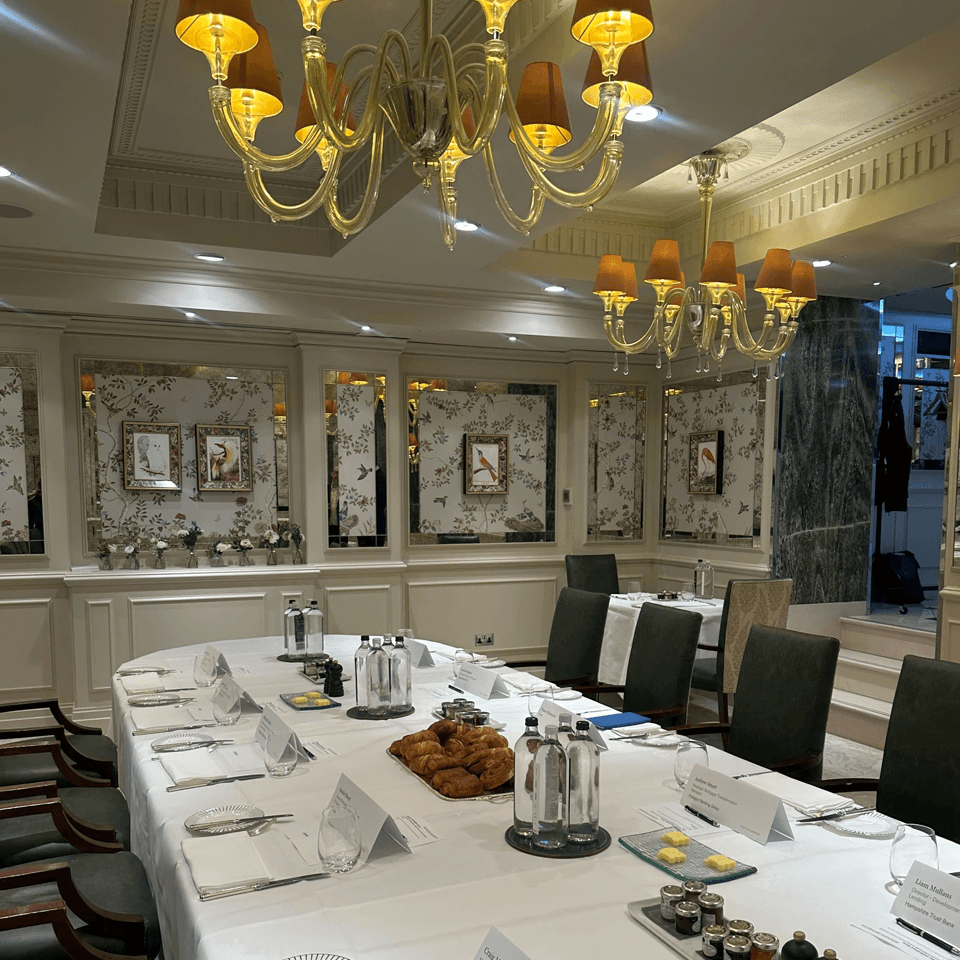

Building Customer Loyalty in Mortgage Lending: Insights from our Executive Breakfast

We recently hosted several senior mortgage executives alongside Business Reporter to discuss the evolving landscape of mortgage lending and the critical challenge of building customer loyalty in an increasingly competitive market.

Read More