Independent Mortgage Banks

Transform your IMB operations with nCino Mortgage, the comprehensive Point of Sale that automates workflows, accelerates loan cycles, and delivers modern borrower experience — all while increasing loan volumes and reducing costs.

Built Better. Powered by nCino.

Independent mortgage banks close 30% of all U.S. home loans, yet face unique challenges big banks don't understand: rate volatility that can make or break quarters, borrowers expecting Amazon-level service, and compliance rules that change faster than systems can adapt.

You deserve better, and so do your borrowers

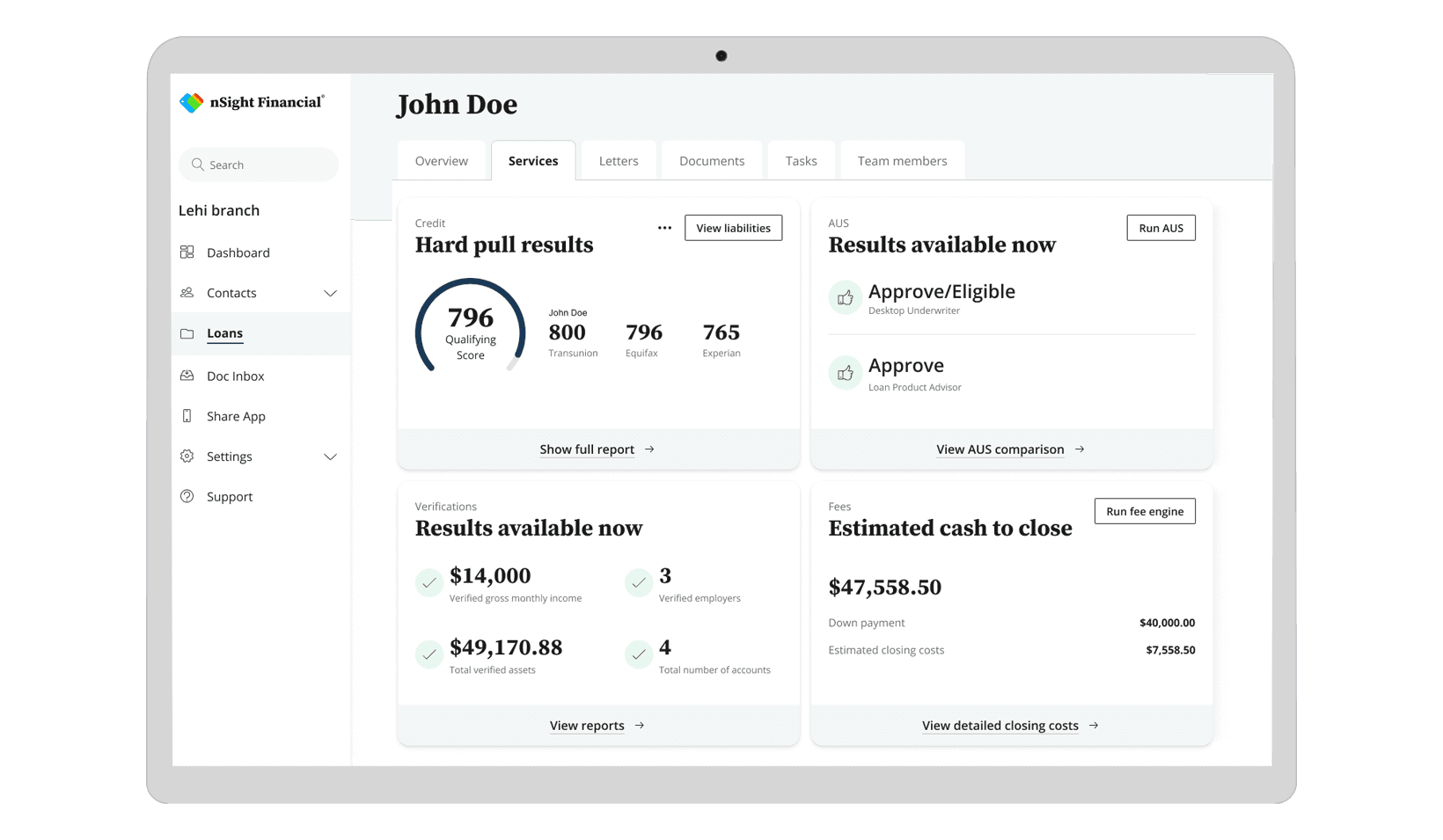

While big banks debate in committees, you're already adapting to market changes. Our mobile-native point of sale gives you the agility you need.

You move fast. Your technology should too.

Today's homebuyers shop for mortgages the same way they shop for everything else - on their phones, at their convenience. With nCino, you can deliver.

Compliance doesn’t have to be painful.

You know the stakes. One audit finding can cost you millions. Our built-in compliance engine handles the heavy lifting.

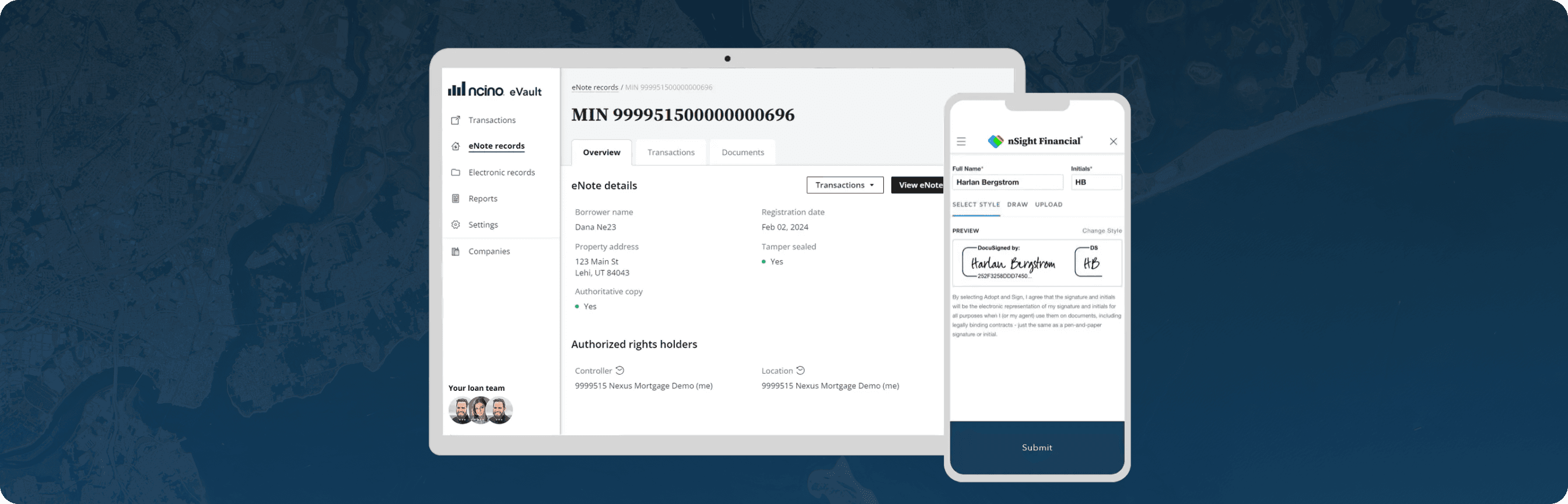

"With the nCino Mortgage Suite and native eVault, our team can seamlessly access closing documents from origination to closing to secondary market delivery, while offering borrowers and settlement agents a digital experience they actually want to use."

Mark Workens, Chief Executive Officer, Mortgage1

Success that speaks for itself

1/3

of all loans originated in the US are touched by nCino

60%

reduction in time to close mortgage loans

88%

improvement in loan application time