How nCino Helps Leading Banks Turn Their $15.9M Problem into Profit

Solución

Región

Institución

Leading banks spend millions every year on commercial onboarding—until they discover how to transform this cost into accelerated revenue.

Recent research from Celent revealed that the world’s major financial institutions spend an average of $15.9 million on commercial onboarding per year—a staggering figure that CFOs have long viewed as an unavoidable cost of doing business. But what if this massive expense could become your best revenue moment instead of your last operational hurdle?

Leading banks are discovering that onboarding isn't just a necessary evil—it’s a revenue accelerator. For a bank onboarding 1,000 clients annually, cutting just 10 days from the typical 49-day timeline unlocks $3M in cash flow. By reframing commercial onboarding from a cost center to a profit driver, leading financial institutions can unlock millions in hidden value while delivering the seamless experiences their commercial clients demand.

The Hidden Cost of Commercial Onboarding

What $15.9M Actually Represents

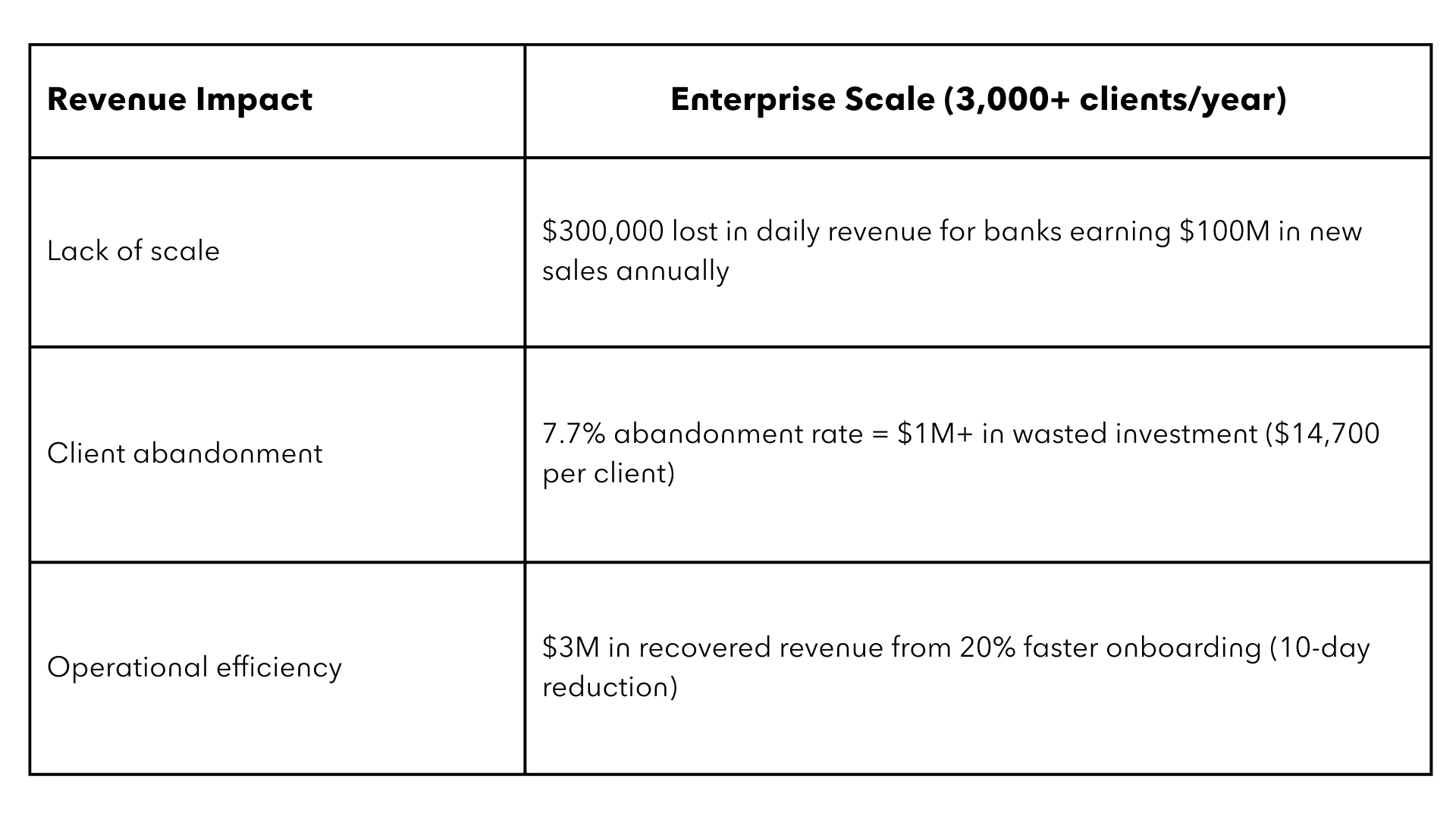

The $15.9 million figure tells only part of the story. For banks onboarding 3,000+ commercial clients annually, the true cost extends far beyond operational spending:

Visible costs: $15.9M in annual operational expenses across systems, staff, and processes

Invisible costs: Revenue delays from 49-day average onboarding timelines and 7.7% client abandonment rates

Scale reality: Repetitive, manual work and rekeying equates to 29,656 days of work for your staff

Manual burden: 6 out of the 9 major steps in onboarding remain mostly or fully manual

The Revenue You're Leaving on the Table

The math is clear: at enterprise volume, every day of onboarding delays compounds into millions in deferred revenue. With commercial deposits significantly larger than retail accounts and treasury services generating fee income without offering interest, the opportunity cost of slow onboarding becomes even more critical.

Why Leading Banks Are Reframing Onboarding

Smart banks see what others miss: onboarding is your first opportunity to wow a commercial client, not your last operational checkbox. Instead of asking "How can we cut this $15.9 million cost?" they're asking "How can we turn onboarding into a revenue accelerator?"

This shift creates momentum. Deliver an exceptional first experience, and you'll see immediate revenue flow. That revenue justifies further investment, which improves the experience even more. Before you know it, you've built a competitive moat that others can't easily cross.

According to a recent Cornerstone report, 25% of banks are investing in commercial account opening capabilities in 2025—more than any other financial technology solution. The message is clear: the window for establishing competitive advantage through superior onboarding is closing rapidly. In today's deposit wars, operational excellence becomes the differentiator, making it even more important to evaluate your processes to guarantee success.

How nCino Commercial Onboarding Transforms the Economics

Purpose-Built for Commercial Banking Complexity

Unlike generic enterprise platforms that require multi-year custom builds, nCino brings over 15 years of commercial banking expertise embedded in every workflow. Our platform handles the unique requirements of enterprise banking—complex entity structures, centralized KYC data, legacy core integration, and embedded analytics—without the typical implementation headaches.

This purpose-built advantage means you can streamline commercial account opening with a single, unified platform rather than spending years customizing generic platforms for banking-specific needs.

Platform Approach vs. Fragmented Systems

Built for Enterprise Scale and Complexity

When you’re operating at regional, super-regional, and national scale, you need:

Proven implementations at major financial institutions globally

Complex entity structure support including beneficial ownership and multi-party verification

Department and team scalability without recreating workflows

Faster implementation than internal builds or generic platform customization

Reduced IT overhead compared to maintaining multiple point solutions

The ROI Case at Enterprise Scale

What the Math Looks Like for You

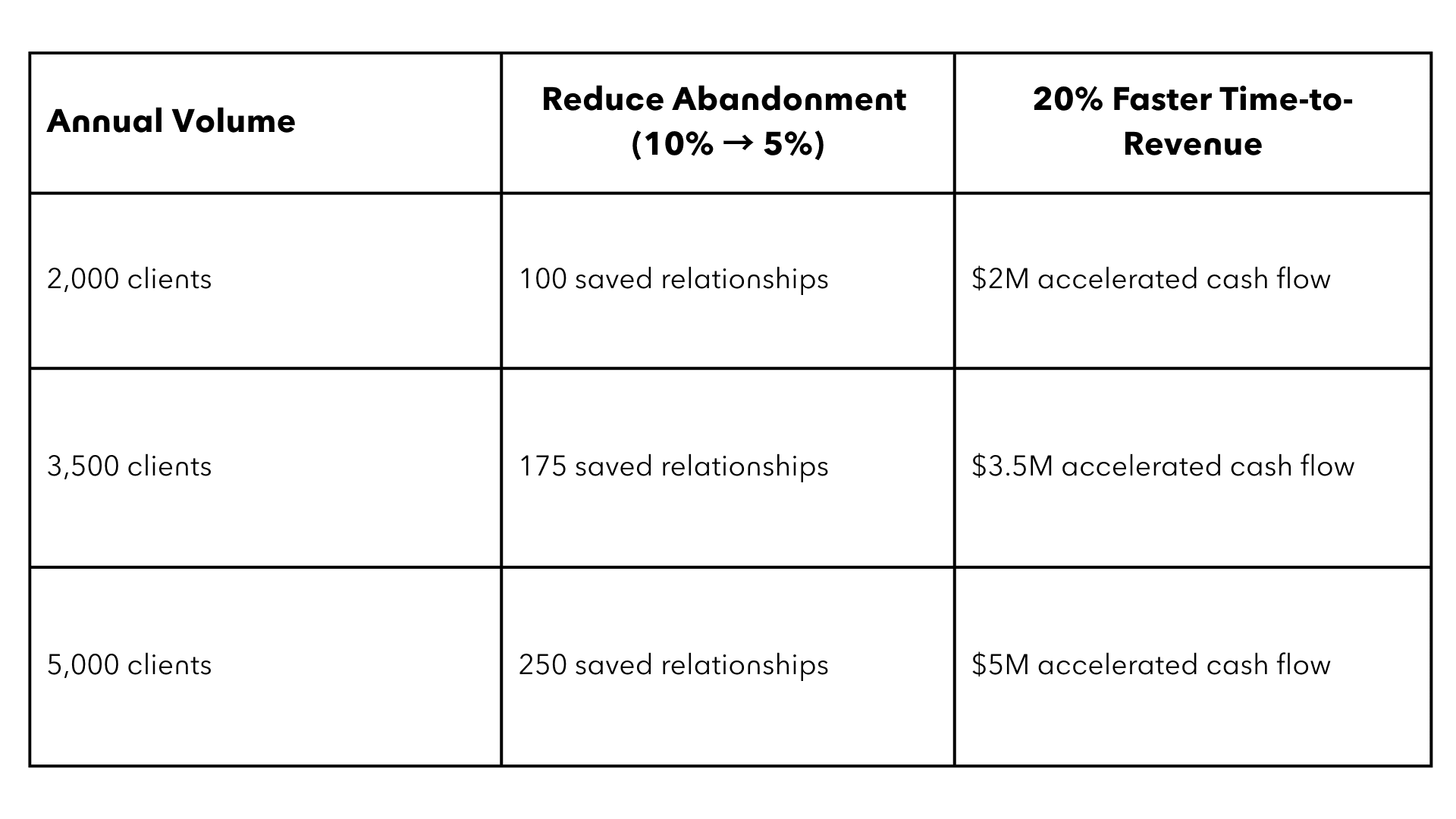

Let’s get specific about what this means for your institution:

Calculations based on: 5% reduction in abandonment rate × client volume; 10-day acceleration (20% of 49-day average) × $274K daily revenue impact.

These projections aren't just numbers on paper. Banks using nCino see transformative results that validate—and often exceed—these ROI estimates:

200% increase in conversion rates – capturing relationships that would have abandoned during lengthy onboarding processes

86% increase in total assets year-over-year – accelerating growth through faster client acquisition and expanded relationships

75% reduction in onboarding time for complex customers – compressing 14-21 days down to just 5 days

80% reduction in account opening times – eliminating weeks from manual processing workflows

5-to-1 consolidation of account opening systems – replacing fragmented tools with a single platform

For enterprise banks onboarding 3,000+ clients annually, these improvements recover millions in revenue while streamlining operations. The 20% timeline reduction in our ROI model? That’s conservative—many institutions have actually achieved 75-80% reductions.

Speed to Revenue Creates Compounding Value

When you accelerate onboarding by just 20%, you're not just recognizing revenue 10 days sooner—you're capturing deposit growth, cross-sell opportunities, and lending income weeks earlier. At enterprise scale, those weeks translate to millions in cash flow annually.

Plus, faster onboarding timelines mean happy clients who stick around. They bring more business. They recommend you to others. And you handle it all without adding proportional headcount, preserving your margins as you grow.

Why Leading Banks Are Choosing nCino

The Platform Decision: Partner vs. Build vs. Generic Tools

According to Celent's framework, when a capability is both strategically important and highly complex, partnering wins. For commercial onboarding:

Why not build: Too complicated, too expensive, and too slow to market with ongoing maintenance overhead

Why not generic platforms: Years of banking-specific customization required with no embedded expertise

Why not point solutions: Integration complexity and vendor management overhead multiply at scale

What Makes nCino Different

nCino brings something unique to the table:

Commercial banking DNA: 15+ years of purpose-built workflows for beneficial ownership, entity hierarchies, and multi-party verification—not generic platforms learning banking

Relationship banking philosophy: Augments bankers rather than replacing them

Meet customers where they’re at: Self-service journeys for customers to onboard and apply on any device at their convenience

Platform thinking: Single source of truth connecting onboarding, lending, and ongoing monitoring—eliminating the data silos that cause duplicate information requests in 72% of onboardings

Enterprise-proven scale: Deployed at major financial institutions managing annual commercial onboardings

Implementation speed: Months, not years, compared to enterprise platform customizations

The result? Your commercial clients experience a centralized, intelligent platform that turns them into revenue-generating relationships faster than ever before.

See How It Works

The $15.9 million your enterprise spends on commercial onboarding doesn't have to remain a cost center. By transforming onboarding into a revenue acceleration engine, you can reduce abandonment, speed time-to-revenue, and maximize customer lifetime value—all while meeting the complex compliance requirements of enterprise banking.

That’s exactly what nCino Commercial Onboarding delivers: the enterprise-grade scale, sophistication, and speed you need to win in today's market.

Ready to turn your onboarding costs into competitive advantage?

Schedule a demo to see how nCino Commercial Onboarding reduces manual processing from 200 minutes to 8 minutes per case.

Download the full Celent report to explore the complete research findings and detailed ROI calculations for enterprise institutions.

This analysis is based on Celent's Global Commercial Banking Onboarding Survey 2025, surveying 409 banking professionals across North America, EMEA, and Asia-Pacific, representing financial institutions ranging from $10 billion to $500 billion+ in assets.