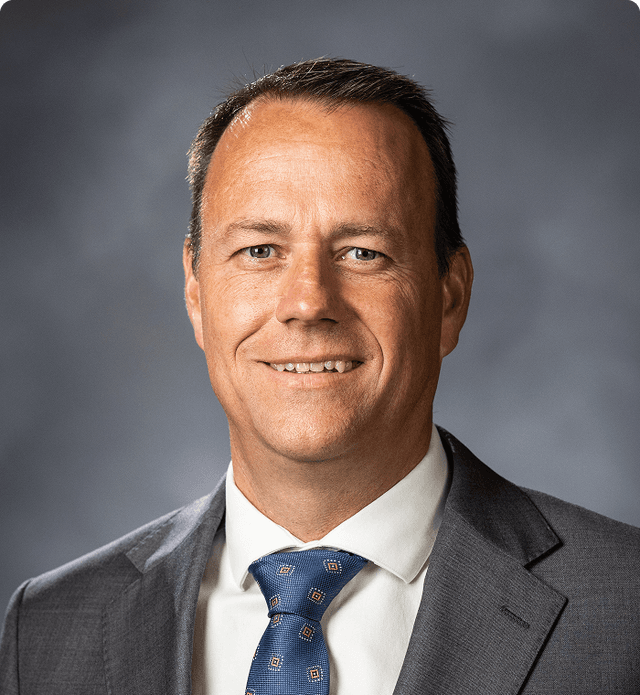

Taylor D. Nadauld

Chief Economist at nCino, Chair of Finance Department and Professor of Finance at BYUVer biografía

El Instituto de Investigación nCino

Our mission is to deliver timely, data-driven insights that empower financial institutions to make informed decisions and thrive in a complex global banking landscape.

Built on rigorous research, transparent findings, and real-world impact, nRI is a trusted resource for decision-makers looking to stay ahead of industry shifts.

Robust Data Assets: We combine public data with aggregated and de-identified customer-consented performance metrics, giving us unmatched visibility into economic, banking, and consumer trends.

Proprietary Research & Expertise: Our team of economists and banking veterans ensures every publication, white paper, and benchmark report meets the highest standards for accuracy and relevance.

Actionable Intelligence for Modern Bankers: nRI regularly reports on economic trends, synthesizing timely academic research into strategic insights to help institutions adapt in real time, empowering them to shape the future and not just react to it.

Global Perspective: In an interconnected financial landscape, our analysis encompasses regional and international developments, illuminating the broader forces driving change in financial services.

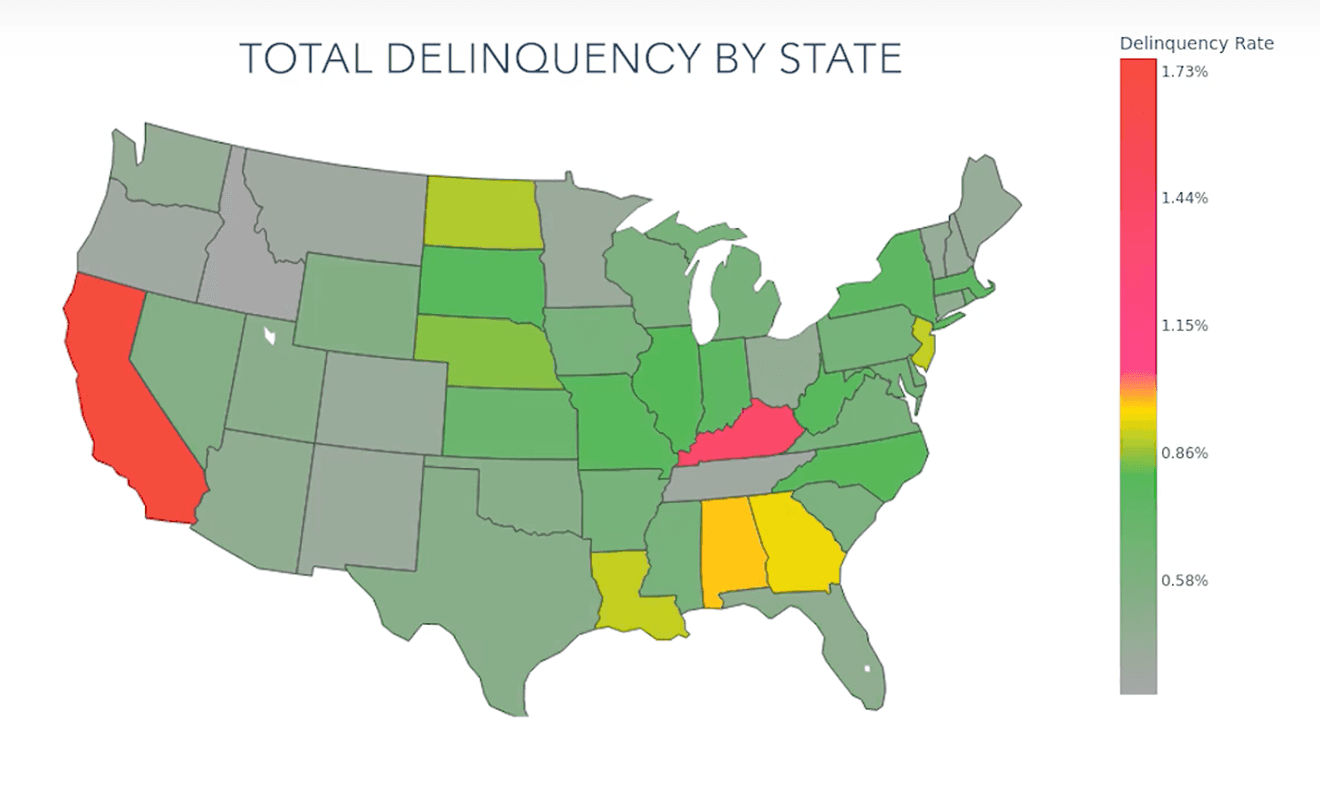

Quarterly Credit Trend Analysis

Explore comprehensive assessments of emerging credit metrics, delinquency patterns, and macroeconomic conditions shaping lending decisions.

Banking Benchmarks

Access banking sector performance data on operational trends, identifying industry best practices and opportunities for optimization.

Economic Data Visualizations

Dive into interactive charts and visual analyses that reveal shifts in consumer behavior, market conditions, and regulatory environments.

Discover how deposit stickiness within institutions can influence the design of smarter retention strategies that contribute to long-term deposit franchise profitability.

70% of deposits are controlled by 10% of the depositors.

Our research shows high-balance depositors may value liquidity over highly-competitive interest rates.

Pricing matters, but behavior and utility define your deposit franchise.

Forecast portfolio performance with monthly analyses of consumer credit trends across all 50 states delivered by distinguished economists, banking veterans, and data scientists.

Spot inflection points in real time with monthly trended analysis.

Forecast from leading indicators to model future performance.

Anticipate regional migration patterns before local markets deteriorate.

On-Demand Webinar

New research analyzing 10.6 million deposit accounts reveals that 70% of deposits are held by just 10% of depositors—and these high-value customers behave completely differently than traditional models predict.

Watch the Webinar

Empowering you with unprecedented insights into emerging financial trends and economic health with monthly trended analysis across critical asset classes.

Monthly credit card, auto loan, and total delinquency trends by state from January 2020 to March 2025.