nCinoプラットフォームの特長

nCinoは、金融機関の法人・個人融資業務に関わるプロセスを一気通貫で統合し、事業課題の解決を支援するクラウド型プラットフォームです。

プラットフォーム概要

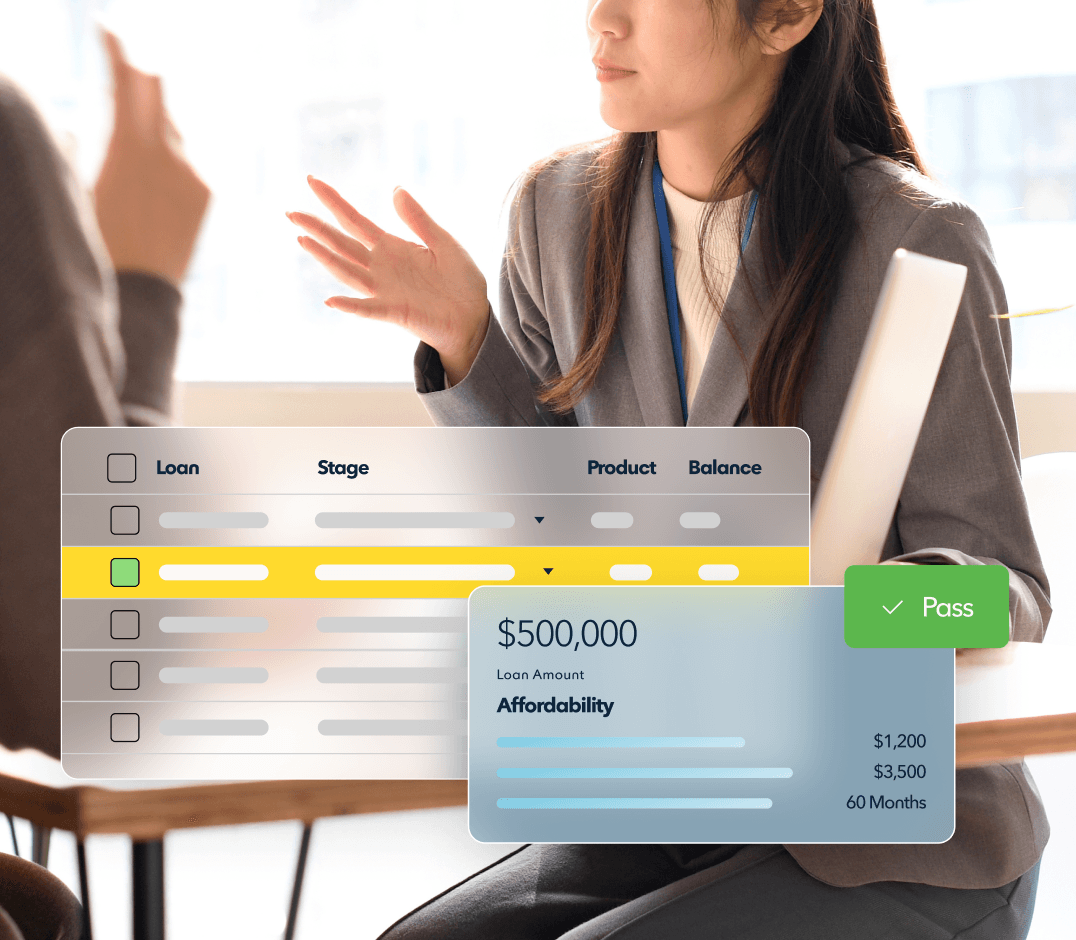

nCinoは、金融機関の法人・個人融資業務に関わるプロセスを一気通貫で統合し、事業課題の解決を支援するクラウド型プラットフォームです。 融資の申し込みから審査、実行後のモニタリングなど複数部門にわたる複雑な業務をワンプラットフォームで提供し、グローバル大手行から地域金融機関様まであらゆる地域・規模の金融機関の業務変革を支援してきました。

法人融資、住宅ローン、個人ローン、住宅ローンなど各種融資商品のデジタル化・業務効率化によって、顧客・住宅事業者や保証会社などのパートナー企業・そして行員といった関係者全員の体験を向上します。

nCinoの提供価値

少子高齢化や競争環境の激化、顧客の期待値の高まりにより金融機関はかつてない変革を求められています。 しかし、レガシーシステムの存在やデータの分断といった課題により、部分的な最適化や既存業務の電子化にとどまるケースが少なくありません。

nCinoは、複雑な融資プロセスを根本から見直し、業務の統合と自動化を実現することで、デジタルを好む顧客には高品質なオンライン体験を、対面を重視する顧客にはより多くの時間を割いて関係構築ができるよう、徹底した業務効率化を支援します。

顧客・パートナー企業・行員の三者が一体となったプロセスを構築することで、収益の向上、コストの削減、業務効率の改善、リスクの低減、そして顧客との関係強化を包括的にサポートします。

金融機関個別の要件に柔軟に対応

nCinoは金融機関の変化に柔軟に対応するプラットフォームです。 デジタル時代においても人と人とのつながりを大切にし、各部門・支店間での連携やお客様との関係強化を実現します。 銀行の融資業務に必要な業務機能をカバーした統合プラットフォーム、稼働後も内製開発で変更可能な柔軟性、そして充実したサポート体制。 市場のニーズを反映しながら進化し続けるソリューションで金融機関の成功を支援します。

顧客を中心とした一気通貫の業務設計

テクノロジーの進化により、顧客と金融機関の接点は大きく変化しています。口座開設や各種銀行取引はオンラインでいつでもどこでも行うことが可能です。そして顧客体験は「取引を始める時点」ではなく、「情報収集や銀行の検討を始める段階」から始まっています。

予算の見直し、ローンの必要性、資産運用の相談、新規事業の立ち上げなど、顧客は金融機関に寄り添ってもらいたいと考え、その過程で、タイムリーなアドバイスやサポートを必要としています。 顧客のあらゆる金融ニーズに寄り添い、各ステップで最適な支援ができる金融機関こそが、変化の激しい時代において成長を遂げることができます。

複数事業をワンプラットフォームで

nCinoは法人融資、住宅ローン、その他個人ローンといった融資に関わる各種事業領域を一つのプラットフォームで統合。 データとプロセスを一元管理することができ、業務の効率化、顧客体験の向上、組織全体でのデータ活用を可能にします。

プラットフォーム概要を見る

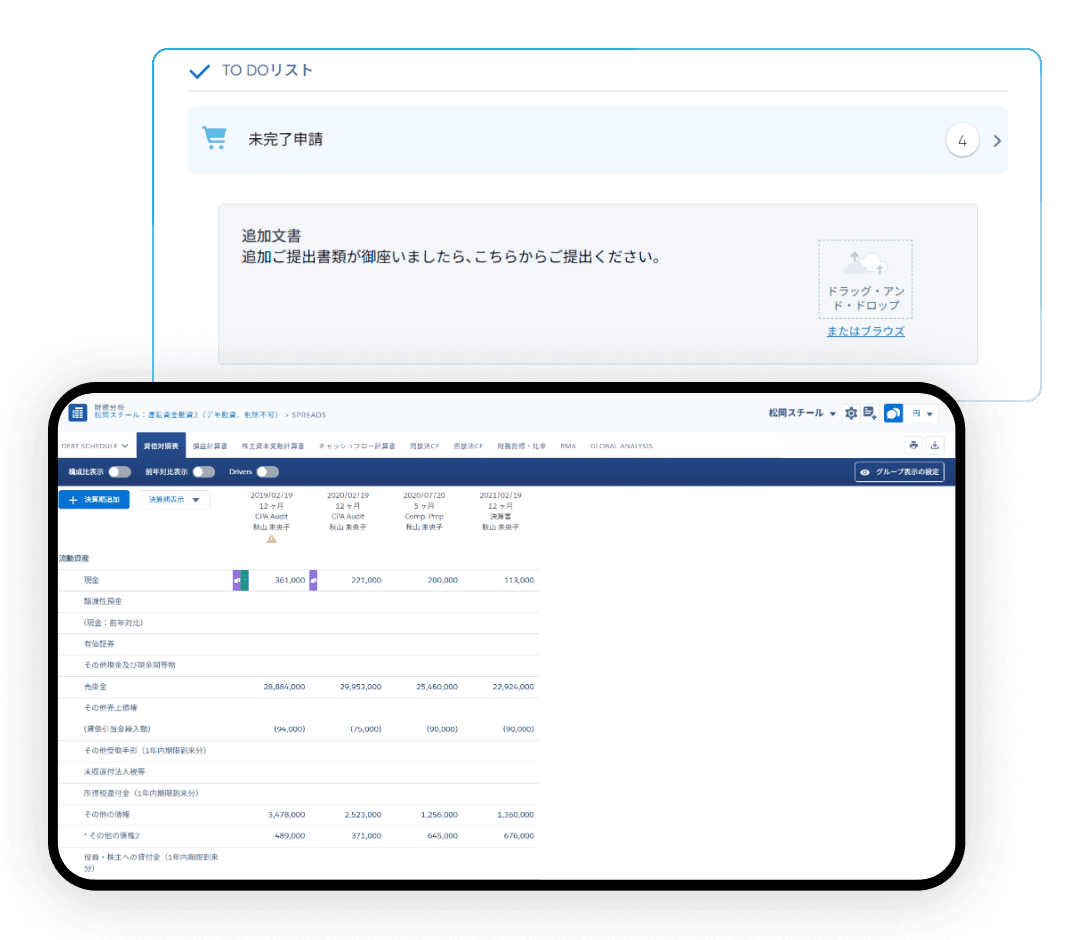

データに基づく意思決定を支えるAI機能の組み込み

業務のデジタル化が進むにつれ、金融機関には膨大なデータが蓄積されていきます。nCinoは、機械学習と高度な分析技術を活用し、こうしたデータを「価値あるインサイト」へと変換。OCR(光学文字認識)により、決算書類など紙ベースの情報を自動でデジタル化し、手作業の負担を軽減します。

これにより、業務効率の向上だけでなく、データを直接的なビジネス価値へとつなげることが可能になります。

さらに、業界データや独自の機械学習モデルを活用し、信用リスクや収益性に関するインサイトを、最適なタイミングで行員に提供。意思決定の現場に必要な情報を届けることで、判断の精度を高め、顧客体験の向上と収益成長を同時に実現します。

AI機能について詳しく見る

フロントからバックオフィスまでをつなぐ統合型プラットフォーム

nCinoは口座開設、融資の申し込み、文書管理、稟議審査、契約書作成、係数管理といった金融機関の業務全体をカバーする機能を提供しています。あらゆるチャネル・デバイスから、いつでも顧客に最適なサービスを届けることが可能です。

自動化ワークフローやチェックリスト、財務分析、ダッシュボード機能により業務プロセスを効率化。顧客やパートナー企業に迅速で透明性の高い体験を提供することができます。

データを中心に据えた業務設計

金融機関の業務の中心には常に「データ」があります。しかし、紙の業務や分断されたシステムによってデータの持つ本来の価値を十分に引き出せていない状況です。

nCinoは、文書や業務プロセスを統合・デジタル化することでデータの透明性を高めるだけでなく、金融機関の勘定系システム、CRM、顧客の財務情報、業界データといった関連システムとAPI連携する「データハブ」として機能します。

これにより、部門やシステム間で分断されていたデータを統合し、組織全体でのリアルタイムなデータ活用を可能にすることで業務の効率化、意思決定の高度化、そして顧客体験のパーソナライズを加速させることができます。

nCinoを導入したことで銀行全体の透明性が向上し、業務の効率化とワークフローの最適化を実現。最終的には、顧客体験の向上につながりました。

Peter Swan, Head of Credit Transformation, Allied Irish Bank