Deliver Seamless Digital Experiences

Transform your financial institution with connected digital experiences that unify customer journeys across onboarding, digital account opening, and lending and span multiple lines of business—from application to approval and beyond.

デモのご予約

あらゆる規模の金融機関さまに採用されています

Overcoming Challenges in Delivering Digital Excellence

Financial institutions face critical barriers that prevent them from delivering the seamless digital experiences today's customers demand.

Disconnected Customer Journeys

Fragmented digital experiences—across stages such as account opening, lending and servicing, and lines of business including commercial, small business, consumer and mortgage—can create friction, abandoned applications, and lost revenue opportunities.

Outdated Legacy Processes

Manual workflows and disconnected systems slow down digital account opening and lending decisions, creating competitive disadvantages in a digital-first market.

Siloed Data Systems

Isolated platforms prevent a unified customer or member view, limiting your ability to deliver personalized digital onboarding experiences and make intelligent lending decisions.

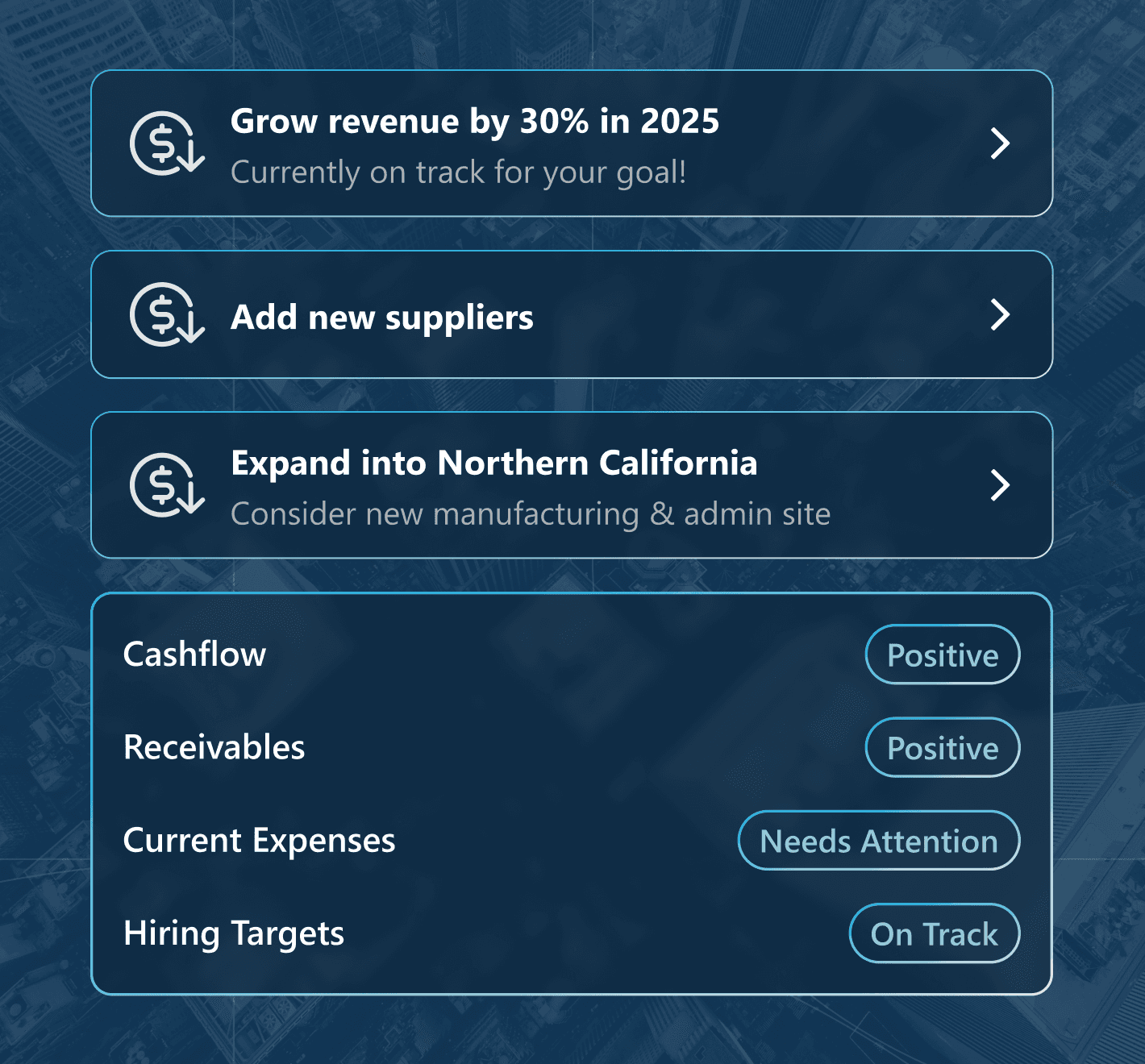

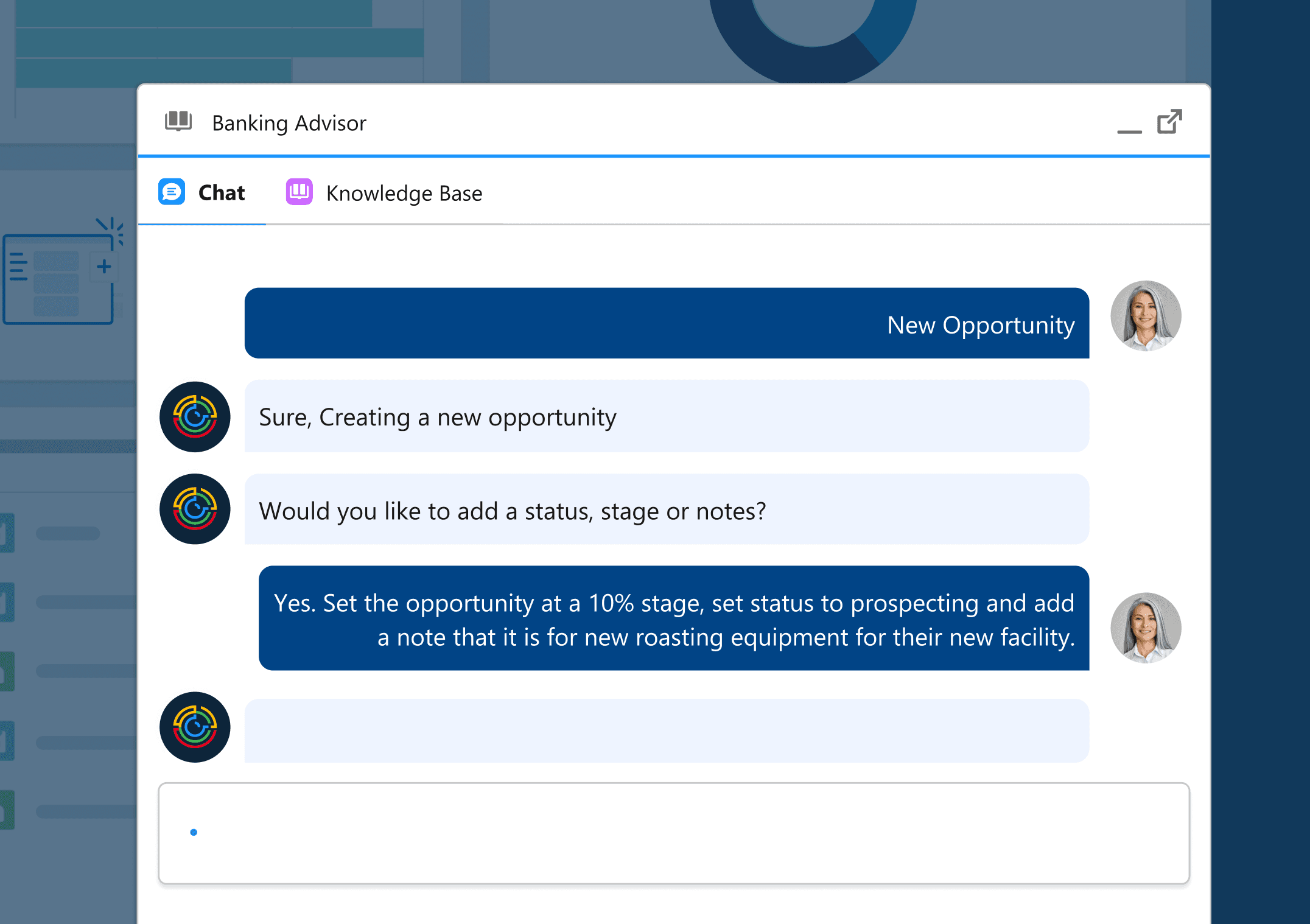

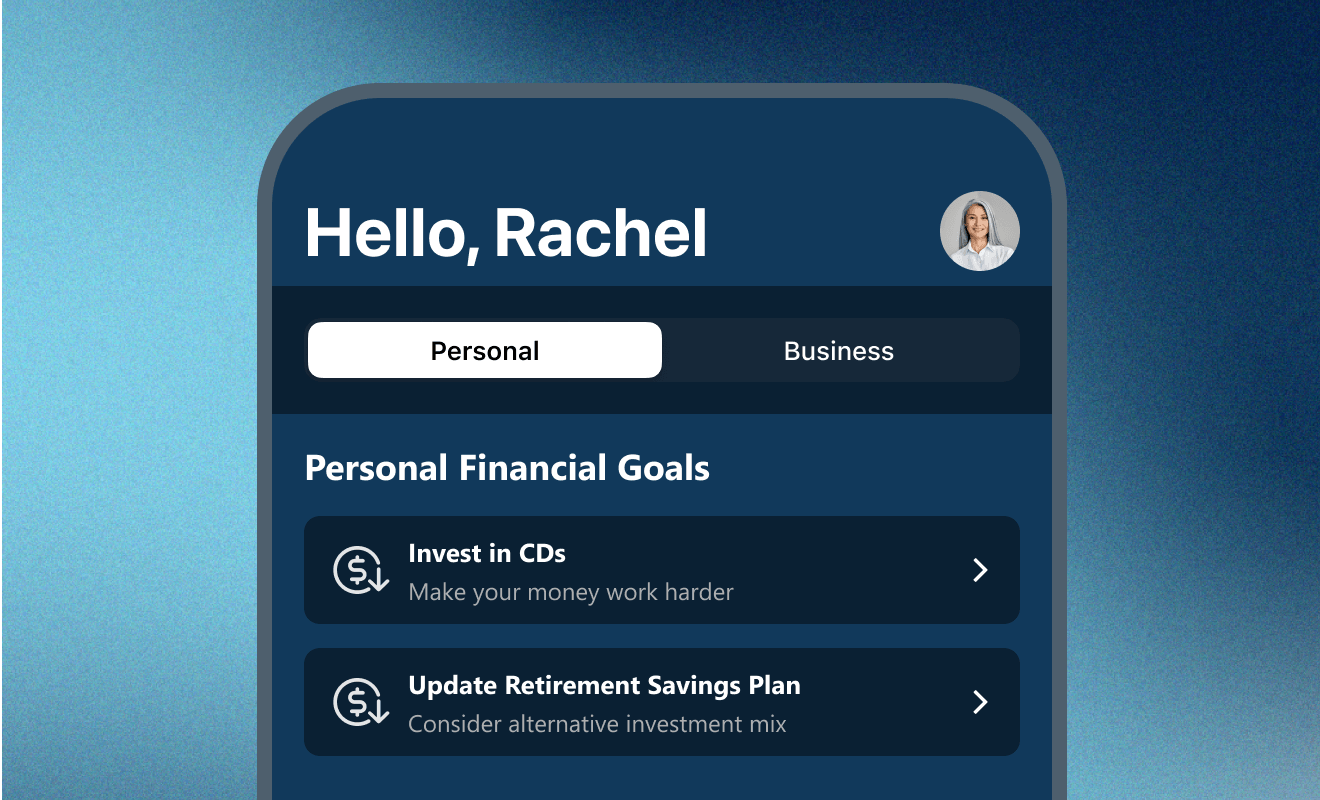

Unified Digital Banking Built for Growth

nCino's digital banking solutions create seamless customer and member experiences and optimize operations across your entire institution. Powered by intelligence and automation, the nCino Platform connects your onboarding, digital account opening, and lending workflows into one unified system.

Seamless Digital Account Opening

Enable customers and members to open accounts online or in-person with intelligent workflows that reduce abandonment, accelerate approvals, and create exceptional first impressions.

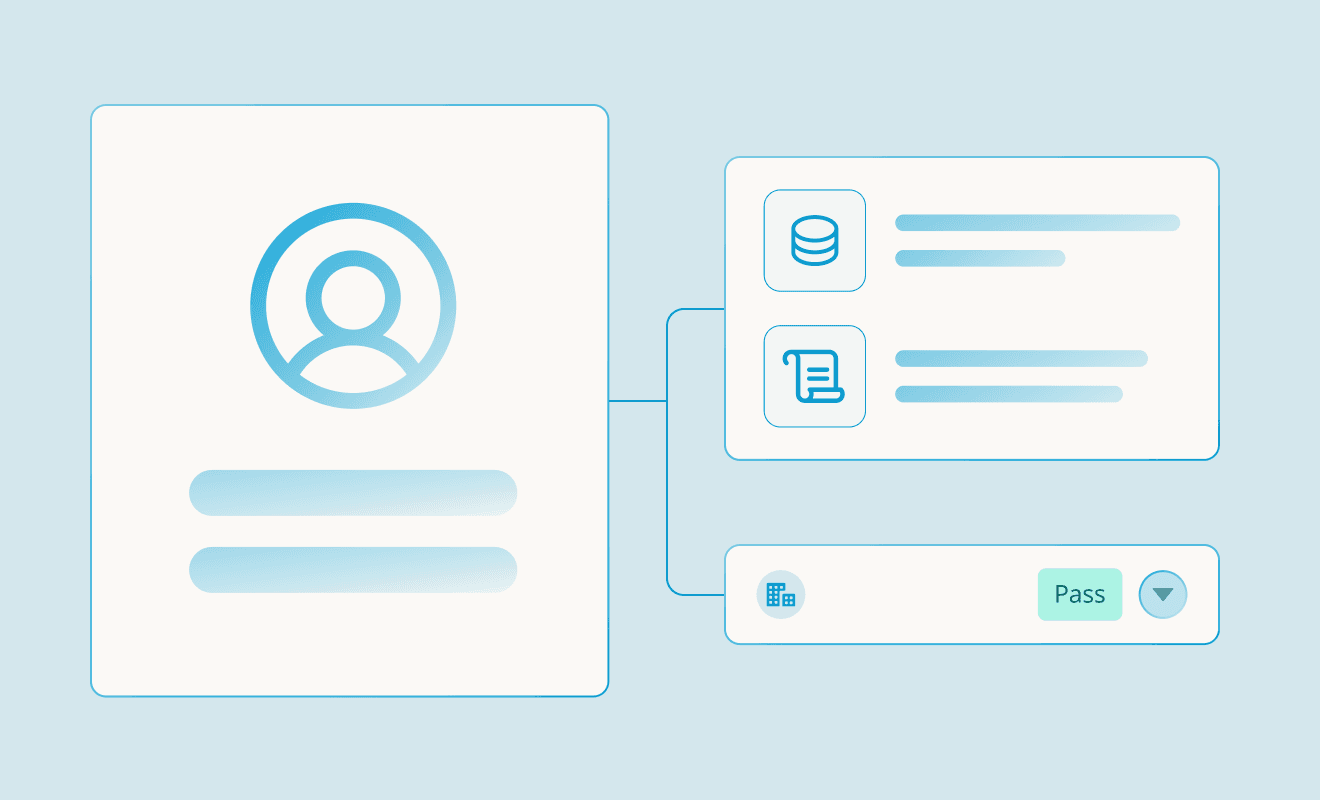

Connected Digital Onboarding

Streamline consumer and commercial onboarding with automated workflows that centralize data, reduce manual errors, and deliver faster time-to-value for new relationships.

Intelligent Digital Lending

Transform your lending operations with end-to-end automation that connects application, underwriting, approval, and servicing into one seamless digital experience.

Unified Customer Data

Centralize customer data across all digital touchpoints to enhance collaboration, improve decision-making, and deliver personalized experiences that drive loyalty and growth.

“Our clients expect to be able to do almost everything digitally, so we’re ready to deliver on that. We believe nCino is going to help propel our digital evolution and enable us to continue to grow that market.”

Selena Suggs, VP of Project Management, Bank Independent