nCino's Big 5 Insurance Predictions for 2026

As we move into 2026, we’re reflecting on what 2025 taught us, and what it means for our insurance customers.

Read More

As we move into 2026, we’re reflecting on what 2025 taught us, and what it means for our insurance customers.

Read More

After years of hard market conditions, the UK commercial insurance market is now softening.

Read More

We recently hosted several senior mortgage executives alongside Business Reporter to discuss the evolving landscape of mortgage lending and the critical challenge of building customer loyalty in an increasingly competitive market.

Read More

Banks are under growing pressure to make faster, more accurate credit decisions, whilst managing risk exposure and improving customer outcomes.

Read More

Now more than ever, banks need to focus on customer affordability.

Read More

In the high-stakes world of commercial lending, timing is everything

Read More

Every year, lenders are missing out on millions in bookable lending from viable borrowers who were either rejected or approved but didn’t take up offers.

Read More

For decades, banks have been navigating the crucial decision of whether to build lending platforms in-house or buy an external vendor solution.

Read More

Small and medium-sized enterprises (SMEs) are the lifeblood of the UK economy, yet they’re locked out of critical funding.

Read More

The latest CMA business banking survey has dropped some serious insights, and we're excited to share what's happening in the commercial banking world.

Read More

How can brokers get their risks to the top of an underwriter’s inbox?

Read More

Artificial Intelligence (AI), Machine Learning (ML) and robotic process automation (RPA) are shaping the future of the lending industry, enabling lenders, both traditional and alternative, and other financial institutions to improve efficiency and reduce costs. But AI can do much more than automate processes and boost efficiency.

Read More

Ashleigh Gwilliam from nCino provides his guidance on the future of networks in the insurance industry.

Read More

The principal finding of the inaugural report of the CFIT Open Finance Coalition was that substantially more lending could be made to small businesses, and significant increases in lending acceptance rates made possible, with the timely provision of more high-quality, reliable data to lenders.

Read More

Let’s put it out there right from the start, your Customer Lifecycle Management (CLM) journey has become increasingly complex, expensive, and difficult to navigate.

Read More

Recent sentiment shows that SMEs are feeling more optimistic about their prospects in 2025.

Read More

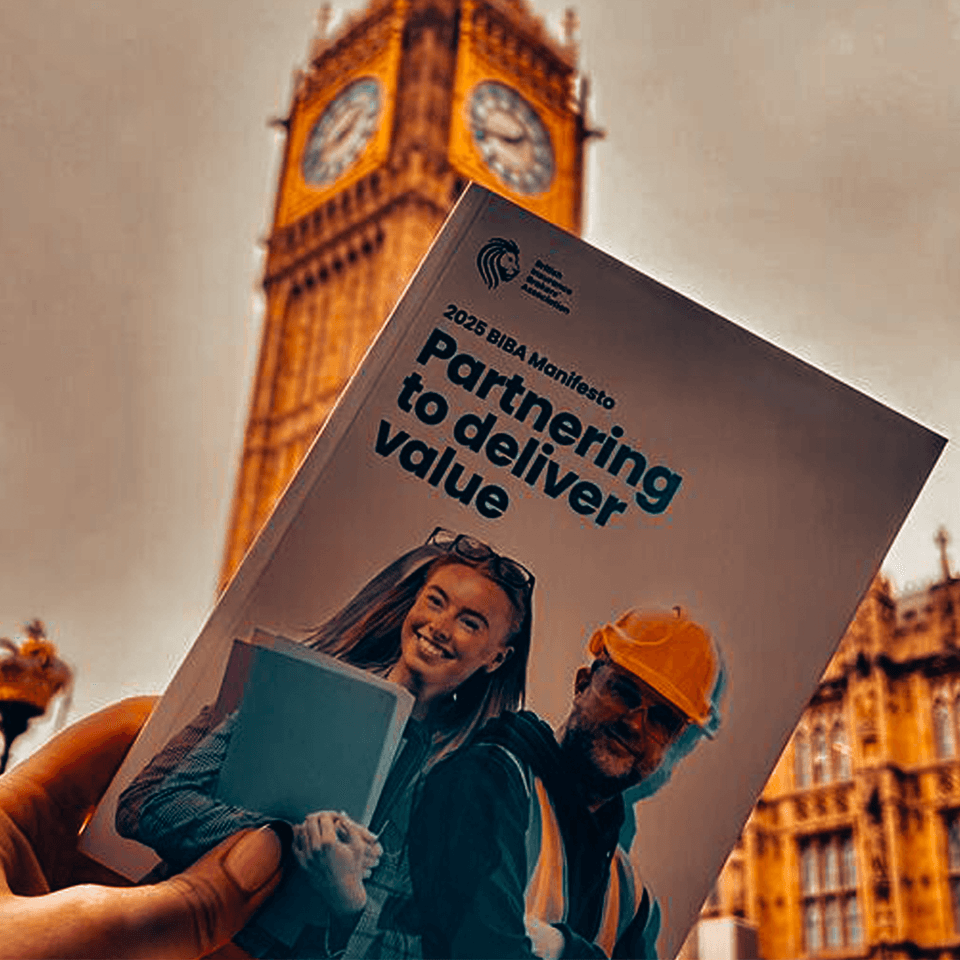

On Wednesday January 15, BIBA launched their 2025 Manifesto at the houses of parliament. The key theme in 2025 is “Partnering to deliver value” and as a BIBA Facility provider, we couldn’t agree more!

Read More

A renowned panel of analysts and industry experts studiously selected the finalists for the annual InsurTech100 list, from a shortlist of more than 2100 nominations.

Read More

A renowned panel of analysts and industry experts studiously selected the finalists for the DataTech50 list, from a shortlist of more than 400 companies.

Read More

The project initiative is driven in part by the vision of Carl Shuker, CEO, Howden UK&I, aiming to support a consistent Howden client experience across the National Branch Network.

Read More

Hedron has signed a three-year contract to help brokers achieve data-driven growth.

Read More

The SmartBroker API integration will provide next generation data enrichment to Acturis users proven to drive growth, improve decisioning, and enhance compliance.

Read More

Regulation is a constant in the banking industry, with new requirements regularly being introduced. The challenge lies in interpreting and actioning these regulations, and with the UK Consumer Duty regulation approaching, it's clear that financial institutions in the UK need to be proactive.What is Consumer Duty?The FCA’s proposed Consumer Duty regulation requires firms to prioritise their customers’ interests by focusing on delivering “good outcomes”.According to the regulation, “good outcomes” are based on three core principles: acting in good faith, supporting financial objectives and avoiding foreseeable harm. In other words, lenders must act in their customers’ best interests by providing tailored products and services, communicating transparently and avoiding any potential harm.- Starting on July 31, 2023, every lender will be required to define and monitor what constitutes good outcomes for their customers.- From September 2023, the FCA will be reaching out to a select number of firms to investigate what has changed (or not) in the gap analysis.- Beginning in January 2024, lenders will be asked for dashboard samples with supporting data demonstrating avoidance of harm.The regulation will continue to evolve throughout these phases. Based on the findings, the FCA could recommend further changes to improve compliance with the Duty through 2025.

Read More

In this white paper, experts from nCino and PwC explore five common mistakes that firms make when attempting a digital transformation project, and offer best practices drawn from their experience in deploying hundreds of new platforms on behalf of clients across multiple geographic regions.With regulatory headwinds picking up, interest rates still rising and borrower expectations changing, the macroeconomic outlook for UK homebuyers and mortgage lenders alike is daunting.This is why many UK mortgage lenders are intent on disrupting the market by serving their clients throughout the entire homeownership journey, from applying for a loan to refinancing their home. To achieve this goal of capturing more of the home buying journey and growing direct lending market share, mortgage lenders will need to provide borrowers with seamless and efficient mortgage experiences. During a time when it is more important than ever to identify and act on operational efficiencies and areas for cost savings, lenders can no longer afford to ignore their legacy technologies and antiquated processes.

Read More

In September, the nCino UK Mortgage team ran a workshop with 40 delegates at the MoneyLive Building Societies event on the topic of digitising mortgage journeys and the solutions technology offers.

Read More