AI vs. Automation in Banking: Why Confusing These Two Technologies Costs Millions

AI and automation aren't the same—confusing them can cost your bank millions in mismatched technology investments.

In today’s market, AI is the mandatory checkbox no vendor can afford to leave unchecked. Sift through any stack of RFP responses, and you'll find nearly identical promises of intelligent solutions transforming operations. But here's the reality: many of these systems are sophisticated automation dressed up as AI, and financial institutions are paying premium prices for capabilities that don't match their actual needs.

This isn't just about semantics—it's a multi-million-dollar, multi-year platform decision that shapes your institution's competitive position for years to come. Once you commit to a technology partner and begin implementation, reversing course becomes exponentially complex and costly.

The good news? Understanding the fundamental architectural differences between AI and automation—and knowing exactly which questions to ask vendors—transforms you from a confused buyer into an informed decision-maker who can match technology capabilities to operational needs.

The Core Distinction: What Actually Separates AI from Automation

Automation: Efficient Execution of Known Processes

Automation excels at executing predefined tasks through explicit programming—think "if this, then that" logic applied at scale. These systems deliver tremendous value through speed, accuracy, and cost reduction for high-volume, repetitive tasks that follow consistent patterns.

But automation has an operational ceiling. When scenarios fall outside programmed parameters, these systems stop cold. They can't adapt, learn, or handle the unexpected without human intervention to reprogram the rules.

Consider document data extraction in loan origination. An automation system efficiently pulls standard fields from familiar formats—until a borrower submits documents in a new layout. The system flags the unfamiliar format for manual review, creating bottlenecks until someone manually updates the extraction rules.

AI: Adaptive Decision-Making at Scale

AI fundamentally differs by learning from data patterns to make contextual decisions without explicit programming for every scenario. These systems recognize patterns, adapt to new conditions, and make nuanced judgment calls that continuously improve decision quality.

True AI requires three critical components: quality data to learn from, compositional architecture that coordinates specialized capabilities, and embedded domain expertise that guides intelligent decisions.

nCino's Analyst Digital Partner exemplifies this approach. Rather than following rigid rules, it accelerates risk assessment and complex financial analysis by understanding context, learning from patterns, and adapting its analysis based on peer-benchmarked intelligence. The system gets smarter over time, handling increasingly complex scenarios without constant reprogramming.

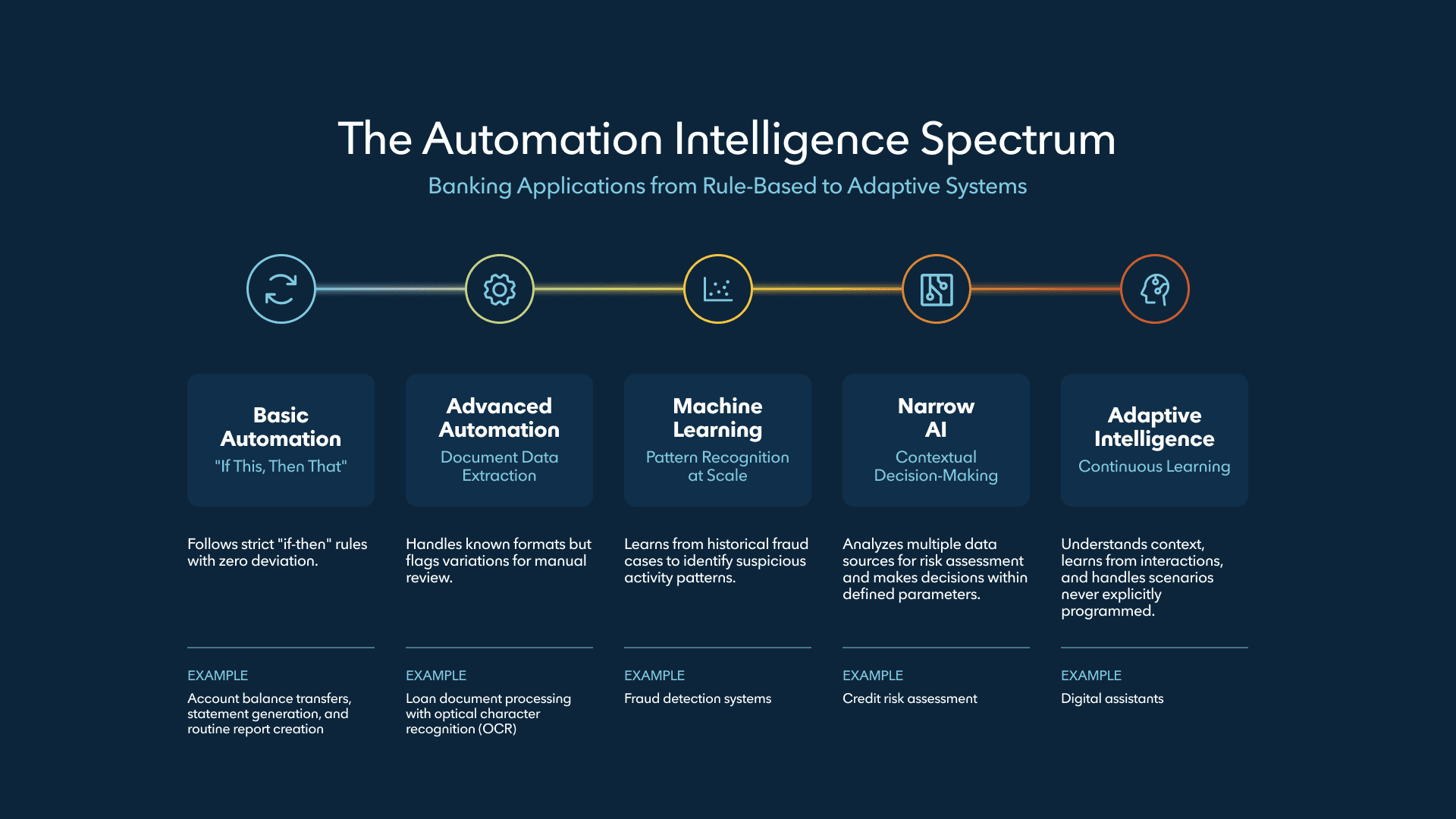

The Spectrum Reality: Why Binary Labels Fail

Banking technology doesn't exist in binary categories—it spans a spectrum from simple automation to sophisticated AI. Most comprehensive platforms intelligently combine both layers: automation handles efficiency-driven tasks while AI manages complex judgment calls.

The key is matching capability to complexity. Basic document routing? Automation works perfectly. Credit risk assessment requiring analysis of multiple variables and market conditions? That demands AI's adaptive intelligence.

Smart institutions stop asking, "Is this AI?" and start asking, "Does this capability match my problem's complexity?" This reframing transforms vendor evaluation from checkbox comparison to strategic capability matching.

Why This Confusion Exists (And Why It Matters)

The Market Reality: "AI-Powered" Became a Checkbox

After 2023's AI explosion, virtually every banking vendor added "AI-powered" to their marketing materials—regardless of actual capability. The result? A marketplace where sophisticated automation masquerades as AI, commanding premium prices for capabilities that don't deliver adaptive intelligence.

Research reveals the scope of this challenge: while 87% of financial institution leaders recognize intelligent automation's transformative potential, only 32% have successfully advanced beyond pilot programs to meaningful enterprise-wide implementation. The gap between recognition and realization often stems from mismatched expectations about what the technology actually does.

Many vendors rebrand existing automation with AI terminology, knowing that institutions struggle to distinguish between the two. One vendor's "AI-powered invoice processing" might be rules-based extraction that breaks with format changes, while another's uses transfer learning to adapt to novel document structures. Both claim AI capabilities, but only one delivers adaptive intelligence.

The Business Cost: What Happens When You Get It Wrong

Choosing the wrong technology creates cascading problems that compound over time. Overpaying for marketed "AI" that's actually automation means spending significant premiums over multi-year contracts for capabilities that don't match operational complexity.

Under-investing creates different problems. Choosing basic automation when you need adaptive intelligence means missing competitive differentiation opportunities. While you're stuck with rigid rules, competitors using genuine AI are delivering superior customer experiences and making better credit decisions.

The operational gap might be the most painful discovery. Imagine realizing 18 months into implementation that your "intelligent" system can't handle the contextual decisions your business requires daily. You're locked into contracts, deep into implementation, and facing the prospect of starting over or accepting limitations.

According to recent research, 95% of automation implementation barriers stem from organizational and strategic factors rather than technological limitations—meaning the problem usually isn't picking the wrong technology, it's misunderstanding what problem you're actually solving. Understanding the critical execution gaps can help you avoid these common pitfalls.

How to Evaluate What You're Actually Getting

Question 1: "Can you show me how your system handles scenarios it wasn’t programmed for?”

This question cuts straight to the fundamental difference between AI and automation. Adaptive systems handle novelty; automation requires explicit programming for every scenario.

A genuine AI vendor will walk you through specific examples: "When a small business applies with an unusual ownership structure we've never seen, our system coordinates specialized sub-agents—one analyzes the ownership complexity, another evaluates risk implications, while a third searches for similar patterns in our data. The system synthesizes these analyses to make an informed decision."

Automation vendors deflect differently: "The system flags unusual cases for manual review" or "We can add rules to handle that scenario in the next update." These aren't wrong answers—they're just automation answers.

Press further: "What percentage of transactions require human intervention because they fall outside system parameters?" AI systems show decreasing intervention rates over time as they learn. Automation systems show consistent or increasing rates as edge cases accumulate.

Question 2: "Can you walk me through your agent architecture?”

Genuine AI banking systems employ compositional architecture where multiple specialized agents collaborate. This isn't marketing fluff—it's fundamental to how AI handles complexity.

Ask vendors to diagram their architecture. Can they show how specialized sub-agents for credit risk, compliance verification, and cross-sell opportunity identification work together? How do these agents share information and resolve conflicts? What happens when agents disagree?

If a vendor can’t articulate architecture beyond vague "AI engine" descriptions, responds defensively about proprietary technology, or provides presentations showing single-purpose tools with chatbot interfaces, they may have sophisticated automation rather than true AI.

Question 3: "How does your system learn and improve over time?"

Continuous learning distinguishes adaptive AI from sophisticated automation. This isn't about periodic updates—it's about systems that actively evolve through experience.

AI vendors describe memory banks and performance curves: "Each transaction teaches the system. After processing 10,000 commercial loans, accuracy improved from 87% to 94% without manual intervention. Here's the performance data showing continuous improvement."

Automation vendors discuss scheduled updates: "We retrain models quarterly based on accumulated data" or "Learning happens through software releases" or "The system needs to be taken offline for model updates."

The difference is fundamental. AI systems learn continuously while operating. Automation systems require discrete retraining events that interrupt operations.

Matching Capabilities to Your Banking Operations

Use Automation When Speed and Consistency Are Primary Goals

Automation shines when process steps are documented and stable, edge cases are infrequent and easily routed to humans, and consistency matters more than adaptability. When speed improvements translate directly to measurable cost savings, automation delivers exceptional ROI.

Regulatory reporting exemplifies automation's sweet spot. Reports follow fixed formats with deterministic calculations where automation reduces processing from days to hours. Using AI here would be problematic—regulators want exact, reproducible logic, not adaptive decision-making.

Use AI When Judgment and Context Drive Outcomes

AI becomes essential when multiple variables interact in complex ways, edge cases are frequent and require sophisticated handling, and processes demand judgment that would otherwise require experienced human expertise.

Performance should improve through learning from outcomes rather than manual rule updates. This is where AI's adaptive intelligence creates competitive advantage.

nCino Banking Advisor's conversational interface demonstrates this perfectly. Its five core capabilities—Knowledge, Access and Retrieve, Analyze, Automate, and Summarize—adapt to each employee's role and workflow context. The system doesn't just execute commands—it understands context and provides intelligent support exactly when needed, learning from each interaction to become more helpful over time.

Use Both When You Need Foundation Efficiency and Strategic Intelligence

Most high-volume banking processes combine routine components requiring automation's efficiency with complex decision points demanding AI's judgment. The key is deploying each technology where it delivers maximum value.

Consider mortgage origination. Automation handles document collection and data extraction—the high-volume, repetitive tasks that consume the majority of processing time. But when evaluating risk profiles or handling exception cases, AI steps in to make nuanced decisions that would otherwise require senior underwriter expertise. This layered approach delivers both efficiency gains and enhanced decision quality.

The Data Foundation Question

The Reality Check Most Institutions Need

Here's an uncomfortable truth: the majority of AI project failures trace back to data quality issues, not algorithm problems. Banking data typically sprawls across core systems, loan origination platforms, CRMs, and document management systems, creating silos that prevent effective AI deployment.

Test your readiness with this simple challenge: Can you generate an accurate list of all commercial loans with specific covenant types without manual review? If that requires multiple system queries and manual reconciliation, you're not ready for AI's full potential.

What "Data Foundation" Actually Means

A proper data foundation requires four pillars:

Unification brings together customer 360 views, relationship hierarchies, and historical transaction data in accessible formats.

Standardization ensures consistent formats, aligned taxonomy, and enforced data quality rules.

Accessibility demands API-enabled real-time access—not just batch processing—with analytics-ready structures.

Governance provides appropriate security controls, regulatory compliance frameworks, and master data management.

When these pillars work together, they create the data-driven foundation that makes smart banking automation possible—whether you're implementing basic efficiency improvements or sophisticated AI capabilities.

The Buy vs. Build Decision

Determining whether to buy or to build is a crucial decision in today’s market. Building custom data foundations means multi-year timelines, substantial ongoing investment, and significant project risk—especially for mid-sized institutions without dedicated data engineering teams.

Platform approaches accelerate implementation through proven data models tested across hundreds of institutions. They deliver more predictable outcomes with lower risk. This isn't about cutting corners—it's about recognizing that data foundation isn't your competitive differentiator. What you do with unified data is.

Making the Decision: A Framework for Your Institution

When Budget Forces Choices: How to Prioritize

If your team is drowning in manual work with well-documented processes, start with automation for immediate capacity relief. But if your competitive position is eroding because you can't match larger institutions' sophisticated decision-making, prioritize AI investments in strategic areas.

The smartest approach often involves phasing. Quick automation wins in document processing or account opening create immediate efficiency gains and free up budget. Those savings fund AI investments in areas like credit decisioning or risk management where intelligent decision-making drives competitive advantage.

Avoid the trap of buying "AI" everywhere when automation solves many problems more effectively and affordably. Equally dangerous is limiting yourself to automation when competitors are building AI-powered advantages that will eventually lock you out of market segments.

Building the Business Case: What Your Board Actually Cares About

Your board doesn't care about technical architecture—they care about business outcomes. Translate technology capabilities into language they understand: competitive positioning, risk management improvement, and measurable financial impact.

Frame automation's business case around operational efficiency:

Show current manual processing costs versus automation costs, including implementation expenses

Demonstrate clear break-even timelines and ongoing savings projections

Focus on capacity relief and cost reduction with predictable payback periods

Frame AI's business case around strategic capability:

Show how improved decision quality multiplied by transaction volume creates compounding value over time

Include competitive analysis demonstrating what capabilities competitors are building and market share implications

Focus on competitive positioning and revenue opportunity rather than just cost savings

Address the "why not wait?" objection directly. Quantify the cost of delayed implementation—lost market share, inferior customer experience, missed cross-sell opportunities. Then present a phased approach that de-risks investment while building momentum.[RS9]

De-Risking Your Decision

Understanding what's reversible versus what creates lock-in helps manage risk effectively.

Critical risk management considerations:

Understand lock-in versus flexibility. Automation implementations tend to be more modular—you can switch document processing vendors without rebuilding everything. AI investments create deeper dependencies through learning models and integrated decision-making. Evaluate how deeply a vendor's solution embeds into your infrastructure to assess future flexibility.

Start AI initiatives with focused pilots. Target single, measurable use cases to prove value before expanding. Prove ROI in commercial loan decisioning before rolling out to the full credit portfolio. This approach builds confidence, demonstrates results, and identifies issues before they become systemic.

Evaluate vendor dependencies carefully. Can you export your data in usable formats? Are APIs open or proprietary? What happens to learned models if you switch platforms? Effective integration architecture is fundamental to making either automation or AI work within your existing technology ecosystem.

Negotiate contractual protection. Include terms that protect you if the technology doesn't deliver promised capabilities. Define clear performance thresholds and exit provisions.

Define success metrics upfront. Establish clear measurement criteria—processing time reductions, decision accuracy improvements, customer satisfaction scores. Monitor these metrics from day one to identify problems early and adjust course before small issues become major failures.

What This Means for Your Technology Strategy

The path forward requires clear thinking about a complex landscape. First, recognize that automation and AI serve fundamentally different purposes—confusing them leads to expensive mismatches between capability and need. Success comes from understanding the distinction, not from following vendor marketing.

Most institutions need both technologies strategically deployed. Automation provides the efficiency foundation that frees resources and reduces costs. AI delivers the competitive advantages through superior decision-making and adaptive customer experiences. The winning combination deploys each where it delivers maximum value.

Vendor evaluation demands architectural scrutiny. The three questions outlined above—handling unprogrammed scenarios, explaining agent architecture, demonstrating continuous learning—cut through marketing spin to reveal actual capabilities. Use them relentlessly.

Remember that data foundation determines success more than algorithm sophistication. The most advanced AI fails without quality, unified data. Assess your data readiness honestly before committing to AI investments.

Turning Knowledge Into Strategic Action

Your next steps are clear. Start by auditing current "AI" investments using the three evaluation questions. You might discover you're paying AI prices for automation capabilities.

Map your top operational challenges to capability requirements. Where do you need efficiency? Where do you need intelligence? Where do you need both? Prioritize based on competitive impact and available budget.

Build business cases using the frameworks provided. Translate technical capabilities into board-ready language focused on outcomes, not architecture. Be prepared to show both efficiency gains and competitive advantages.

The question isn't whether to adopt AI—it's understanding where AI solves problems automation can't, where automation delivers better ROI than AI, and ensuring your data foundation supports whichever path you choose. Get these distinctions right, and you'll avoid the million-dollar mistakes that come from confusing two fundamentally different technologies.

How Institution Type Shapes Your Execution Strategy

Understanding AI versus automation is just the beginning. The research shows that 95% of implementation barriers are organizational, not technical. Your institution's structure determines which strategies actually work: