Agilice la incorporación de nuevos clientes

Simplificar la incorporación de clientes es clave para el crecimiento. Las entidades financieras deben captar más depósitos, agilizar el alta y ofrecer una experiencia excelente desde el primer contacto para seguir siendo competitivas.

Programe una demostración

Líderes del sector en todo el mundo confían en nosotros

Superar los obstáculos de la incorporación

Las entidades financieras están cada vez más presionadas para ofrecer experiencias bancarias fluidas y sin fricciones. Sin embargo, los retos en la gestión de depósitos y en el proceso de incorporación suponen una pérdida de oportunidades y una menor satisfacción del cliente.

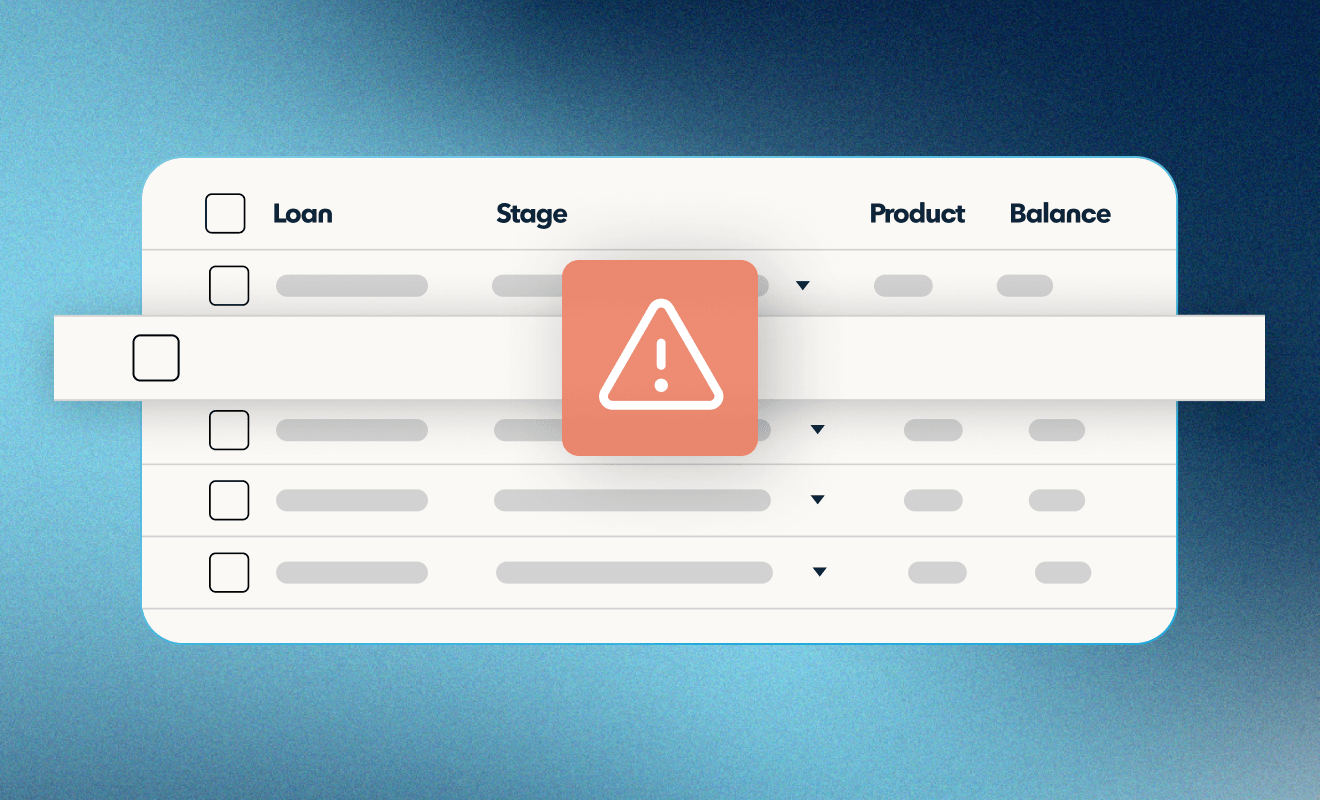

Ineficiencias manuales

Los sistemas heredados, con introducción manual de datos y papeleo, ralentizan significativamente la incorporación de nuevos clientes.

Barreras normativas

Las regulaciones KYC y AML suponen una carga adicional de recursos y aumentan la complejidad del cumplimiento normativo.

Expectativas de los clientes

Los clientes exigen un alta rápida, personalizada y sin complicaciones. Cualquier demora pone en riesgo su fidelización.

Escalabilidad limitada

Las entidades que están creciendo encuentran dificultades para mantener la eficiencia de los procesos de onboarding a medida que aumenta la demanda.

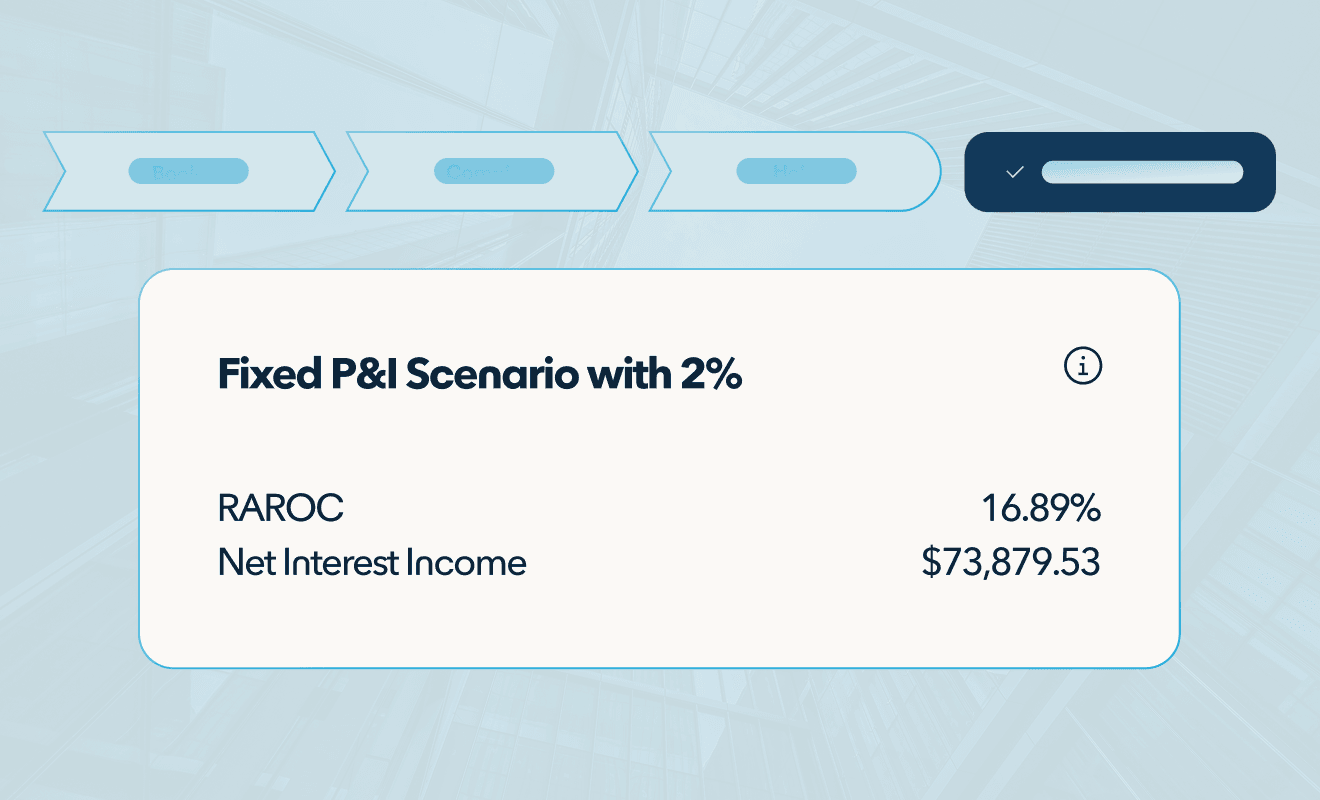

Mejore la integración de cuentas con nCino

La plataforma de nCino transforma los desafíos en ventajas competitivas. Gracias a la automatización, la inteligencia de datos y la integración fluida, podrá ofrecer una experiencia de incorporación ágil, digital y orientada al cliente.

Experiencia omnicanal

Permita a sus clientes abrir cuentas en línea, desde el móvil o en la oficina, de forma fluida y sin interrupciones.

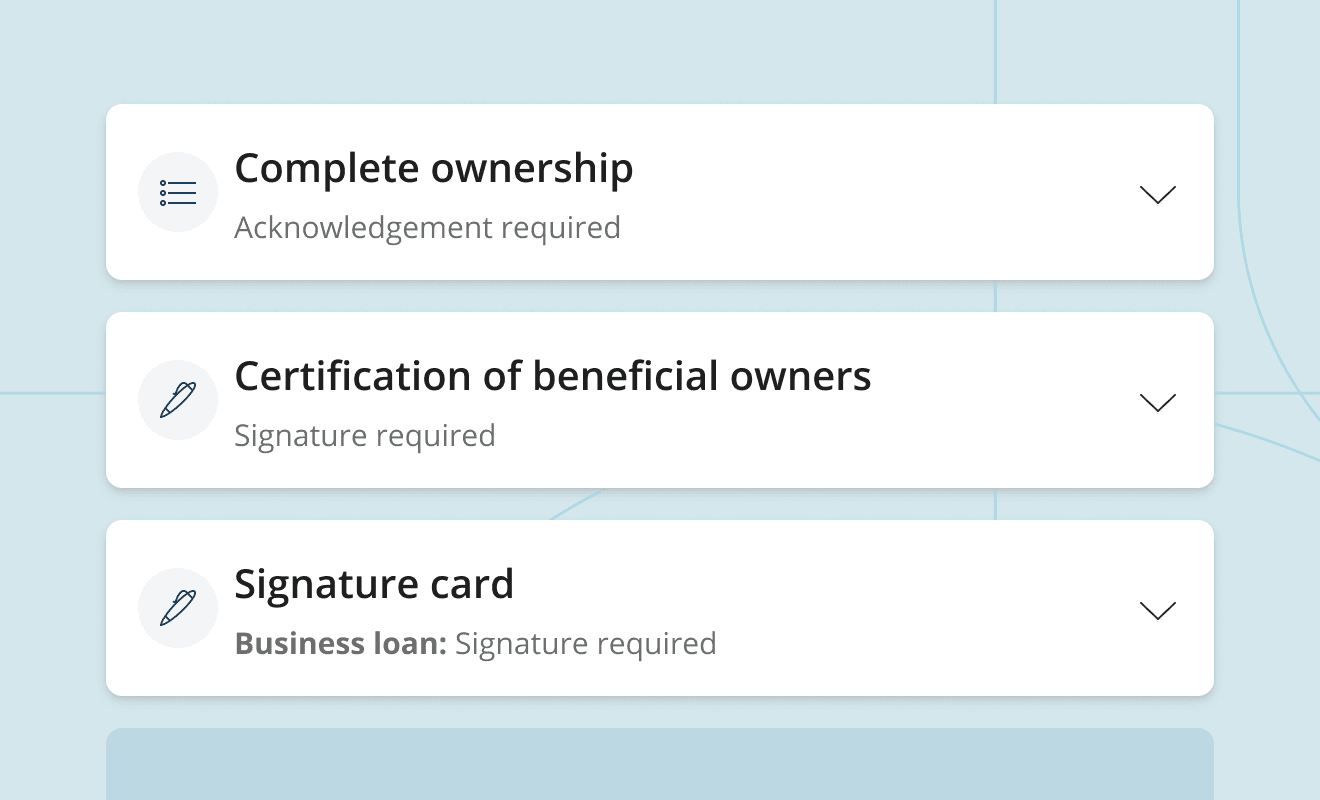

Flujos de trabajo optimizados

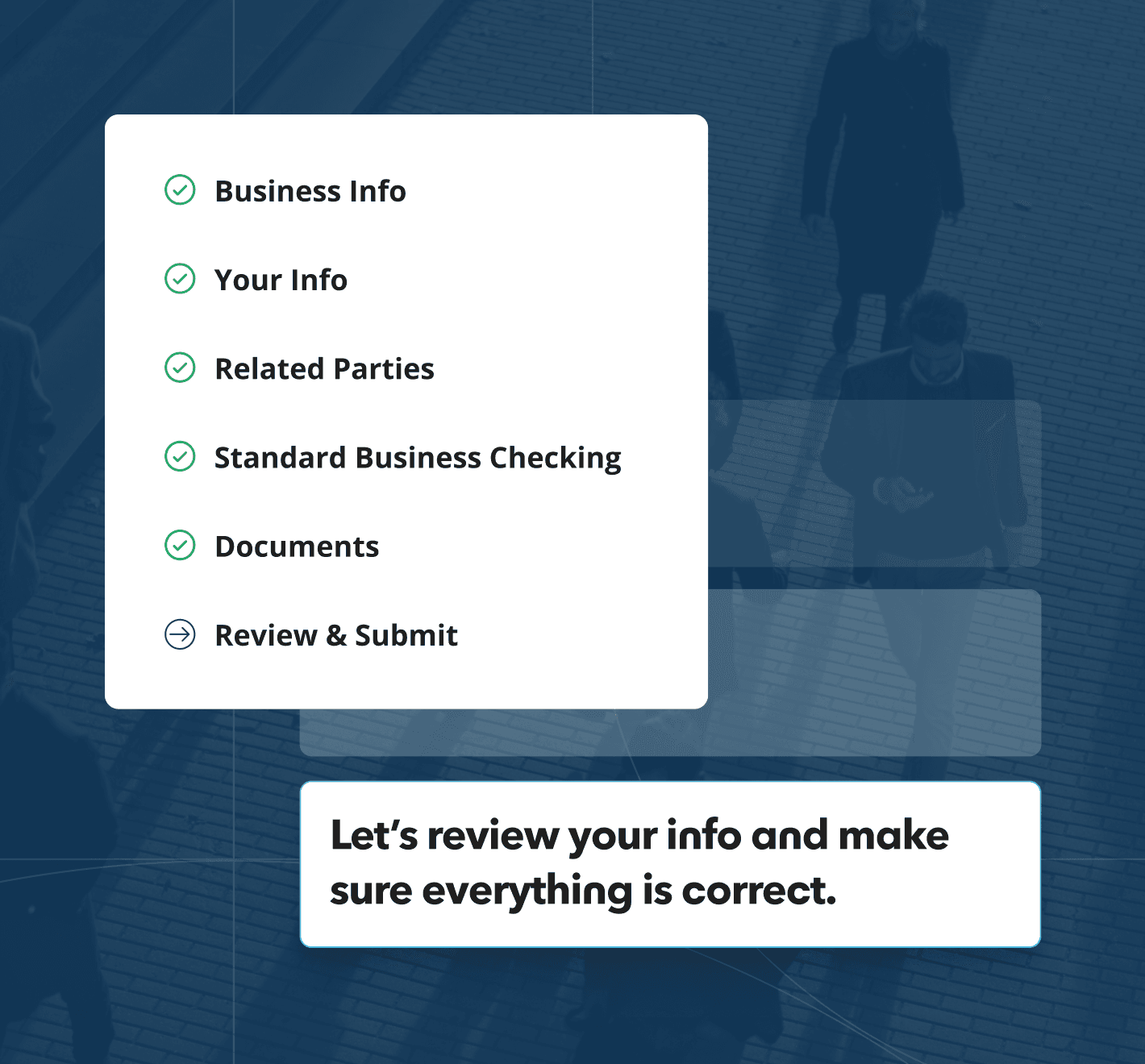

Automatice los flujos de trabajo para ahorrar tiempo y reducir fricciones en la incorporación.

Experiencias mejoradas

Ofrezca una experiencia digital, rápida y sin fricciones que cautive al cliente desde el primer momento.

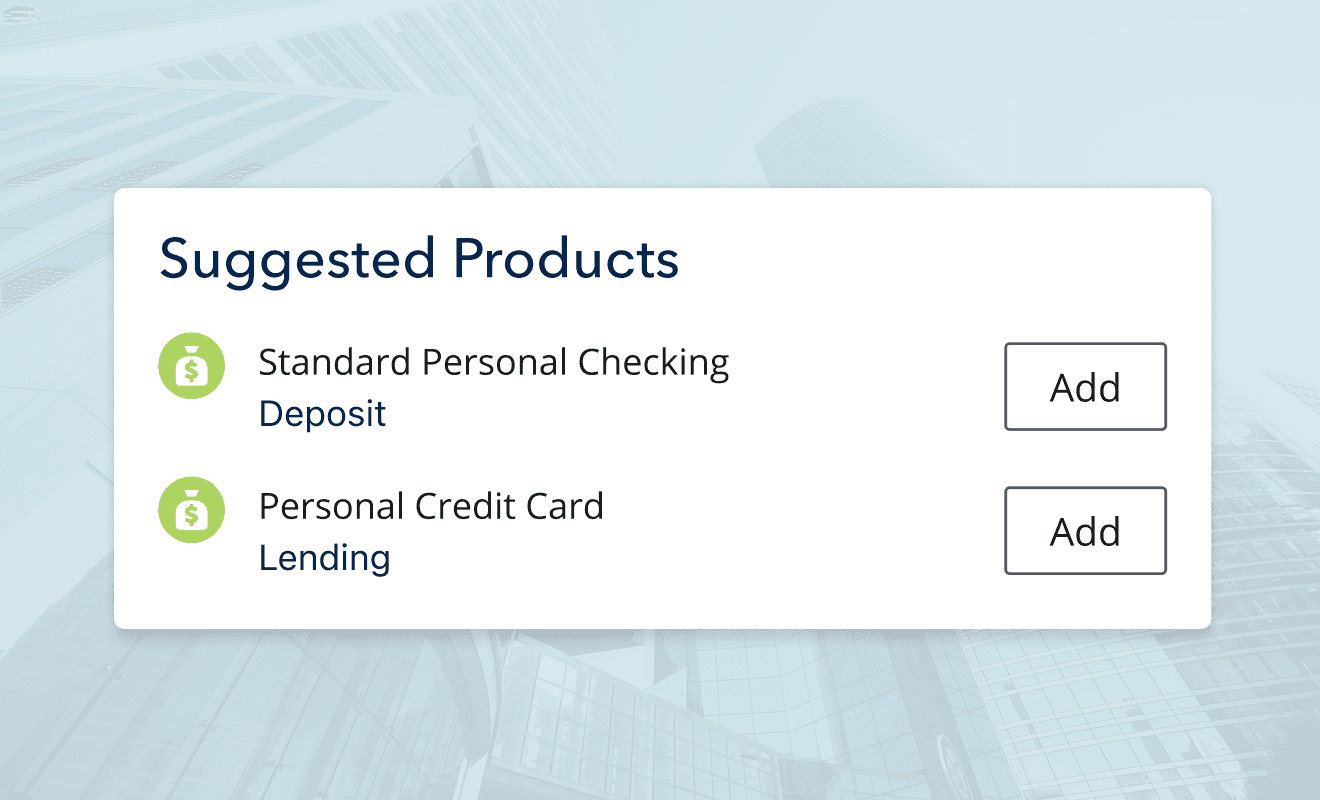

Unificado e integrado

Unifique la apertura de cuentas y la contratación de productos en un solo proceso, garantizando agilidad y coherencia.