Accelerate Business Relationships

Commercial Onboarding

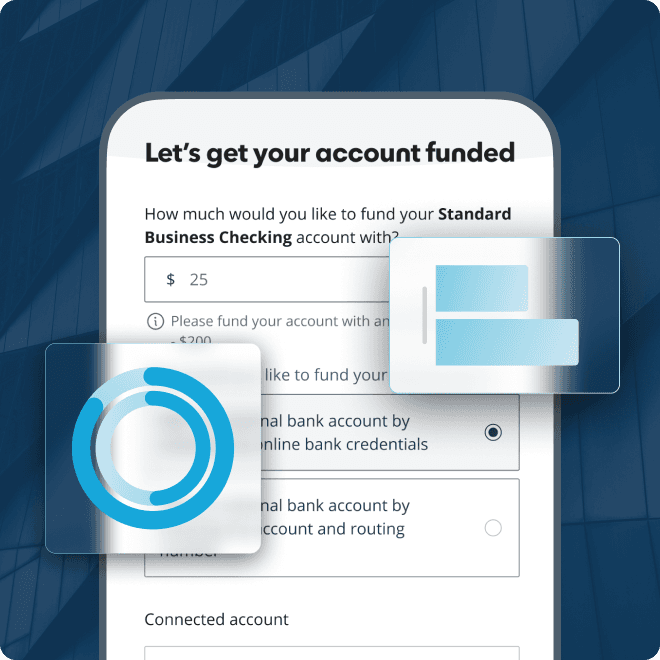

nCino streamlines commercial account opening with an intuitive digital experience that balances speed and compliance, turning onboarding friction into a competitive advantage.

The Platform Trusted by Industry Leaders Across the World

Success that speaks for itself

92%

Improvement in Customer Satisfaction

54%

Faster Account Opening

40%

Reduction in Operational Costs