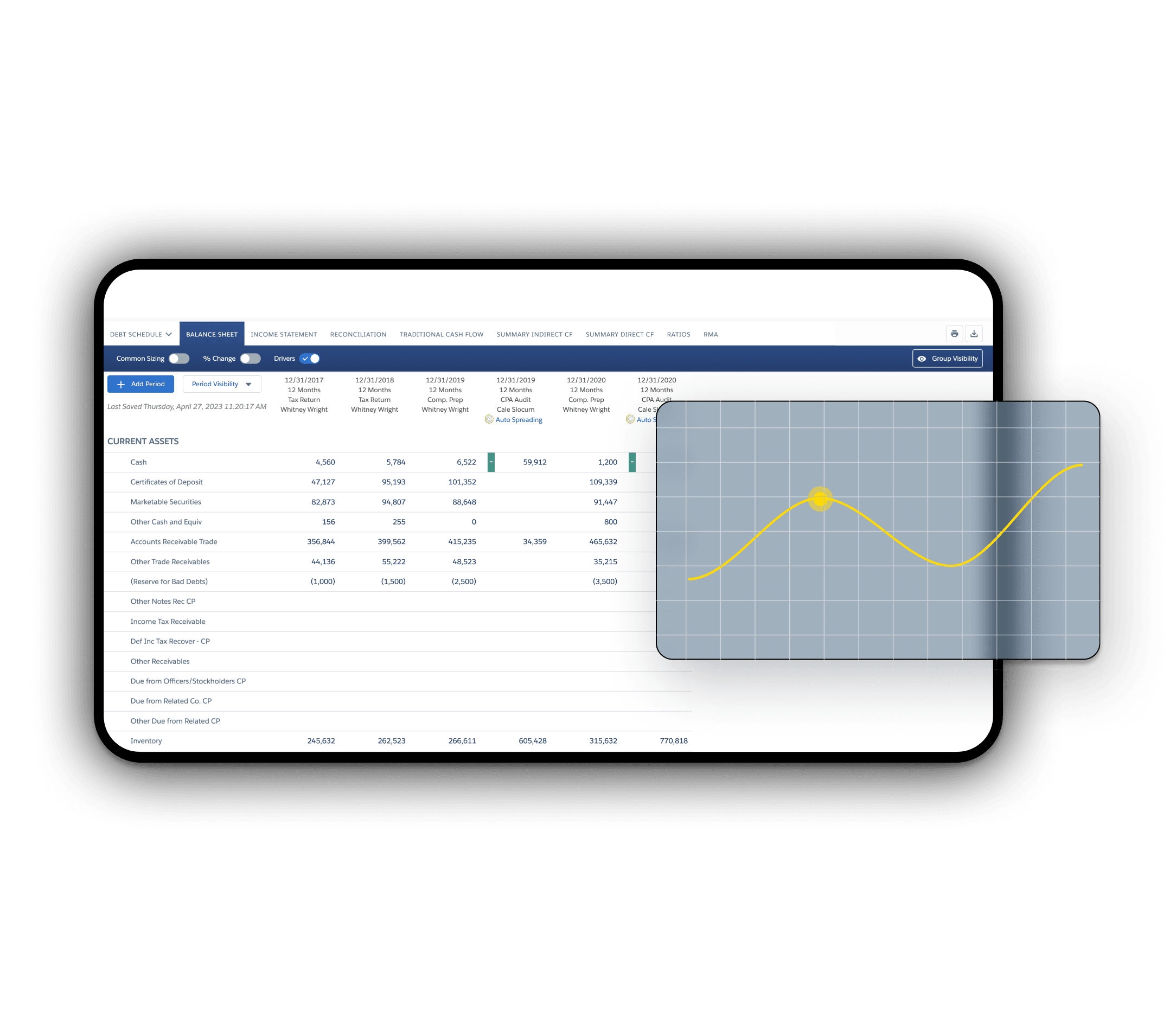

Seamlessly integrated into the commercial loan origination workflow, nCino's Spreads contains a suite of powerful credit analysis tools to produce faster, higher-quality decisions.

Reduce Risk, Grow Intelligently

nCino’s Credit Analysis Suite creates a streamlined, consistent process for underwriters to analyze financial statements, identify major risks and trends, and ultimately provide a better customer experience.

Accelerate underwriting times with automated processes to book more loans faster.

Reduce re-keying of data across disparate systems with a single, intelligent platform.

Increase transparency, communication, and collaboration across teams with centralized spreading data.

Mitigate an institution’s risk with informed and thorough credit analysis.

Improve the customer experience with timely and accurate credit decisions.

From Complexity to Efficiency

With nCino’s Credit Analysis Suite, financial institutions can streamline and accelerate the underwriting process with automation and quickly determine a customer’s creditworthiness to book loans faster.

Reduction in loan servicing costs

Creation by up to 75% and accelerate underwriting times by up to 91%.

Reduction in loan cycle times

Decrease in manual reporting

Quality Credit Decisions with Speed

Underwriters can easily analyze and forecast future cash flows with speed and accuracy for both C&I and CRE loans, while mitigating risk and streamlining documentation.

Easily create a credit memo by automatically pulling the most up-to-date information stored on the nCino platform into a template customized for your FI.

Capture the additional level of detail behind a line item on a financial statement with nCino’s Schedules to provide a more thorough analysis.

Import debts within nCino allowing underwriters to quickly analyze all debt obligations for a borrower and make fast decisions while easily navigating between Debt Schedules and Spreads periods.

Promote the safety and soundness of loan portfolios with user-defined risk ratings that help underwriters assess credit quality, monitor problem loans, and manage risk levels over the life of a loan.

Calculate risk grades using the calculation worksheet’s weighted formulas and manage requests with an approval process that increases transparency and reduces an institution’s risk.

Track collateral and the loans to which they’re secured, lien positions, and associated market rates with nCino’s comprehensive Collateral Management tool.

Credit Analysis In Action

The automation we get from nCino will be impact enough, but the bigger picture is having all parties work a loan from inception to finish in one place.

Annemarie Murphy, SBA Chief Operations Officer at United Community Bank

Ready to transform your institution?

Trusted by over 2,700 financial institutions, the nCino Platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.