Why Banks Still Build What They Should Buy - And What It's Costing Them

For decades, banks have been navigating the crucial decision of whether to build lending platforms in-house or buy an external vendor solution.

Banking on Intelligence: Anthony Morris on Embracing AI and Technology Transformation in Banking

Stay up to date with nCino

Read NowFor decades, banks have been navigating the crucial decision of whether to build lending platforms in-house or buy an external vendor solution.

Small and medium-sized enterprises (SMEs) are the lifeblood of the UK economy, yet they’re locked out of critical funding.

Business lending remains a critical growth driver for banks, yet many struggle to scale effectively. What's holding them back?

The latest CMA business banking survey has dropped some serious insights, and we're excited to share what's happening in the commercial banking world.

Automation isn't just nice to have anymore—it's essential. Financial institutions are under pressure to serve clients faster, manage risk more effectively, and reduce operational costs. Yet too often, the path to value gets slowed by fragmented tools, endless integrations, and complex compliance reviews.

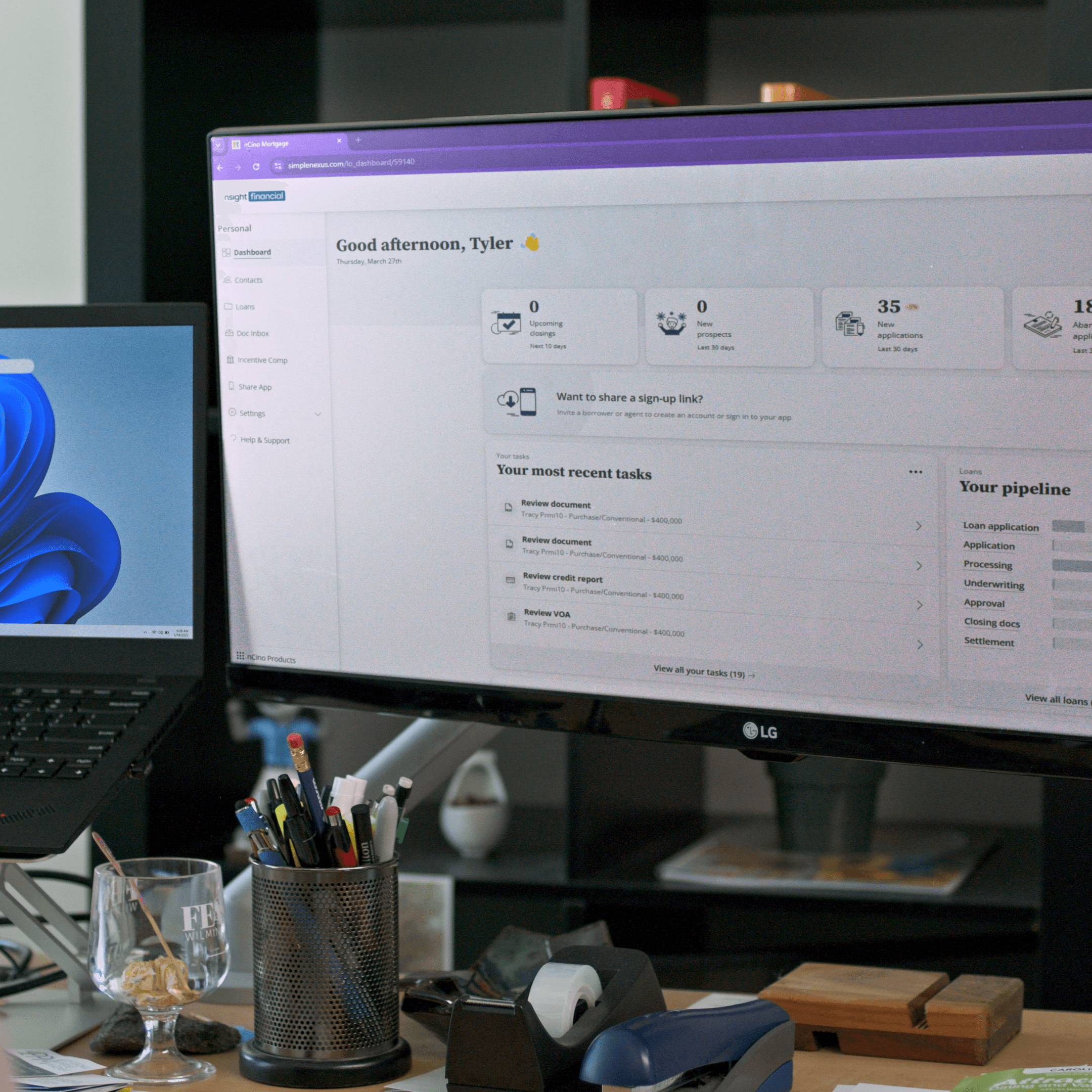

The mortgage industry is evolving at a rapid pace. Borrowers demand faster, more seamless digital-first experiences, and lenders face mounting pressure to adapt. With loan abandonment rates exceeding 75% at critical process stages, the stakes have never been higher.

The banking industry stands at a critical inflection point. As we advance through 2025, artificial intelligence has evolved from experimental technology to a strategic imperative reshaping how financial institutions operate, serve customers, and manage risk.

The financial services landscape is on the brink of a significant transformation, driven by the rapid integration of artificial intelligence (AI). From streamlining operations to enhancing regulatory compliance, AI is reshaping how banks and financial institutions approach lending, offering a competitive edge in a challenging environment.

How can brokers get their risks to the top of an underwriter’s inbox?

Trusted by over 2,700 financial institutions, the nCino Platform will enhance strategic decision-making, risk management, and customer satisfaction at your institution. See our best-in-class intelligent solutions in action—request your free demo today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.