Streamline Customer Opening

Simplifying account Opening is the key to growth. To stay competitive, FIs must grow deposits, improve Opening processes, and deliver outstanding customer experiences.

デモのご予約

あらゆる規模の金融機関さまに採用されています

Overcoming Account Opening Obstacles

Financial institutions face increasing pressure to deliver seamless banking experiences. Yet, a variety of challenges impact deposit management and onboarding, leading to lost opportunities and dissatisfied customers.

Manual Inefficiencies

Legacy systems rely on repetitive, manual data entry and paperwork that slow down onboarding timelines.

Compliance Roadblocks

KYC and AML regulations place additional strain on resources, increasing the complexity of compliance management.

Customer Expectations

Customers demand fast, seamless, personalized banking. Delays risk losing customers.

Limited Scalability

Growing institutions struggle to maintain onboarding efficiency as volumes increase.

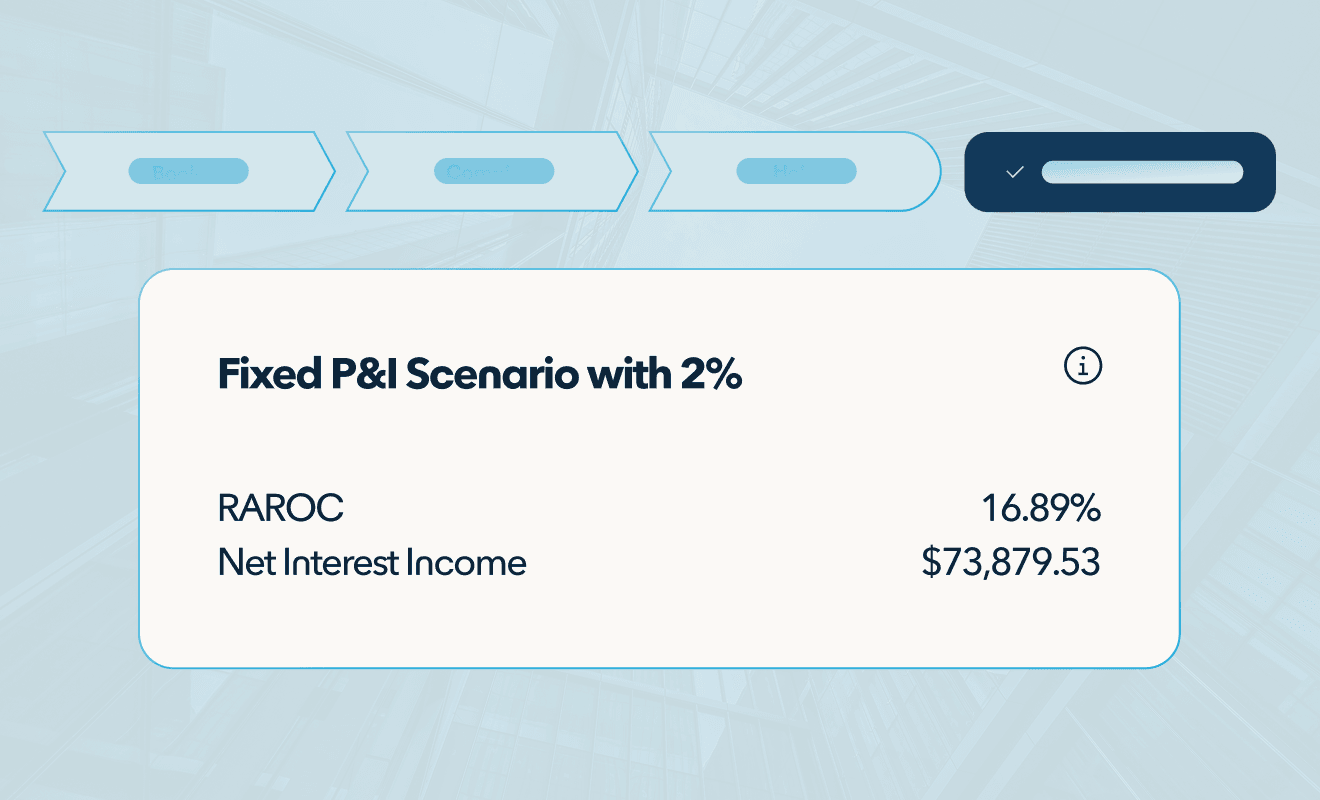

Enhance Account Opening with nCino

The nCino Platform transforms challenges into opportunities. By harnessing the power of automation, intelligence, and seamless integration, nCino helps you deliver an unparalleled account opening experience.

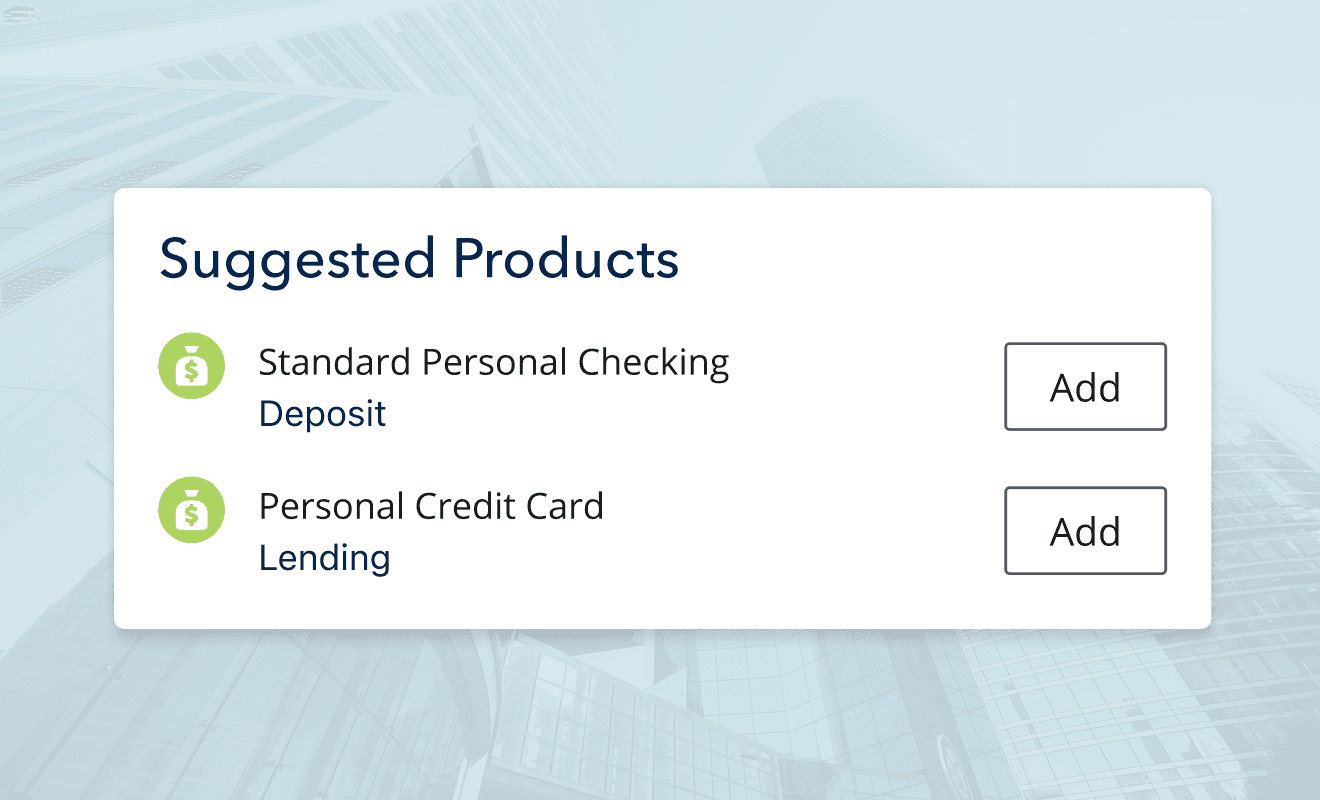

Omnichannel Experience

Enable seamless account opening online, mobile, or in-branch with the nCino Platform.

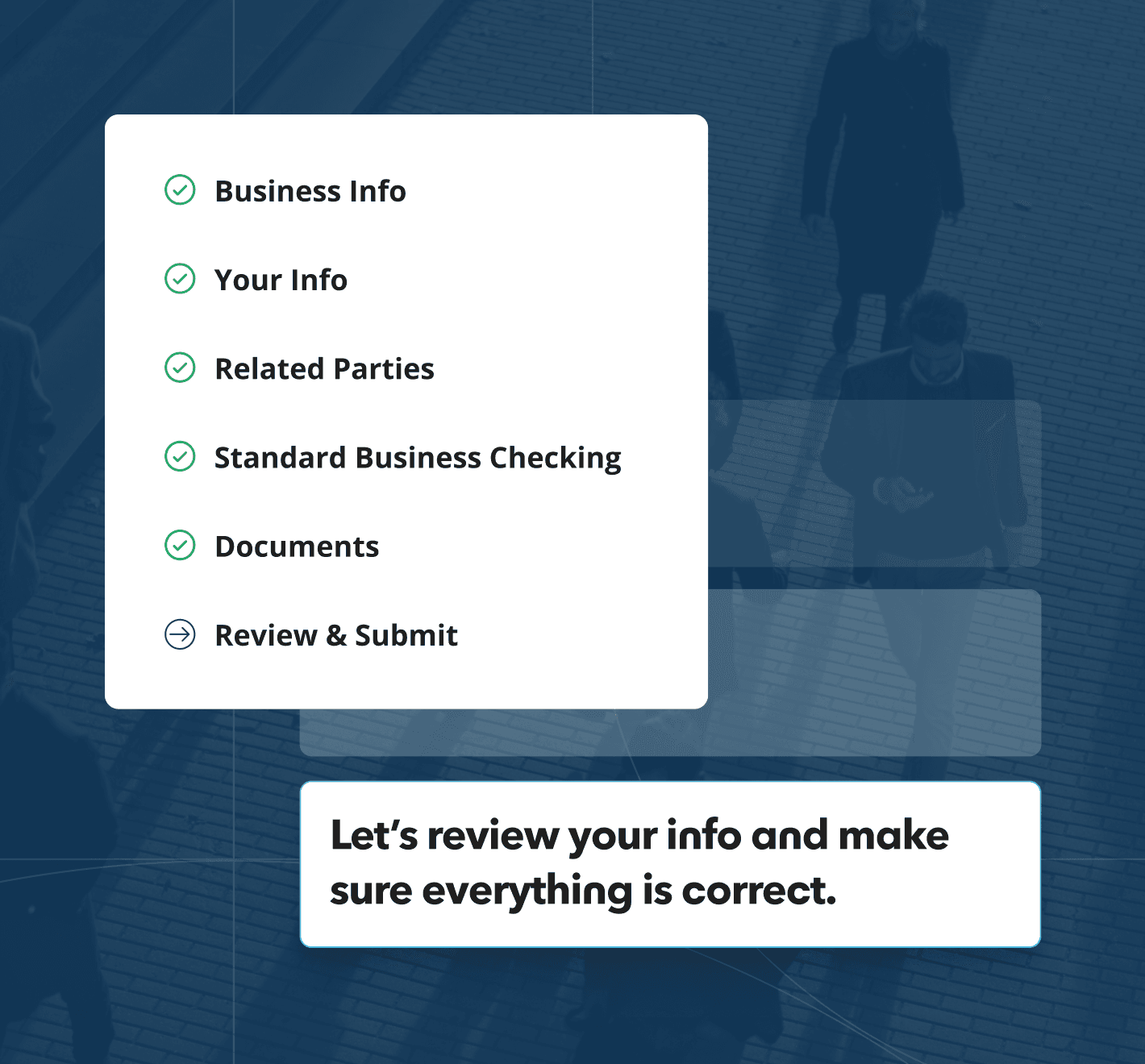

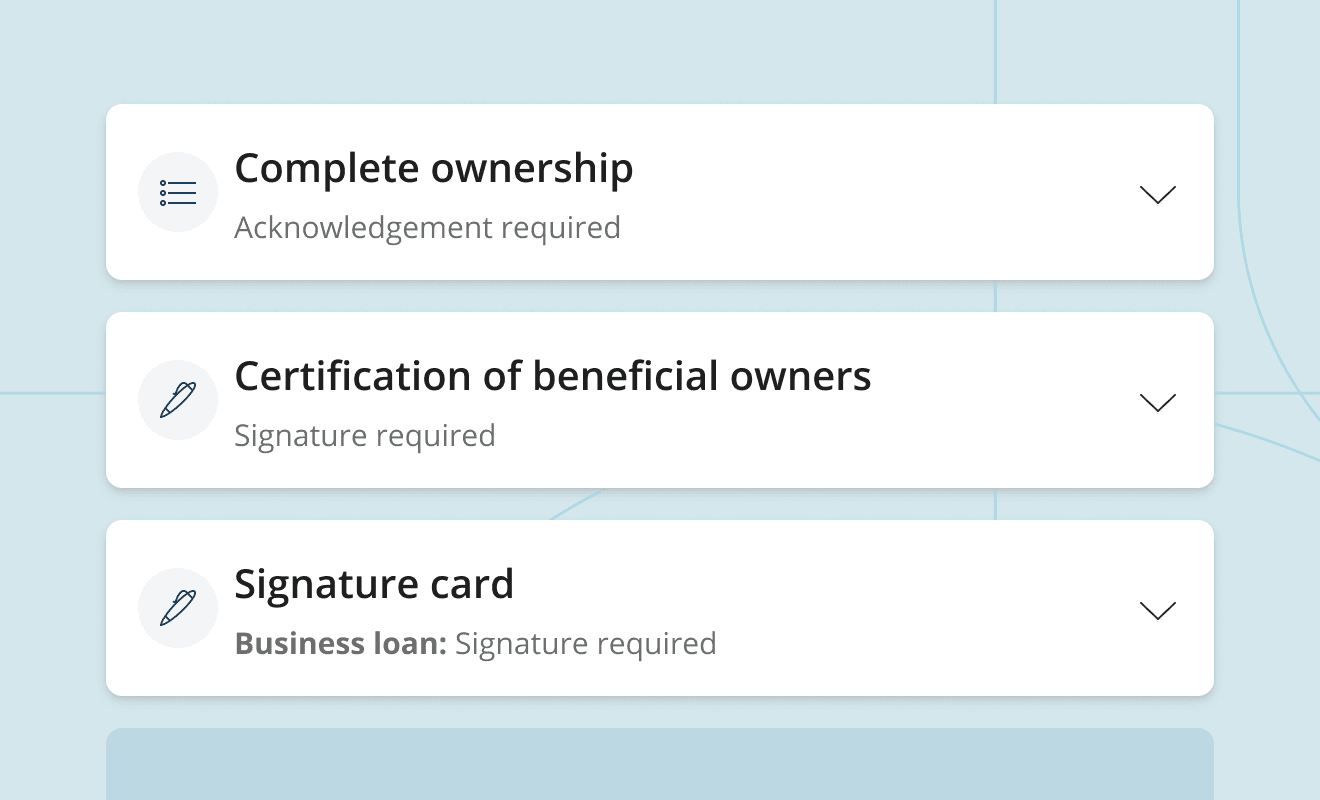

Streamlined Workflows

Streamline onboarding with automated workflows, saving time and reducing friction.

Elevate Experiences

Deliver seamless, digital-first onboarding for a frictionless and engaging client experience.

Unified and Integrated

Combine account opening and product origination processes to deliver a frictionless client experience.