What Makes Automation “Intelligent” in Banking? A Guide to AI-Powered Process Automation

Every vendor demo now features "AI-powered" automation, but your exception queues haven't shrunk.

Intelligent automation combines robotic process automation (RPA)—software that executes repetitive, rule-based tasks—with artificial intelligence, machine learning, natural language processing, and decision engines to handle banking workflows that involve variation, exceptions, and judgment. This is the work that stops traditional rule-based automation in its tracks.

Your operations teams are drowning in exceptions. Five years after implementing RPA to automate data entry, you still have a full exception queue. Commercial loan applications with incomplete tax documentation stop your automated workflows cold. Small business onboarding hits roadblocks when applicant addresses don't match exactly across documents. Your compliance team still manually investigates AML alerts that should have been filtered automatically—despite the $23 billion spent annually by US banks on AML compliance, 90-95% of all monitoring alerts are false positives.

This wasn't how automation was supposed to work.

The gap between RPA's promise and reality comes down to one word: intelligence. Traditional rule-based automation handles perfect scenarios beautifully, but banking rarely offers perfect scenarios. When your automation encounters variation—and variation is the norm in banking—it stops and waits for human intervention.

This article cuts through vendor claims about "AI-powered" solutions to explain what intelligent automation actually means for banking operations. You'll learn which specific capabilities distinguish truly intelligent systems from rebranded RPA, how to evaluate vendor claims with the right questions, and which processes in your institution are ready for intelligent automation versus those that need redesign first.

Why RPA Can't Handle Exceptions (And Never Will)

The root cause isn't RPA failure. It's operating exactly as designed. Rule-based systems can't handle variation without either stopping or requiring exponentially complex rule sets.

Remember the business case for your RPA implementation? Straight-through processing for 80% of loan applications. Automated onboarding that would free relationship managers to focus on client relationships. Same-day payment exception resolution.

The reality: your exception teams are still here, still investigating mismatches, still tracking down missing documentation, still routing edge cases to the right analyst.

RPA executes predefined rules flawlessly. When a commercial loan application arrives with tax returns in the expected format, financial statements with standard line items, and collateral documentation that matches templates exactly, RPA moves it through your workflow at machine speed. But when that same loan arrives with prior-year tax amendments, revenue reported across multiple business entities, or appraisals in an updated format your system doesn't recognize, RPA stops. The loan lands in an exception queue, and an analyst investigates.

You could write rules to handle revenue discrepancies between tax returns and financial statements, but those rules would need to account for timing differences, accounting method variations, entity structure nuances, and dozens of other factors. Even if you built those rules, the next edge case—and there's always a next edge case—would require new rules, new testing, and new deployment.

The uncomfortable truth: many institutions automated workflows that were already broken. If your paper-based process requires three manager approvals because "that's how we've always done it," automating that process just makes you efficiently execute unnecessary steps. Intelligence won't fix a fundamentally flawed process; it will just help you execute inefficiency faster.

If your automation initiatives haven't delivered expected results, the problem often lies in execution rather than technology. Understanding these common gaps helps prevent repeating past mistakes.

Process Design Matters More Than Technology

Before implementing intelligent automation, ask yourself: "Are we automating the right process, or digitizing a 1990s paper workflow?" If your approval chains exist because paper documents needed physical signoffs, if your data collection forms mirror paper applications field by field, if your exception handling assumes someone will call the customer to clarify information, you're automating legacy thinking.

Fix the process first. Intelligent automation scales what you build, good or bad.

Three Forces Making This Urgent

Regulatory change velocity is accelerating. Basel III implementation, real-time payment requirements, climate risk disclosures, beneficial ownership rules each demands process changes across your institution. Manual adaptation isn't sustainable.

Talent scarcity compounds the problem. You can't hire enough credit analysts to handle volume growth. Your most experienced underwriters are retiring, taking decades of institutional knowledge with them. New hires require months of training before they can independently handle complex credit decisions.

Competitive pressure from digital lenders raises the stakes. When competitors approve small business loans in minutes while your "automated" system still takes days, you lose relationships. Speed wins, but only when paired with sound risk management.

These three forces aren't isolated challenges—they're part of broader industry trends that AI is accelerating. The institutions that recognize how these trends interconnect and compound each other will be better positioned to respond strategically rather than reactively.

What Intelligence Actually Means: Four Components Working Together

Intelligent automation isn't a single technology. It's four components working together to handle what traditional automation can't. Seeing how these components work together in real banking scenarios often clarifies what "intelligent" truly means better than any technical definition.

RPA Handles the Doing

RPA remains the foundation: it executes repetitive, rule-based tasks without human intervention. In banking, that means extracting data from applications, populating core systems, generating standard documents, and moving information between platforms.

RPA's limitation is also its strength: it does exactly what you program it to do. When exceptions occur, RPA stops and escalates. This is appropriate. You want machines to recognize the boundaries of their capability.

If you're building hundreds of rules to handle edge cases, simplify the process first. Complex rule sets become unmaintainable quickly.

AI and Machine Learning Handle the Thinking

AI and machine learning add the intelligence layer: recognizing patterns in data, making predictions based on historical outcomes, and learning from new information without explicit reprogramming.

In banking, this means document classification that handles varied formats, fraud detection that identifies statistical anomalies rather than rule violations, and credit risk assessment that considers hundreds of variables simultaneously. McKinsey estimates that generative AI alone could add $200 billion to $340 billion in value annually to banking—2.8 to 4.7% of industry revenues—largely through increased productivity.

The critical warning: AI learns from your process. If your current process produces poor outcomes—approving risky loans, missing fraud patterns, creating customer friction—AI will scale those poor outcomes. You must have sound processes and good data before implementing AI-driven automation.

Equally important: you need to understand how AI reaches its conclusions. AI explainability isn't just a technical nice-to-have—it's essential for regulatory compliance, risk management, and building institutional trust in automated decision-making. When AI flags a loan application or identifies a compliance risk, your team needs to understand why.

nCino Banking Advisor, for example, reduces document filing time from several minutes to under 10 seconds—letting staff process three to four times more documents in the same timeframe. This frees staff to focus on credit analysis and client consultation rather than document management. This frees employees to focus on higher-value activities that require human judgment, like allowing staff to review credit decisions or consult with borrowers.

NLP Handles the Reading

Natural language processing adds comprehension: understanding and generating language, extracting meaning from unstructured documents, and interpreting regulatory requirements or customer inquiries.

For banking operations, NLP reads financial statements regardless of format, extracts relevant data from appraisals and legal documents, monitors regulatory updates across jurisdictions, and interprets customer communication to route requests appropriately.

The challenge: if human interpretation of documents is inconsistent across your organization, AI will amplify that inconsistency. A commercial bank using different credit memo templates across branches will get unreliable results from NLP-based extraction. Standardize interpretation before automating it.

Decision Engines Apply the Judgment

Decision engines codify business rules and policies, applying them to AI for recommendations. This is where risk tolerance, compliance requirements, and institutional strategy turn AI insights into actions.

In practice, decision engines route exceptions based on risk severity and analyst expertise, apply risk-based decisioning frameworks to credit applications, trigger compliance workflows when AI detects potential issues, and determine which automated decisions require human review.

Critical warning: decision engines codify judgment, which means inconsistent human decisions become inconsistent with automation. If your commercial lenders apply credit policies differently, automating those decisions will perpetuate the inconsistency.

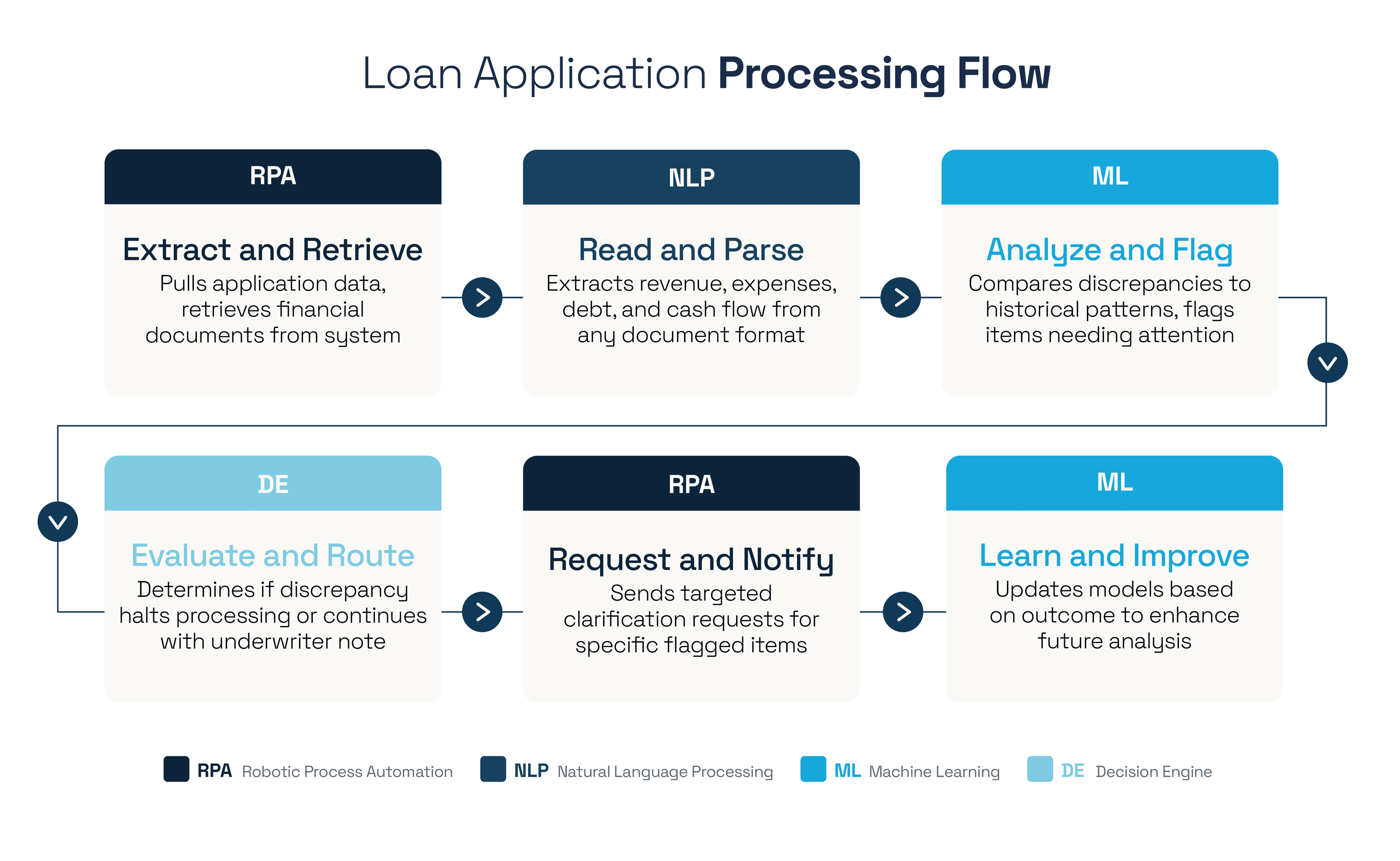

How All Four Components Work Together on a Complex Loan

Consider a commercial real estate loan application with incomplete documentation and revenue discrepancies between the applicant's tax returns and financial statements:

RPA extracts basic information from the application and retrieves the applicant's financial documents from your document management system.

NLP reads tax returns and financial statements regardless of format, extracting revenue, expenses, debt obligations, and cash flow data even when documents use non-standard templates.

ML analyzes the revenue discrepancy, comparing patterns to historical cases where similar discrepancies were and weren't problematic, and flags specific items requiring attention.

The decision engine determines whether the discrepancy is critical enough to halt processing or if the application can continue with a note for the underwriter to verify during review.

RPA sends a specific, targeted request to the applicant for clarification on the flagged items rather than a generic request for "additional financial information."

ML learns from the eventual outcome—whether the discrepancy indicated real risk—improving future analysis.

Each component handles exceptions within its domain instead of escalating everything to humans. The system becomes more capable over time as ML improves from accumulated experience. If your policies are inflexible by design, requiring specific documentation regardless of risk level, mandating approvals based on hierarchy rather than expertise, fix those policies before automating. Intelligent automation works best when your processes allow for appropriate variation based on risk and circumstances.

Three Banking Processes Where Intelligence Makes the Difference

Each of these use cases follows a pattern: first, identifying what traditional automation can't handle; second, asking the process design question; third, showing how intelligent automation transforms the workflow; and fourth, demonstrating concrete results.

Commercial Credit Memo Preparation

The problem: Credit analysis is too complex for pure RPA. Interpreting financial statements, assessing collateral adequacy, evaluating industry trends, and synthesizing qualitative factors into a coherent credit narrative requires judgment that rule-based systems can't provide.

The process question: "Do our approval layers serve risk management or just reflect organizational hierarchy?" If your credit memos route through multiple approval levels because executives expect to review deals rather than because additional risk assessment is needed, you're creating unnecessary work.

The intelligence solution: NLP reads financial statements in any format, extracting relevant data regardless of how CPAs present information. ML analyzes trends across reporting periods, identifies unusual patterns, and compares the applicant's performance to industry benchmarks. The decision engine applies your credit policies—debt service coverage requirements, loan-to-value limits, industry exposure constraints—to flag issues requiring attention. AI compiles a draft credit memo that highlights relevant risks and structures the analysis according to your institution's standards.

Results: Underwriters review AI-prepared analysis instead of building credit memos from scratch. They focus their expertise on relationship dynamics, market conditions, and qualitative factors that machines can't evaluate. Credit decisions happen faster without sacrificing quality.

Systems like nCino Continuous Credit Monitoring can compress credit review prep from nearly two hours of manual data gathering to under two minutes of automated aggregation—a 98% time reduction. This lets credit analysts spend their time evaluating risk rather than compiling spreadsheets.

Exception-Heavy Payment Processing

The problem: High-volume payments process smoothly, but exceptions such as mismatched account numbers, unclear payment references, and duplicate transactions require investigation. Analysts spend hours each day reconciling payments that should have been automated.

The process question: "Are these genuine exceptions or signs of unclear reference standards?" If exceptions primarily result from inconsistent formatting or ambiguous payment descriptions, you have a process design problem, not an automation gap.

The intelligence solution: RPA processes standard payments. ML detects patterns in exceptions, learning which variations are problematic and which are superficial formatting differences. NLP interprets payment references even when customers use inconsistent descriptions. The decision engine routes exceptions by risk level—high-value mismatches go to senior analysts immediately, formatting variations get auto-corrected, and potential duplicates get flagged for quick human verification.

Results: Analysts focus on genuine problems like potentially fraudulent transactions, unusual payment patterns, actual account mismatches rather than formatting issues. Same-day resolution becomes standard instead of aspirational.

AML False Positive Reduction

The problem: Rule-based AML monitoring systems generate overwhelming false positives. Analysts spend the majority of their time investigating legitimate transactions that happen to trigger rules, missing signals in the noise.

The process question: "Are we monitoring because regulations require it or because we've always done it this way?" Effective AML programs focus resources on genuine risk. If you're investigating every transaction that matches a rule regardless of customer history or transaction context, you're not managing risk; you're just checking boxes.

The intelligence solution: ML builds behavioral profiles for each customer, understanding normal transaction patterns for their specific circumstances. AI detects statistical anomalies that indicate genuine risk rather than simple rule violations.

NLP monitors adverse media and regulatory databases for customer mentions. The decision engine prioritizes cases by risk level and auto-closes obvious false positives after human-defined verification checks.

Results: Investigators focus on actual threats instead of paperwork. SAR filing happens faster when analysts aren't buried in false positives. You can answer examiner questions about your risk-based approach with data showing how you allocate investigative resources.

Process Selection: Which Workflows to Automate (and Which to Redesign First)

Not every process benefits from intelligent automation. Some need redesign before any automation. Others work better with human judgment regardless of technological capability.

Good Candidates vs. Poor Candidates

Automate With Intelligence | Avoid or Redesign First |

Exception rates: High volume with predictable exception patterns | Exception rates: Every case is unique, or exceptions are truly random |

Pattern type: Historical data shows clear patterns in successful outcomes | Pattern type: No historical precedent for decisions |

Decision basis: Objective criteria with some subjective judgment | Decision basis: Purely subjective or requires extensive negotiation |

Stakes/impact: Mistakes are manageable and correctable | Stakes/impact: Errors create unacceptable risk or regulatory exposure |

Process design: Workflow reflects current business needs | Process design: Process exists because of legacy constraints |

Good candidates for intelligent automation:

Commercial underwriting with standard documentation requirements

Small business onboarding where most applications are straightforward

Fraud detection in high-volume payment processing

AML transaction monitoring with historical false positive patterns

Poor candidates requiring redesign or remaining manual:

Simple account opening that's already smooth (if it works, don't automate it)

M&A due diligence requiring extensive judgment

Regulatory filings where immediate accuracy is legally required

Highly negotiated commercial deals where relationship dynamics drive outcomes

Four Questions That Prevent Expensive Mistakes

Before automating any process, ask:

Would a new employee question why we do this? If yes, you're automating legacy thinking.

Do steps exist because of old technology constraints? Systems that required batch processing, manual data entry, or paper document routing shaped your workflows. Those constraints are gone.

Are we collecting data we never use? Unused data collection wastes time and creates risk.

Do approval layers serve risk management or hierarchy? If approvals exist to keep executives informed rather than to assess risk, eliminate them.

If you answered yes to any question, redesign before automating. Intelligent automation will efficiently execute unnecessary work.

Where Returns Actually Come From

Return Type | What It Actually Means |

Risk reduction | Fewer errors, more consistent policy application, better fraud detection, improved regulatory compliance |

Revenue acceleration | Faster decisions enable you to close deals before competitors, better customer experience increases retention, freed capacity allows relationship managers to prospect |

Operational improvement | Lower cost per transaction, reduced exception handling, better resource allocation, improved employee satisfaction |

Timeline expectations: Simple use cases with clean data and sound processes can show results in weeks. Complex processes with data quality issues, integration challenges, or unclear policies take longer. Don't expect overnight transformation.

Hidden costs: Change management is often more expensive than technology. Training takes time. Integration with legacy systems creates technical debt. Process redesign requires organizational commitment.

Common Failure Modes and How to Avoid Them

What Goes Wrong | How to Mitigate It |

Organizational resistance | Involve frontline staff in design, demonstrate quick wins, communicate how automation helps them rather than replaces them |

Data quality problems | Clean data before automation, establish data governance, start with processes that have good data |

Integration complexity | Assess integration requirements upfront, prioritize processes with fewer system dependencies, budget for integration work |

Training requirements | Plan comprehensive training, create clear documentation, identify power users who can help peers |

Process design failure | Audit current processes before automation, involve process owners in redesign, test with actual users before full deployment |

Process design failure is both the most expensive and most preventable failure mode. You can fix data quality, manage organizational change, and solve integration challenges, but you can't overcome fundamentally broken processes with technology.

What Actually Defines Intelligence

Intelligent automation means three core capabilities: handling variation without stopping, learning from patterns in data, and routes high-risk exceptions to senior analysts while auto-resolving formatting discrepancies based on risk and circumstances.

RPA automated the easy cases—standard transactions, perfect data, routine workflows. Intelligent automation handles what's left: the exceptions, the variations, the judgment calls that currently require human intervention.

The framework is straightforward: fix your processes first, then scale them with intelligence. Technology amplifies what you build. Build well.

Learn More About Intelligent Automation

nCino offers intelligent automation capabilities embedded throughout the nCino Platform—not as add-ons, but as core functionality that helps financial institutions handle exceptions, learn from patterns, and make better decisions.

To see intelligent automation in action across commercial lending, onboarding, and compliance workflows, visit ncino.com.