WEB APPLICATION

Onboard customers faster. Manage risk smarter.

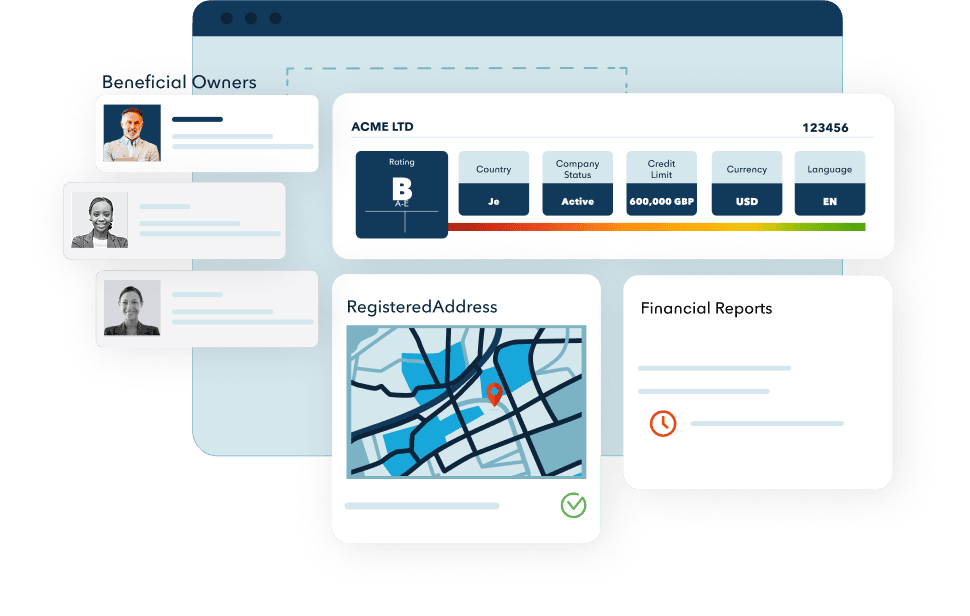

A no-code onboarding platform incorporating robust KYB and KYC procedures, ensuring comprehensive commercial onboarding, thorough people checks, and effortless compliance.

お問合せ

あらゆる規模の金融機関さまに採用されています

Turning Onboarding into a Competitive Advantage

UK businesses face significant delays and inefficiencies in corporate onboarding due fragmented compliance processes. Disjointed workflows can slow customer acquisition and create friction.

Manual verification

Traditional KYC and KYB processes rely on manual document collection and verification, creating time-consuming workflows prone to errors.

System fragmentation

Juggling multiple data providers and platforms for compliance checks, increasing operational complexity and integration challenges.

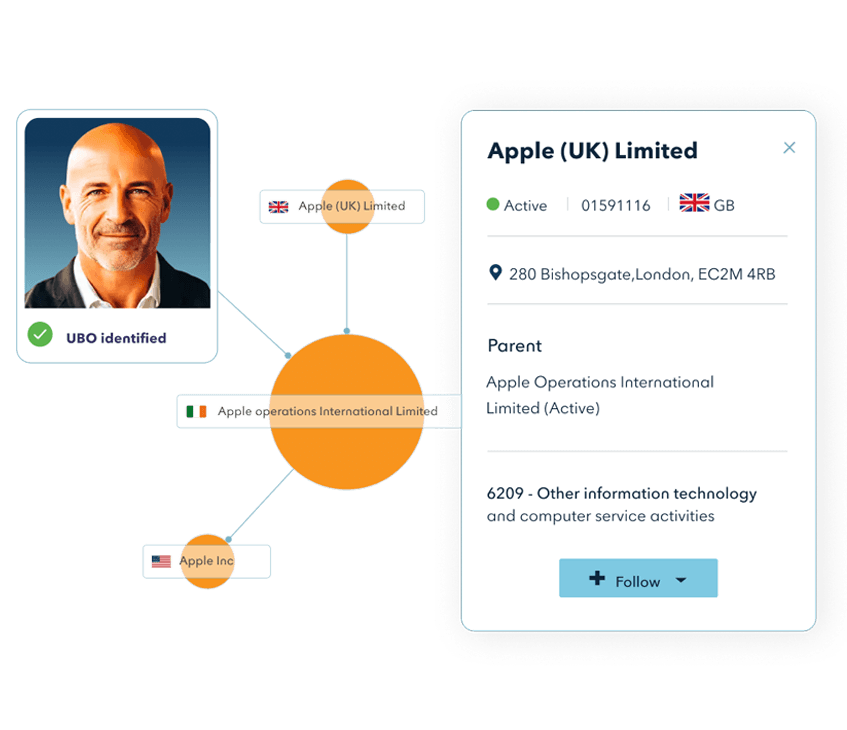

Complex structures

Intricate ownership structures and UBO requirements demand comprehensive due diligence across multiple jurisdictions and databases.

Compliance delays

Lengthy verification processes resulting in customer abandonment and delayed revenue recognition opportunities.

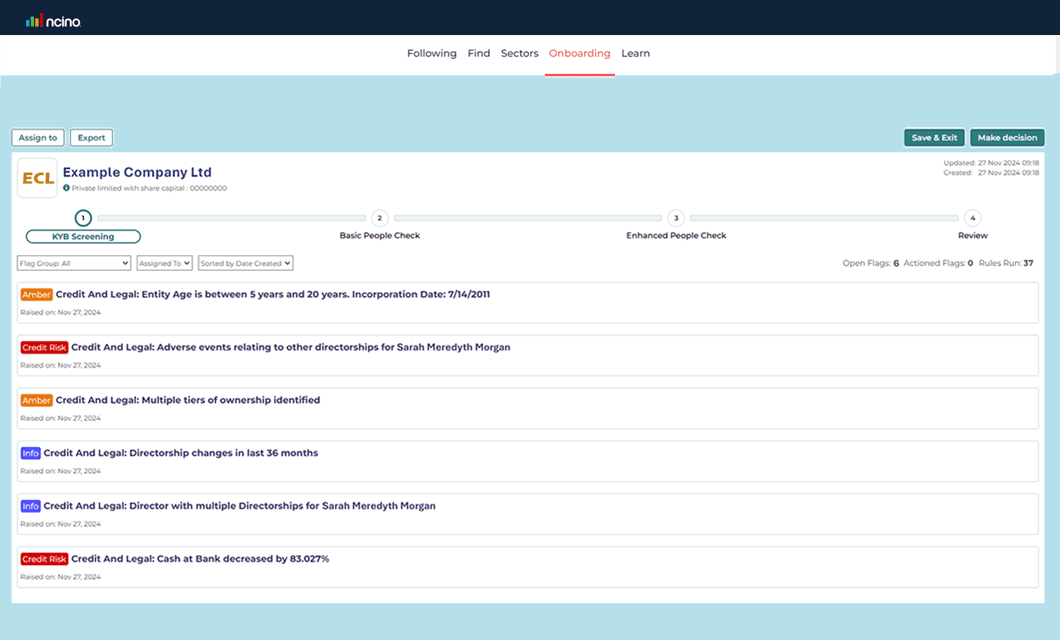

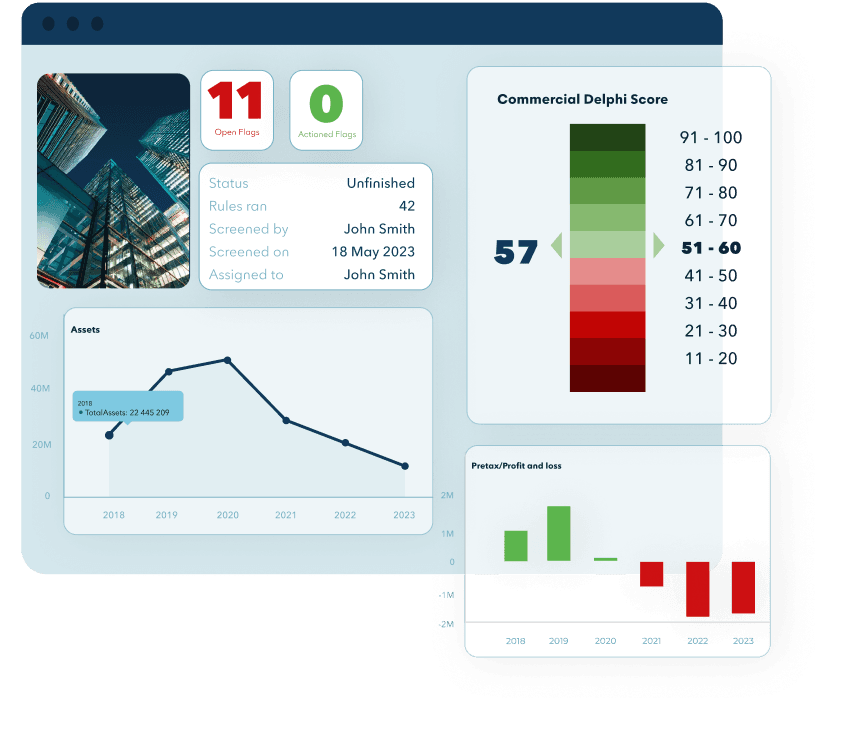

Comprehensive Corporate Onboarding

nCino's SmartOnboard web application transforms customer onboarding with a unified platform that accelerates compliance through exceptional customer experiences, delivering faster business onboarding through automated screening and near real-time risk assessment.

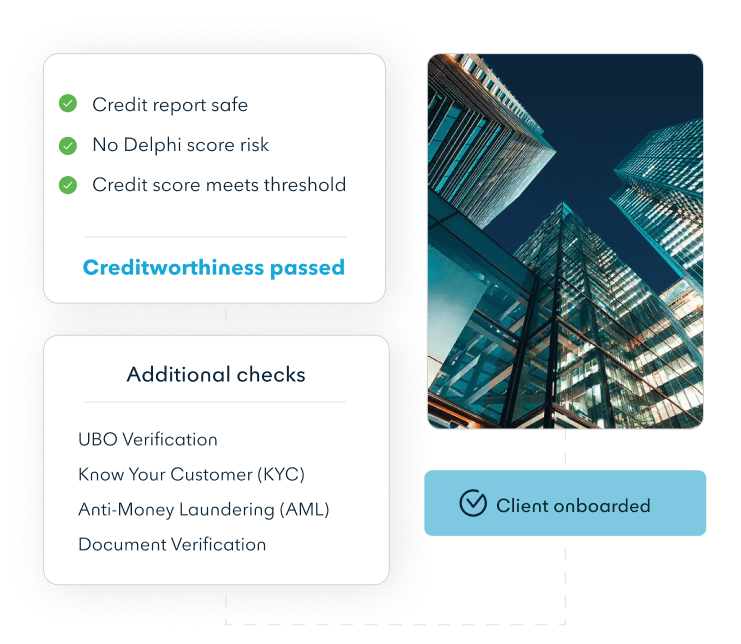

Streamlined Verification

Perform all necessary KYB, KYC, AML, and IDV checks, eliminating manual efforts and reducing complexity.

Automated Onboarding

Automate the entire corporate onboarding journey including director identification, UBO screening, and document verification.

Unified Data Access

Access official registries, credit reference agencies, and premium data partners to avoid operational headaches associated with multiple vendor relationships.

Risk Intelligence

Identify risk levels with access to comprehensive company data including credit risks, regulatory FCA authorisations, directorship changes, court judgements, and financial indicators.

SUCCESS THAT SPEAKS FOR ITSELF

94%

faster onboarding

6M

UK&I companies enriched daily

18M

directors and shareholders

“The chief advantage for the onboarding team has been efficiency. Whereas before they relied on manual data gathering, they can now pull the information they need instantly and verify it."

Katie Ives , Head of Digital Onboarding, Santander UK

免責事項: This testimonial reflects original FullCircl endorsement prior to the company's acquisition by nCino.