Transform Underwriting with Automated Spreading

Reduce the time it takes to spread financials and drive portfolio growth with intelligent financial spreading software. Improve the speed and quality of your credit decisions by leveraging

Accelerate Spreading with Intelligent Automation

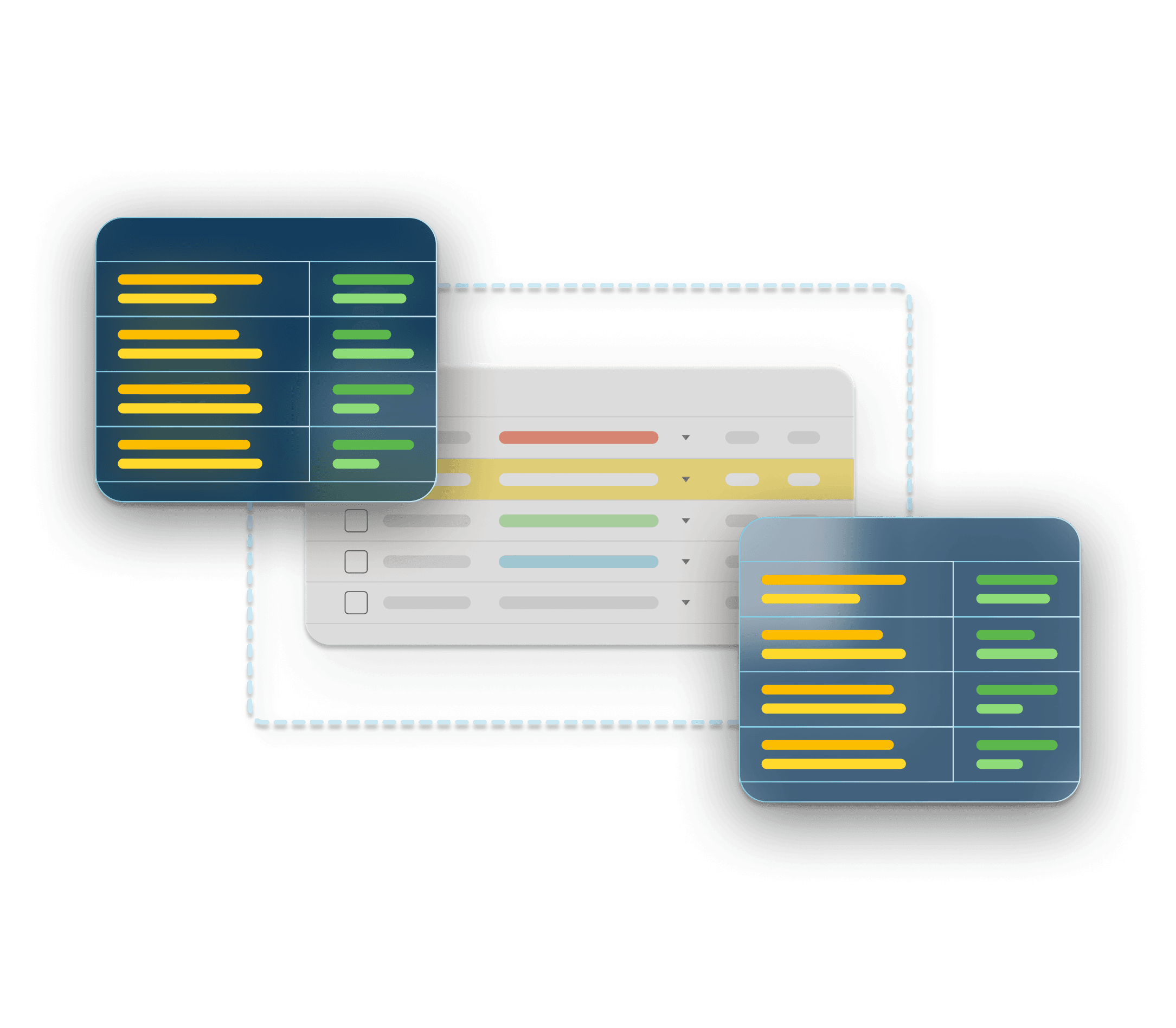

nCino’s software for financial spreading increases efficiency and improves accuracy, empowering your institution to focus on insightful financial analysis instead of manually re-keying data.

Increase efficiency and streamline the underwriting process.

Improve financial spreading consistency and minimize errors.

Enhance productivity and increase focus on value-adding activities, such as analyzing credit.

Leverage artificial intelligence and machine learning to improve data extraction.

Results-Driven Automation

nCino Automated Spreading transforms a tedious, manual, and time-consuming task into an automated, efficient process.

By automating data gathering and analysis, nCino also enables banks to leverage the data gathered across customers and undertake valuable analysis regarding, for example, vertical specific characteristics and performance.

Alenka Grealish

Analyst, Celent

Reduction in time to spread financials

Reduce duplicate data entry by 25%, resulting in less time spent on manual data entry and fewer errors.

Reduction in systems used to spread financials

"We believe people drive banking decisions, but technology enables them"

Lisa Frazier

COO Judo Bank

Reduction in time spent in the underwriting stage of the loan cycle, enabling a quicker time to close

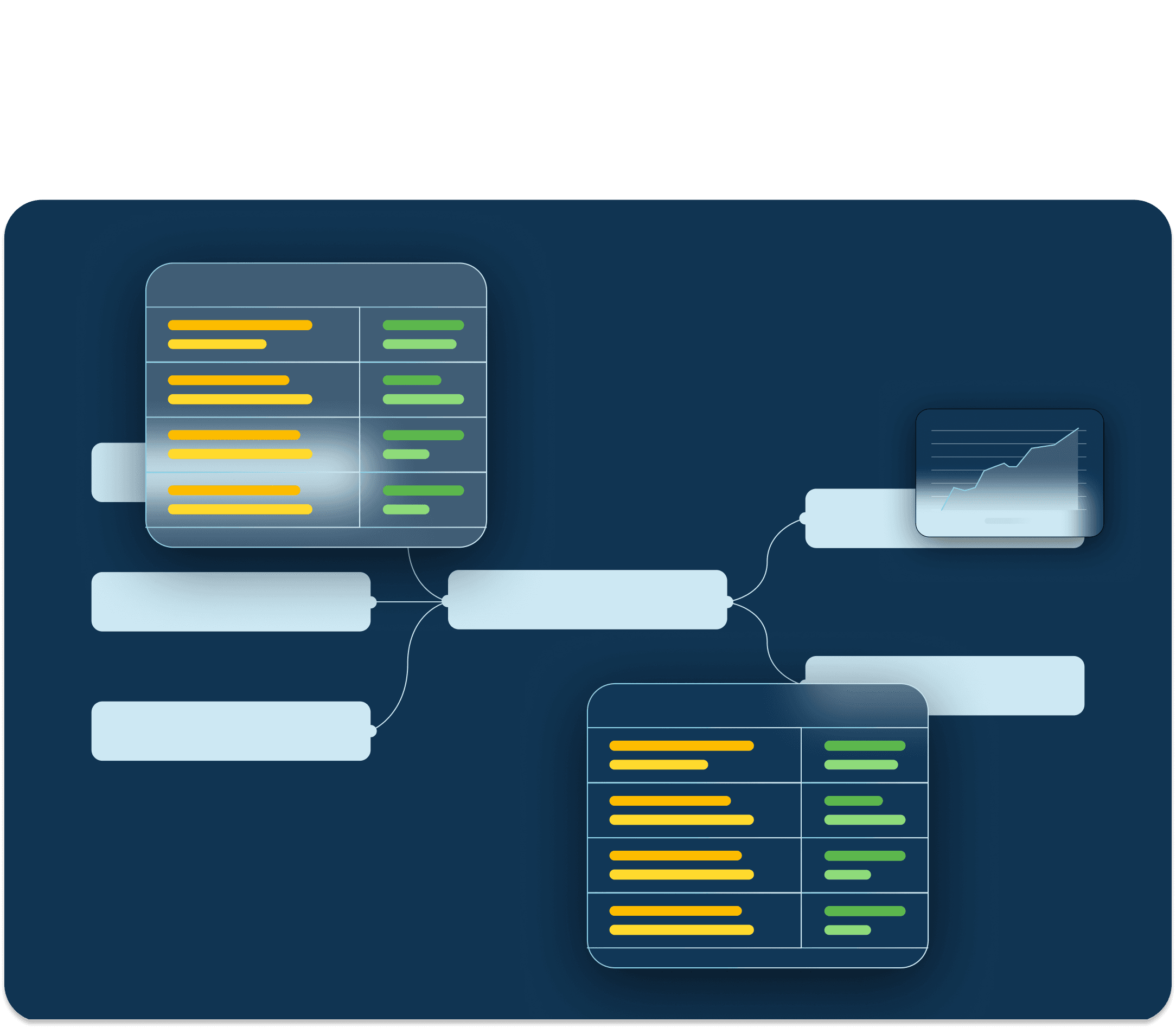

Efficiency Through Automation

Through optical character recognition technology, nIQ automates information gathering procedures, reducing manual data entry, and transforming data into direct business value.

Enhance spreading consistency by intelligently extracting both unstructured and structured data through powerful OCR technology.

Maintain quality control with line-by-line reconciliation and proactive identification of unclear data fields to maximize accuracy.

Spread financial statements including tax returns, audits, company prepared statements, 10-Ks, 10-Qs, and other documents.

Easily and securely extract data from documents in Document Manager, nCino’s integrated, intelligent document filing solution.

Leverage machine learning to automatically learn from previous data mappings and optimize efficiency on subsequent spreads.

Harness the power of Spreads, nCino’s financial analysis tool, to perform credit analysis with ratios, flexible templates, and trend analysis.