WEB APPLICATION

A Unique Market View of Risk and Opportunity Across Portfolios

Equip your front line with the clarity to lend smarter, support faster, and grow stronger client relationships.

デモのご予約

The Platform Trusted by Industry Leaders Across the World

Transforming Commercial Banking with Real-Time Intelligence

UK banks contributing to CAIS and CATO face mounting pressure to leverage shared data effectively while managing fragmented risk signals, reactive relationship management, and siloed internal systems that limit cross-selling opportunities and proactive customer support.

Limited Visibility

Banks lack a consolidated view of customers' total market exposure across multiple institutions, hindering effective risk assessment.

Reaction Management

Relationships managers engage customers after financial stress occurs rather than having the tools to proctively identify opportunities and risks early.

Fragmented Signals

Risk data scattered across CAIS, CATO, and internal systems creates slow decision-making and missed early warning indicators.

Siloed Operations

Internal data isolation prevents effective cross-selling identification and limited proactive financing opportunities for commercial customers.

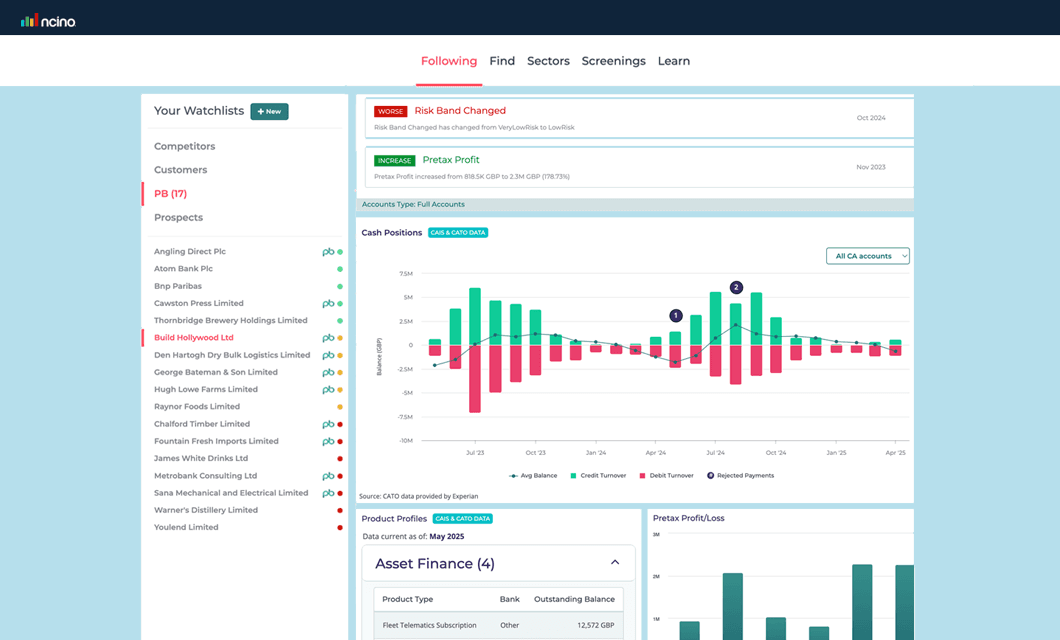

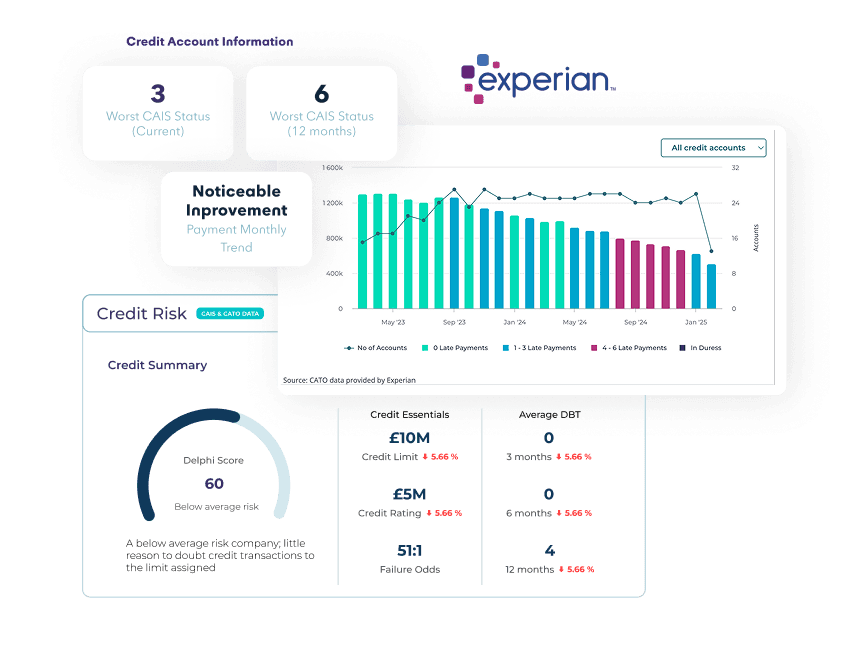

Total Customer Clarity Across Institutions

nCino ProBanker empowers banking teams with comprehensive financial intelligence that provides complete customer visibility, enables proactive relationship management, accelerates decision-making, and unlocks cross-selling opportunities for sustained growth and stronger customer relationships.

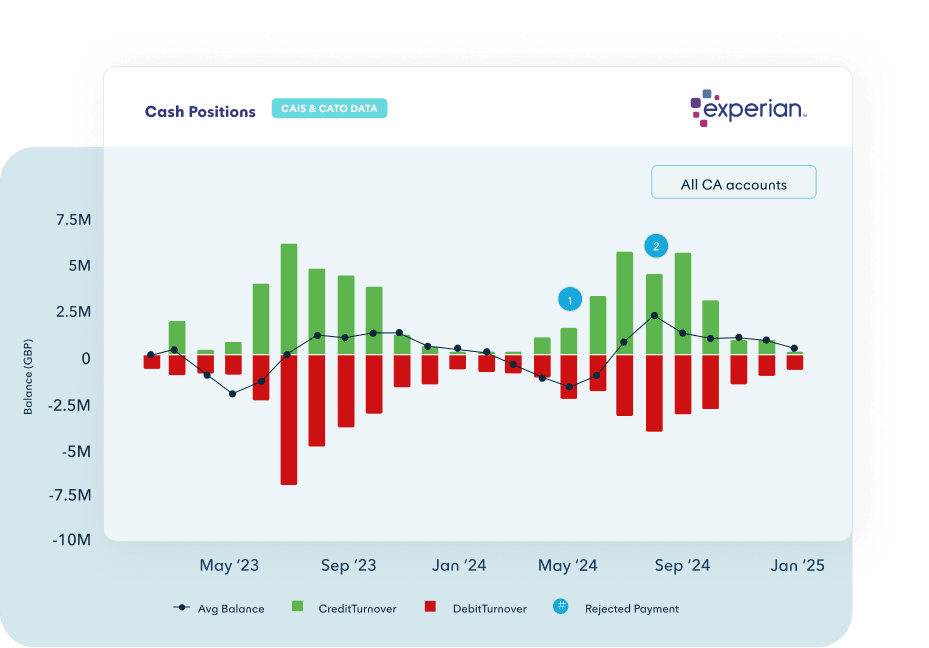

Liquidity Visibility

Access near real-time liquidity insights, cash flow patterns, and debt exposure across multiple banking relationships.

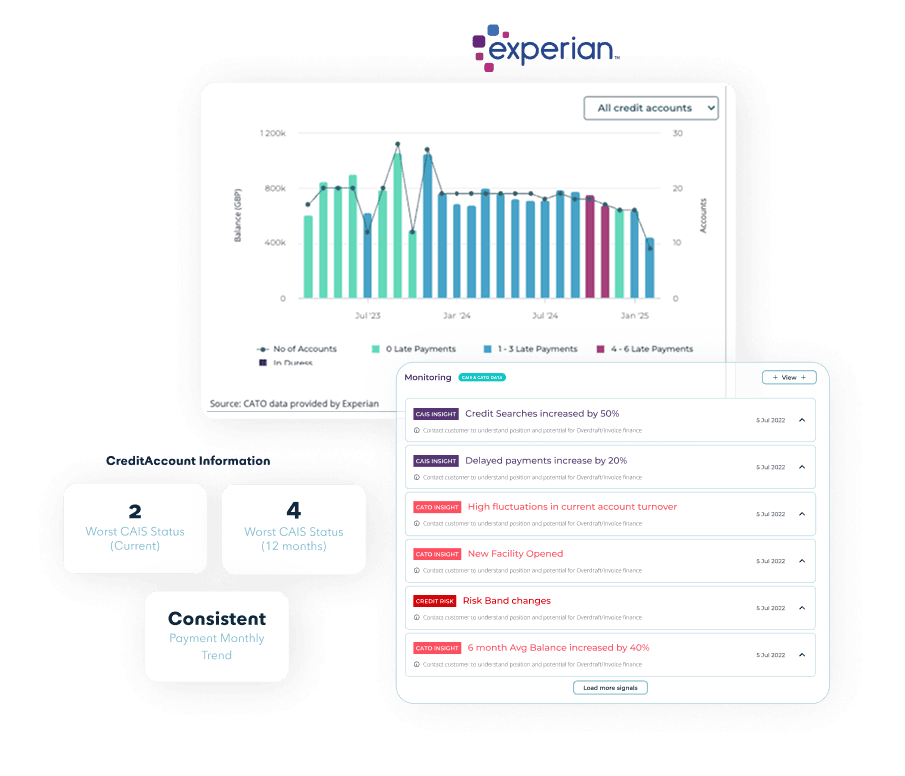

Proactive Monitoring

Monitor key financial changes, credit search activity, and early risk indicators, enabling timely customer outreach.

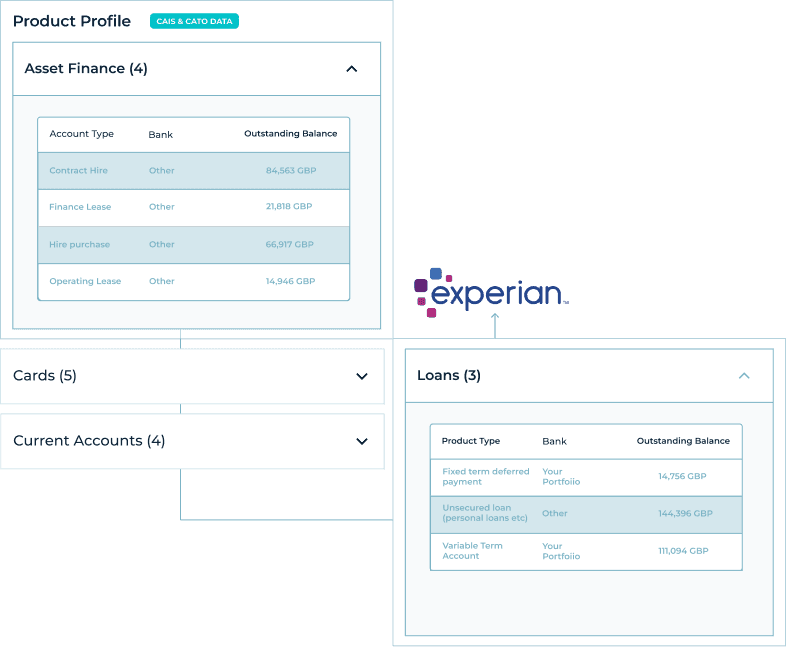

Decision Acceleration

Streamline credit decisions with structured data on outstanding balances, repayment histories, and total exposure across products.

Opportunity Identification

Break down internal silos with unified borrowing views and seasonality analysis, identifying optimal moments to offer additional financial products.

Product Insights

180+

Commercial credit contributors

17m

Commercial credit agreements tracked

£180bn+

in active commercial lending exposure

"ProBanker helps identify risks before meeting with clients. This approach shifts conversations from generic to targeted, ensuring better alignment of services with client needs."

Asset-Based Lending Manager, Tier 1 Bank

免責事項: This testimonial reflects original FullCircl endorsement prior to the company's acquisition by nCino.