Empowering Community Banks to Thrive

Community banks face unique pressures from strict regulations, higher customer expectations, and the need for digital agility. At nCino, we help you stay compliant, grow efficiently, and preserve your community-focused service.

Created for community banking

Built for Community Banking

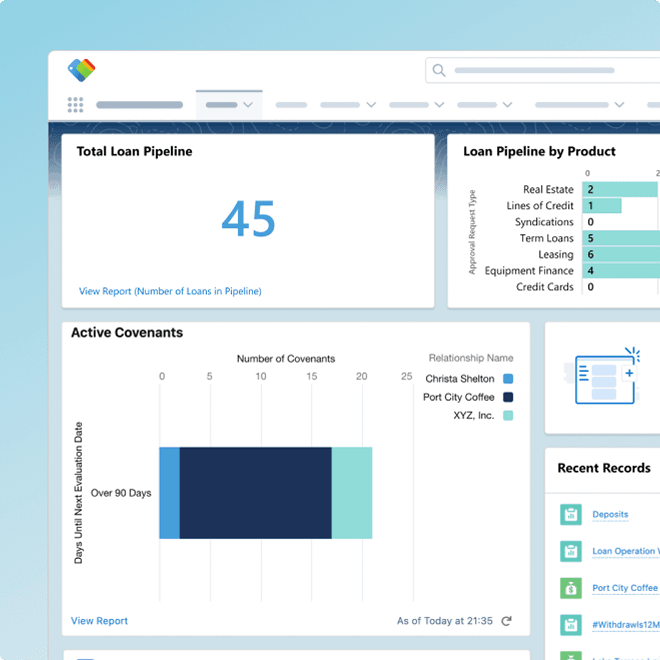

We provide data-driven insights and a flexible suite of solutions to meet your community bank’s specific needs.

Empower deeper customer relationships, streamline processes, and respond swiftly to market changes, all while delivering a personalized experience that keeps you ahead of the competition.

Your passion. Our innovation

We value your trust to help turn homeownership dreams into reality. As your partner, we remain committed to innovation—developing game-changing technology that will help independent mortgage banks continue serving communities while supporting their production goals.

Success that speaks for itself

50%

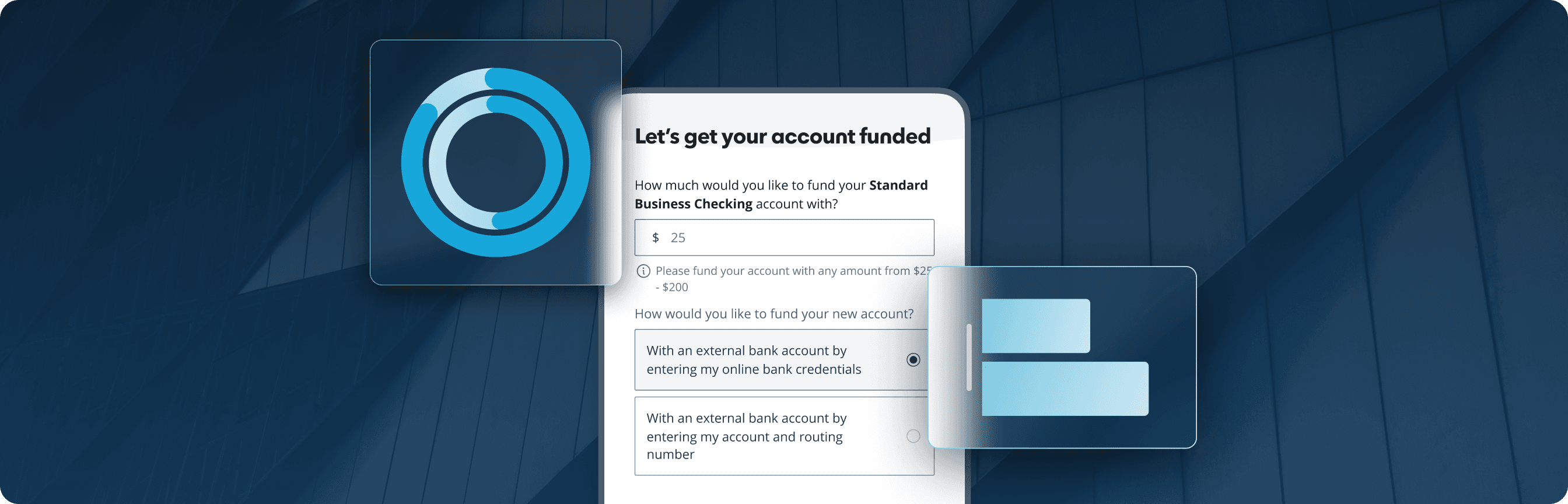

reduction in in-branch account opening time

8

additional technology platforms eliminated with the implementation of nCino Commercial Lending

78%

improvement in booked loans

“By partnering with nCino, we are able to open accounts online—more efficiently, faster and better than our competitors—and that is value added to us as a bank."

Brad Tidwell, President and CEO at VeraBank