Modernizing the Commercial Real Estate (CRE) Lending Experience

With nCino, you can efficiently and proactively originate, analyze, and monitor Commercial Real Estate (CRE) loans.

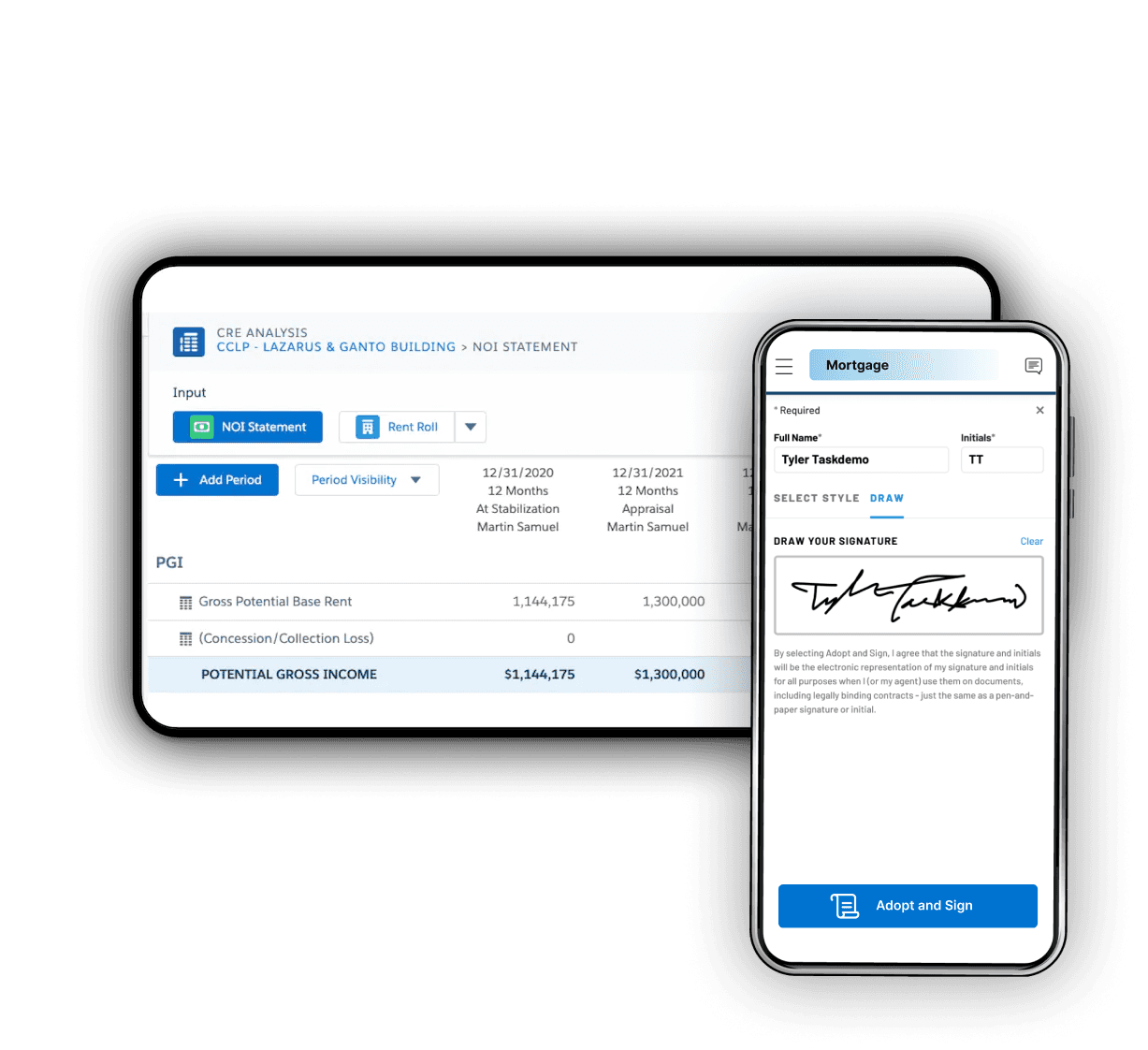

Enhance CRE Lending with Automation and Data-Driven Insights

nCino's CRE Lending Solution provides financial institutions with the efficiency, data insights, and transparency you need across the CRE loan lifecycle.

Optimize operations with automation and streamlined workflows to create a single, connected, and efficient user experience.

Increase transparency and collaboration across your teams to effectively originate and monitor CRE loans.

Centralize data, improve data control and integrity, and increase data visualization for more informed decision making.

Accurately forecast revenue, perform sensitivity analysis, and mitigate risk with a 360-view of CRE portfolios.

On-Platform CRE Workflow and Framework

Provide a CRE experience that brings value to your teams from origination to monitoring.

Increase Collaboration & Mitigate Risk

nCino's CRE Lending Solution provides financial institutions with the tools necessary to easily capture and centralize loan details, increase collaboration, and mitigate risk across the CRE loan lifecycle.

Create net operating income statements to calculate future profits, customizable ratios, and cash flow.

Perform single and multi-variable sensitivity analysis to stress test vacancy and interest rates.

Easily monitor loan portfolios and performance to act faster and mitigate defaults.

Create custom reports and dashboards for valuable, data-driven insights.

Access a customizable property list of tenants, lease terms, concentrations, and rollovers.

Gain a detailed, holistic view of all real estate collateral.