Empowering Independent Mortgage Banks to Thrive

Today’s mortgage banks face market volatility, rising borrower expectations, and complex regulatory demands. At nCino, we help you stay compliant, optimize operations, and maintain exceptional borrower service.

Built for Independent Mortgage Banks

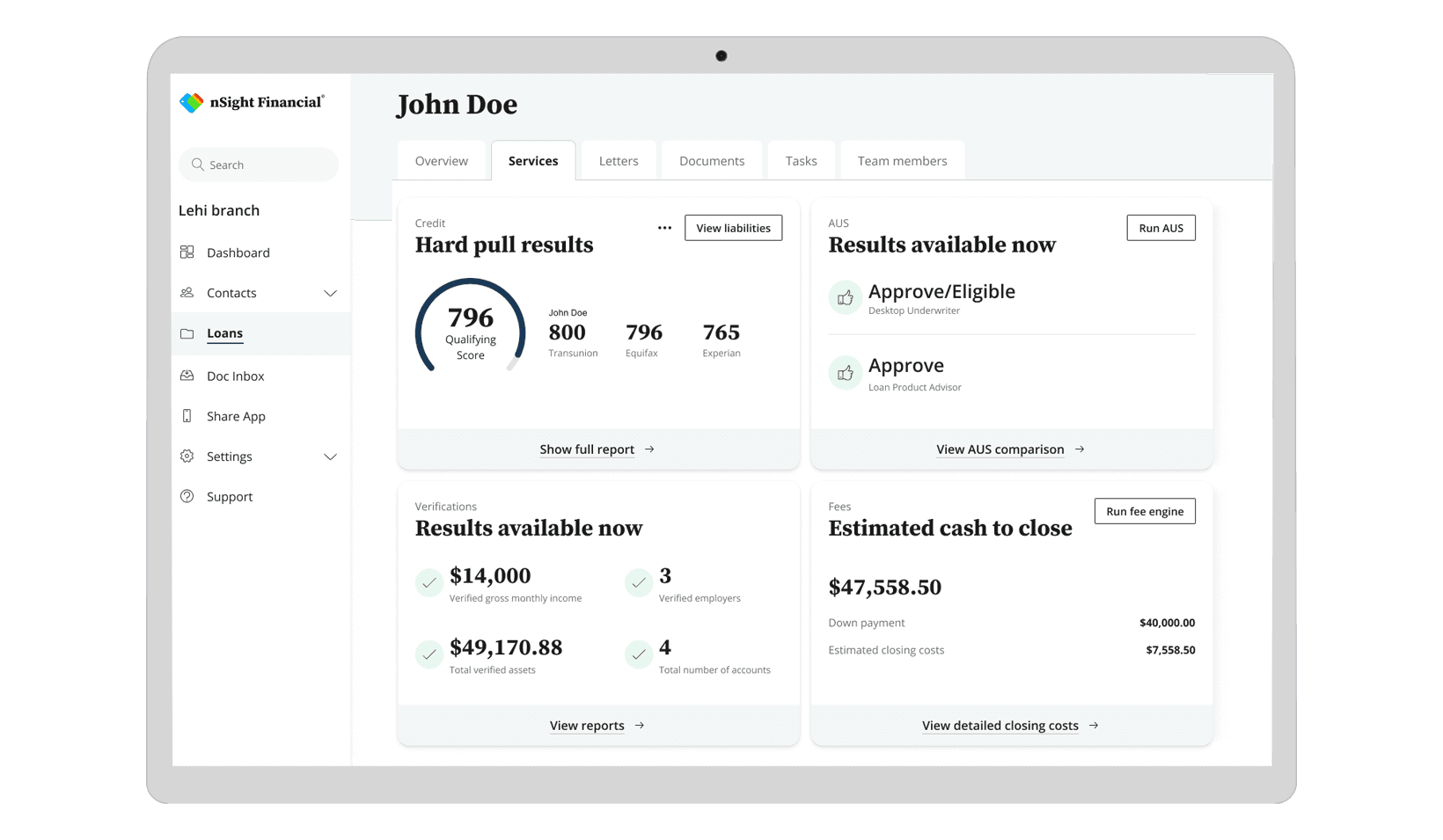

We provide data-driven insights and a flexible suite of scalable solutions to meet your IMB’s specific needs.

Strengthen borrower relationships, improve operational processes, and adapt quickly to market changes, all while delivering personalized experiences that set you apart from the competition.

Powering a New Era in Financial Services

nCino's intelligent solutions are built from the ground up to be banking engines that drive faster innovation, AI decisioning, and efficient workflows. Whether it’s Credit Portfolio Management, Commercial Account Onboarding, Consumer Banking, Small Business Banking, or Mortgage, we deliver rapid implementations and immediate ROI.

Success that speaks for itself

1/3

of loans originated in the U.S. go through the nCino Mortgage Suite

60%

reduction in time to close mortgage loans

88%

improvement in loan application time

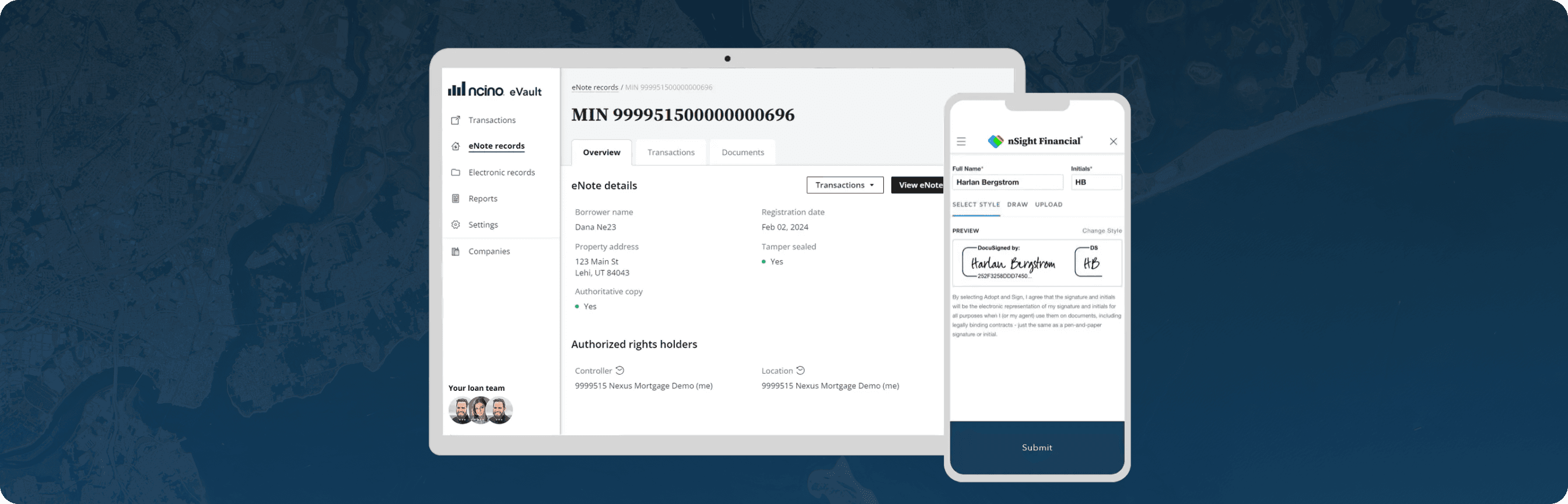

"With the nCino Mortgage Suite and native eVault, our team can seamlessly access closing documents from origination to closing to secondary market delivery, while offering borrowers and settlement agents a digital experience they actually want to use."

Mark Workens, Chief Executive Officer, Mortgage1

Solutions Built to Power and Evolve IMBs

¿Listo para transformar tu institución?

Trusted by over 2,700 financial institutions, the nCino Platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

Este sitio está protegido por reCAPTCHA y Google política de privacidad y Términos del Servicio aplicar.